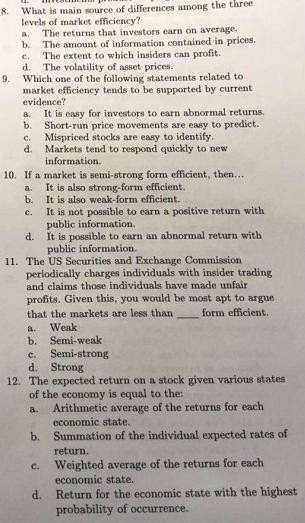

8. 9. What is main source of differences among the three levels of market efficiency? A. b. c. d. The volatility of asset prices.

8. 9. What is main source of differences among the three levels of market efficiency? A. b. c. d. The volatility of asset prices. Which one of the following statements related to market efficiency tends to be supported by current evidence? It is easy for investors to earn abnormal returns. Short-run price movements are easy to predict. Mispriced stocks are easy to identify. Markets tend to respond quickly to new information. B. b. c. d. The returns that investors earn on average. The amount of information contained in prices. The extent to which insiders can profit. 10. If a market is semi-strong form efficient, then.... a. It is also strong-form efficient. b. It is also weak-form efficient. c. It is not possible to earn a positive return with public information. d. It is possible to earn an abnormal return with public information. 11. The US Securities and Exchange Commission periodically charges individuals with insider trading and claims those individuals have made unfair profits. Given this, you would be most apt to argue that the markets are less than form efficient. Weak a. b. Semi-weak b. C. d. Strong 12. The expected return on a stock given various states. of the economy is equal to the: a. Arithmetic average of the returns for each economic state. Summation of the individual expected rates of Semi-strong C. return. Weighted average of the returns for each economic state. d. Return for the economic state with the highest probability of occurrence.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The distinction between the three levels of market efficiency is the amount of information contained ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started