Answered step by step

Verified Expert Solution

Question

1 Approved Answer

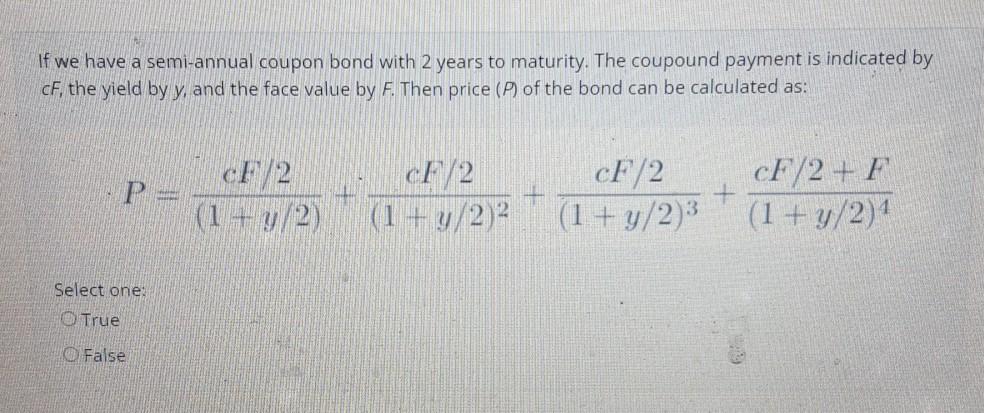

If we have a semi-annual coupon bond with 2 years to maturity. The coupound payment is indicated by cF, the yield by y, and the

If we have a semi-annual coupon bond with 2 years to maturity. The coupound payment is indicated by cF, the yield by y, and the face value by F. Then price (P) of the bond can be calculated as: P. CF/2 (1+y/2) cF/2 (1 + y 2) cF/2 CF/2 + F + (1 + y/2)3 (1 + y/2) Select one: True False We have a 2-year semi-annual coupon bond with a 5% coupon rate, face value of $100, and a yield of 8%. What is the price of this coupon? Answer Consider a treasury bond with 8 years to maturity, coupon rate 4%, face value $100 and a quoted yield of 3.90%. If coupons are paid semi-annually, what is the bond price? [HINT: your formula for valuing an annuity should come in handy here.] Answers Remember the German bond: It pays a 5.375% annual coupon, every year for 6 years. The face value of the bond is 100 euros. Its YTM is 3.8%. We found that P = 108.31. Now assume that the bond is paying semi-annual coupons. What will the price be then

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started