Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case A - building $ ? equipment $ ? cash $ ? Case B - building $ ? equipment $ ? common stock $ ?

Case A -

Case A -

| building | $ ? |

| equipment | $ ? |

| cash | $ ? |

Case B -

| building | $ ? |

| equipment | $ ? |

| common stock | $ ? |

| paid-in-captital in excess of par--common | $ ? |

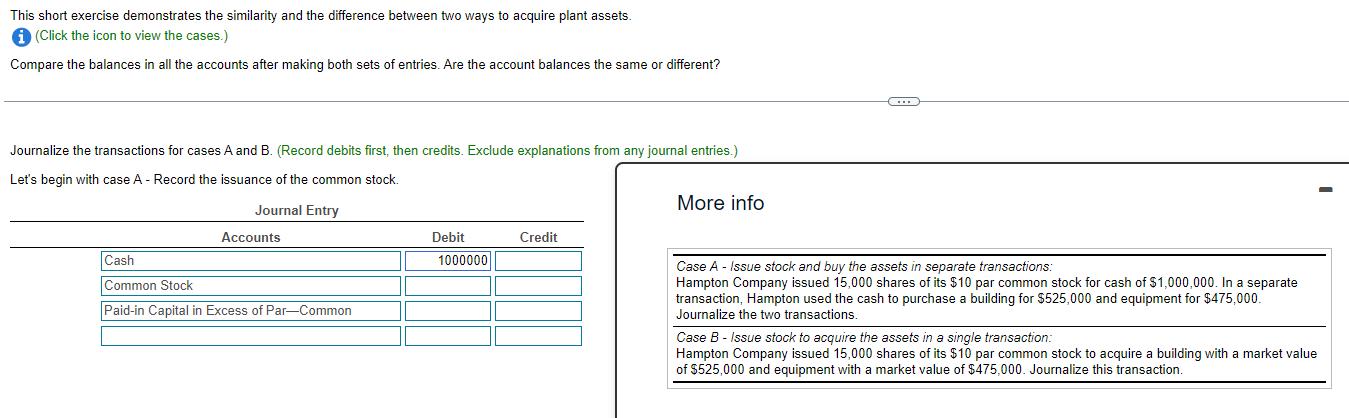

This short exercise demonstrates the similarity and the difference between two ways to acquire plant assets. i (Click the icon to view the cases.) Compare the balances in all the accounts after making both sets of entries. Are the account balances the same or different? Journalize the transactions for cases A and B. (Record debits first, then credits. Exclude explanations from any journal entries.) Let's begin with case A - Record the issuance of the common stock. Journal Entry Accounts Cash Common Stock Paid-in Capital in Excess of Par-Common Debit 1000000 Credit More info C Case A - Issue stock and buy the assets in separate transactions: Hampton Company issued 15,000 shares of its $10 par common stock for cash of $1,000,000. In a separate transaction, Hampton used the cash to purchase a building for $525,000 and equipment for $475,000. Journalize the two transactions. Case B- Issue stock to acquire the assets in a single transaction: Hampton Company issued 15,000 shares of its $10 par common stock to acquire a building with a market value of $525,000 and equipment with a market value of $475,000. Journalize this transaction.

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Case A a b Case B Account name Cash Common Stock 15000 shares 10 Additional paid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d5f48cea34_174985.pdf

180 KBs PDF File

635d5f48cea34_174985.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started