Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you answer all steps and correct. I will give a thumbs up. Suppose you want to compare the price sensitivity of two 10 -year

If you answer all steps and correct. I will give a thumbs up.

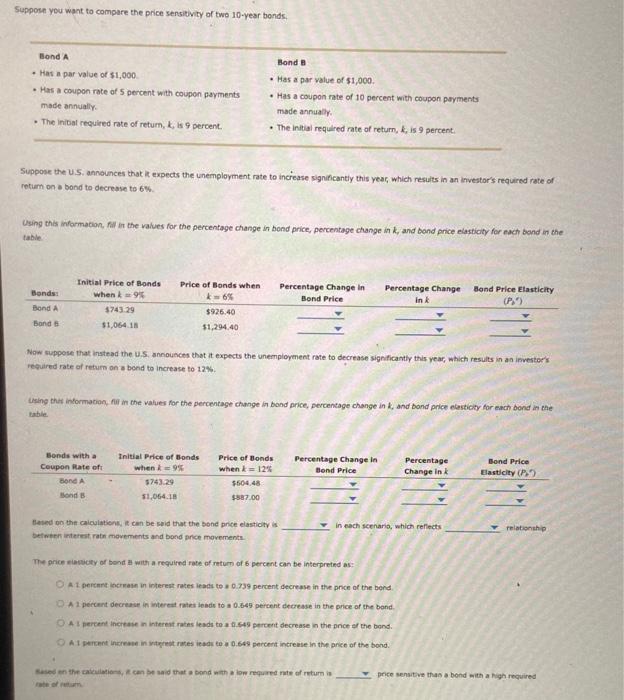

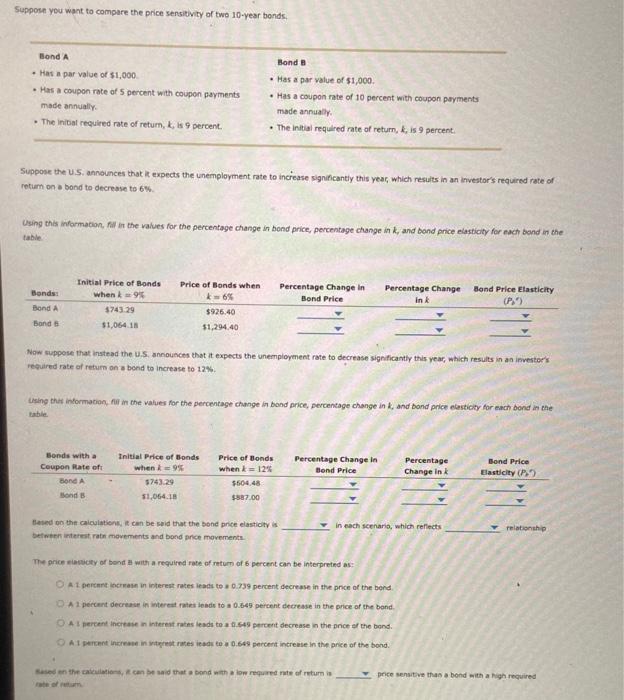

Suppose you want to compare the price sensitivity of two 10 -year bonds. Suppose the U.5. announces that it expects the unemployment rate to increase significantly this year, which results in an investor's required rate of retum on o bond to decrease to 6%. Using this informacion, fail in the values for the percentage change in bond price, percentage change in k, and band price elastiaty for each band in the. tabie Now suppose that instead the u.S. snounces thot it expects the unemployment rate to decrease significantiy this yeac, which results in an investors required rate of return on a bond to increase to 12%. vising thit informacion, fili in the values for the percentage change in bond price, percentage change in K, and band price elasticat for eanch bond in the tatie Hesed ob the caiculatiens, is can be seid that the bone price elasticty is in wach seenario, which refiects befinen interet ratn movements and bond prce movements. The price elasicty of bond as with a requirnd rate of neturn of 6 percent can be interpreted as: A 1 percmet increas in interest rates ieads to s 0.739 percent decrease in the pnce of the bend. A 2 percant decriase in intereat rates leade to a 0.649 peraent decrease in the price of the bond. A I percent incrase in interent rates leads to a 0.549 percent decrease in the pnce st the bons. A 1 persent increate in vitgiest rates ieadi to a 0.649 percent intresse in the price of the bond. Nased en the cakilations, 2 can be aad that a bond with a lon requred nte of return is price sensitve thas a bond with a Nigh required eate of netion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started