Answered step by step

Verified Expert Solution

Question

1 Approved Answer

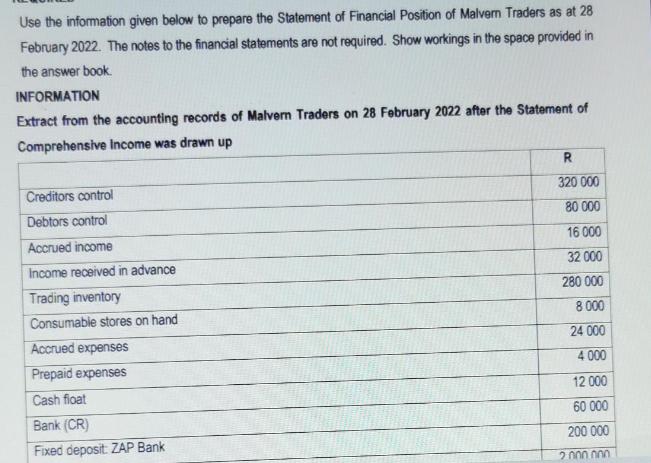

Use the information given below to prepare the Statement of Financial Position of Malvern Traders as at 28 February 2022. The notes to the

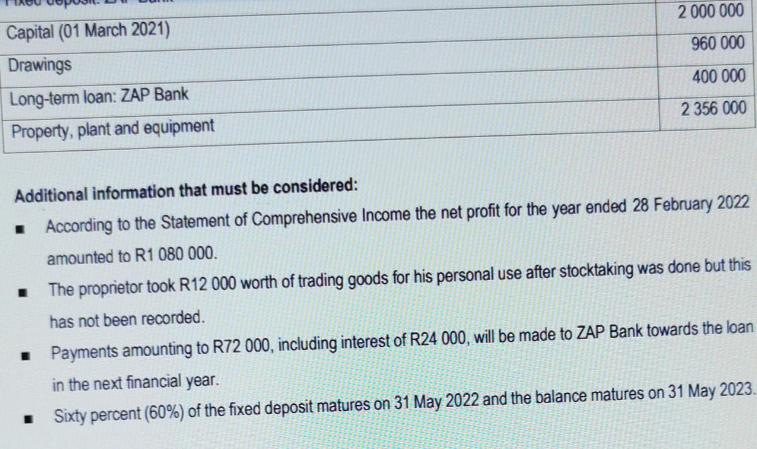

Use the information given below to prepare the Statement of Financial Position of Malvern Traders as at 28 February 2022. The notes to the financial statements are not required. Show workings in the space provided in the answer book. INFORMATION Extract from the accounting records of Malvern Traders on 28 February 2022 after the Statement of Comprehensive Income was drawn up Creditors control Debtors control Accrued income Income received in advance Trading inventory Consumable stores on hand Accrued expenses Prepaid expenses Cash float Bank (CR) Fixed deposit: ZAP Bank R 320 000 80 000 16 000 32 000 280 000 8.000 24 000 4 000 12 000 60 000 200 000 2.000.000 Capital (01 March 2021) Drawings Long-term loan: ZAP Bank Property, plant and equipment 2 000 000 960 000 400 000 2 356 000 Additional information that must be considered: According to the Statement of Comprehensive Income the net profit for the year ended 28 February 2022 amounted to R1 080 000. I The proprietor took R12 000 worth of trading goods for his personal use after stocktaking was done but this has not been recorded. Payments amounting to R72 000, including interest of R24 000, will be made to ZAP Bank towards the loan in the next financial year. Sixty percent (60%) of the fixed deposit matures on 31 May 2022 and the balance matures on 31 May 2023.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

CALCULATIONS Net Profit R1080000 Drawings R12000 Adjusted Net Profit Net Profit Drawings R1080000 R1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started