Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you can answer only one. i need the answer of Case B QUESTION 1 You manage money for Newman Foundation at the University of

If you can answer only one. i need the answer of Case B

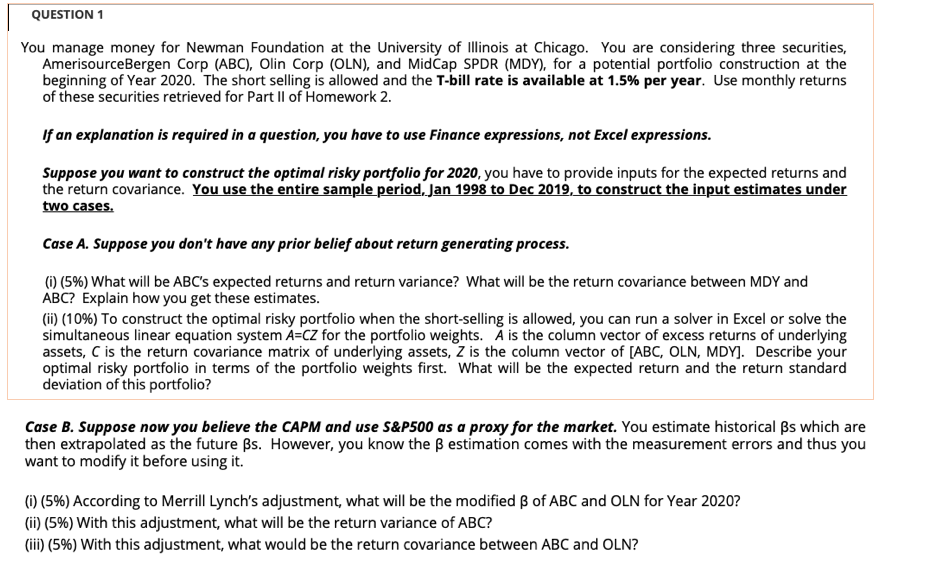

QUESTION 1 You manage money for Newman Foundation at the University of Illinois at Chicago. You are considering three securities, AmerisourceBergen Corp (ABC), Olin Corp (OLN), and Midcap SPDR (MDY), for a potential portfolio construction at the beginning of Year 2020. The short selling is allowed and the T-bill rate is available at 1.5% per year. Use monthly returns of these securities retrieved for Part II of Homework 2. If an explanation is required in a question, you have to use Finance expressions, not Excel expressions. Suppose you want to construct the optimal risky portfolio for 2020, you have to provide inputs for the expected returns and the return covariance. You use the entire sample period, Jan 1998 to Dec 2019, to construct the input estimates under two cases. Case A. Suppose you don't have any prior belief about return generating process. (1) (5%) What will be ABC's expected returns and return variance? What will be the return covariance between MDY and ABC? Explain how you get these estimates. (ii) (10%) To construct the optimal risky portfolio when the short-selling is allowed, you can run a solver in Excel or solve the simultaneous linear equation system A=Cz for the portfolio weights. A is the column vector of excess returns of underlying assets, C is the return covariance matrix of underlying assets, Z is the column vector of (ABC, OLN, MDY). Describe your optimal risky portfolio in terms of the portfolio weights first. What will be the expected return and the return standard deviation of this portfolio? Case B. Suppose now you believe the CAPM and use S&P500 as a proxy for the market. You estimate historical Bs which are then extrapolated as the future Bs. However, you know the B estimation comes with the measurement errors and thus you want to modify it before using it. (0) (5%) According to Merrill Lynch's adjustment, what will be the modified of ABC and OLN for Year 2020? (ii) (5%) With this adjustment, what will be the return variance of ABC? (iii) (5%) With this adjustment, what would be the return covariance between ABC and OLN? QUESTION 1 You manage money for Newman Foundation at the University of Illinois at Chicago. You are considering three securities, AmerisourceBergen Corp (ABC), Olin Corp (OLN), and Midcap SPDR (MDY), for a potential portfolio construction at the beginning of Year 2020. The short selling is allowed and the T-bill rate is available at 1.5% per year. Use monthly returns of these securities retrieved for Part II of Homework 2. If an explanation is required in a question, you have to use Finance expressions, not Excel expressions. Suppose you want to construct the optimal risky portfolio for 2020, you have to provide inputs for the expected returns and the return covariance. You use the entire sample period, Jan 1998 to Dec 2019, to construct the input estimates under two cases. Case A. Suppose you don't have any prior belief about return generating process. (1) (5%) What will be ABC's expected returns and return variance? What will be the return covariance between MDY and ABC? Explain how you get these estimates. (ii) (10%) To construct the optimal risky portfolio when the short-selling is allowed, you can run a solver in Excel or solve the simultaneous linear equation system A=Cz for the portfolio weights. A is the column vector of excess returns of underlying assets, C is the return covariance matrix of underlying assets, Z is the column vector of (ABC, OLN, MDY). Describe your optimal risky portfolio in terms of the portfolio weights first. What will be the expected return and the return standard deviation of this portfolio? Case B. Suppose now you believe the CAPM and use S&P500 as a proxy for the market. You estimate historical Bs which are then extrapolated as the future Bs. However, you know the B estimation comes with the measurement errors and thus you want to modify it before using it. (0) (5%) According to Merrill Lynch's adjustment, what will be the modified of ABC and OLN for Year 2020? (ii) (5%) With this adjustment, what will be the return variance of ABC? (iii) (5%) With this adjustment, what would be the return covariance between ABC and OLN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started