Answered step by step

Verified Expert Solution

Question

1 Approved Answer

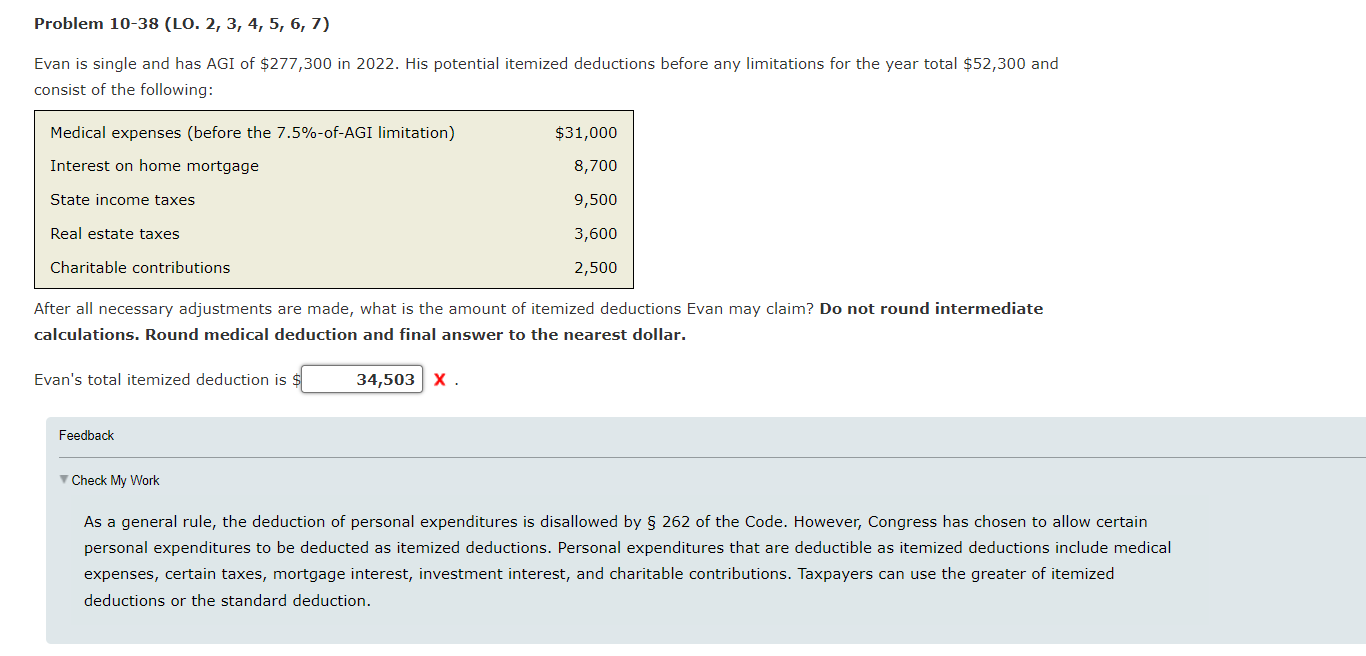

If you can explain how you got the answer, that would be greatly appreciated! ***$31,000-(7.5% of 277,300) = 10,202.50 10,202.50 + 8,700 + 9,500 +

If you can explain how you got the answer, that would be greatly appreciated!

***$31,000-(7.5% of 277,300) = 10,202.50

10,202.50 + 8,700 + 9,500 + 3,600 + 2,500 = 34,503 is NOT the answer.

Problem 10-38 (LO. 2, 3, 4, 5, 6, 7) Evan is single and has AGI of $277,300 in 2022. His potential itemized deductions before any limitations for the year total $52,300 and consist of the following: After all necessary adjustments are made, what is the amount of itemized deductions Evan may claim? Do not round intermediate calculations. Round medical deduction and final answer to the nearest dollar. Evan's total itemized deduction is $ Feedback - Check My Work As a general rule, the deduction of personal expenditures is disallowed by 262 of the Code. However, Congress has chosen to allow certain expenses, certain taxes, mortgage interest, investment interest, and charitable contributions. Taxpayers can use the greater of itemized deductions or the standard deductionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started