Question

If you can't do it just say it because false and lame excuses like the images are not clear or information is not complete etcetera

If you can't do it just say it because false and lame excuses like the images are not clear or information is not complete etcetera is not gonna help for me nor for an expert it'll just make me find another expertise platform. Thank You! plus i'm posting it for sixth time please consider it and solve it correctly.

Payroll Register and Payroll Journal Entry

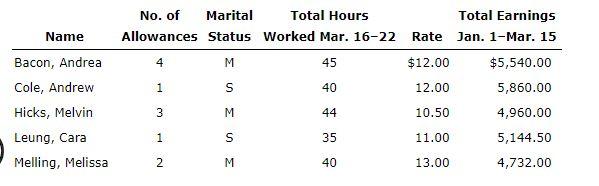

Mary Losch operates a travel agency called Marys Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, individual employee earnings records, and a general journal.

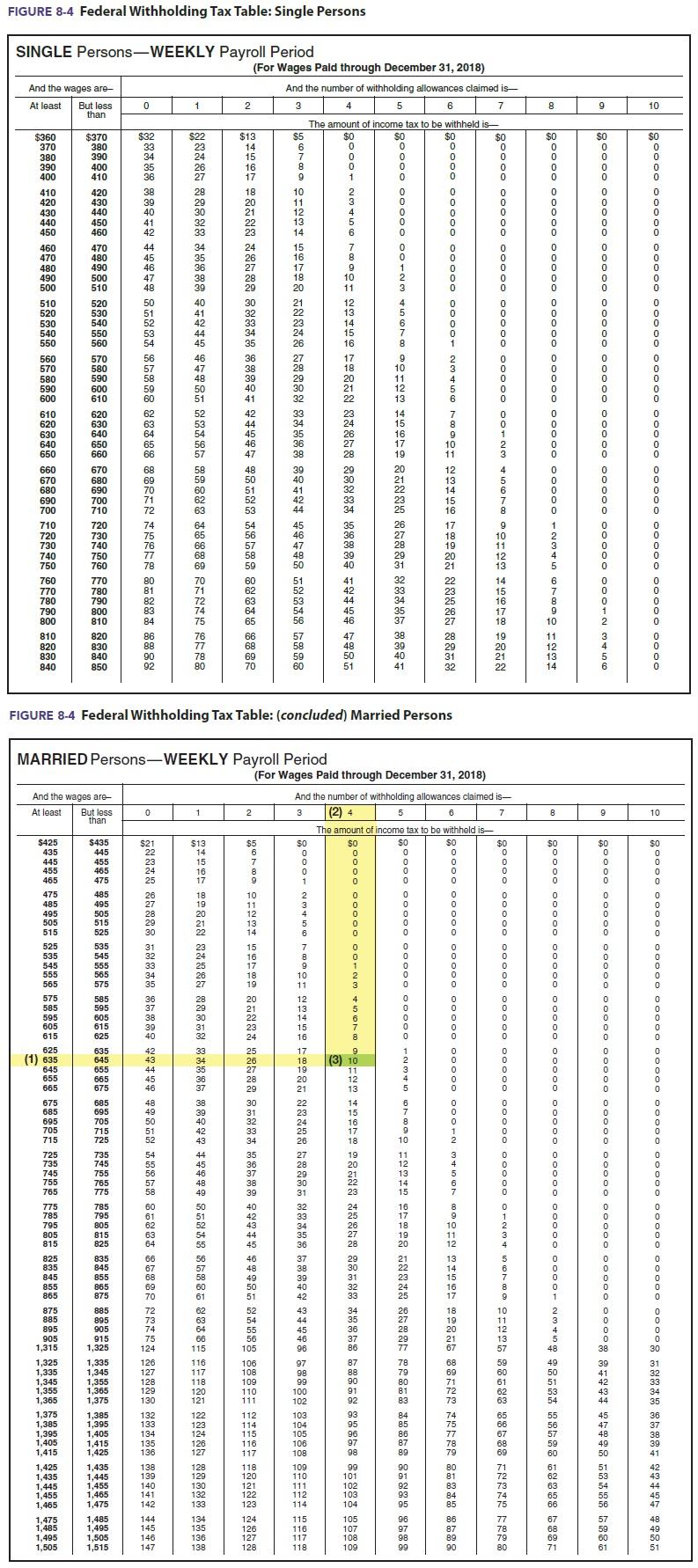

Marys Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20, are shown. Employees are paid 1 times the regular rate for working over 40 hours a week.

| Name | No. of Allowances | Marital Status | Total Hours Worked Mar. 1622 | Rate | Total Earnings Jan. 1Mar. 15 |

| Bacon, Andrea | 4 | M | 45 | $12.00 | $5,540.00 |

| Cole, Andrew | 1 | S | 40 | 12.00 | 5,860.00 |

| Hicks, Melvin | 3 | M | 44 | 10.50 | 4,960.00 |

| Leung, Cara | 1 | S | 35 | 11.00 | 5,144.50 |

| Melling, Melissa | 2 | M | 40 | 13.00 | 4,732.00 |

Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Bacon and Leung have $16 withheld and Cole and Hicks have $4 withheld for health insurance. Bacon and Leung have $18 withheld to be invested in the travel agencys credit union. Cole has $39.75 withheld and Hicks has $17.50 withheld under a savings bond purchase plan.

Marys Luxury Travels payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423.

Required:

Question Content Area

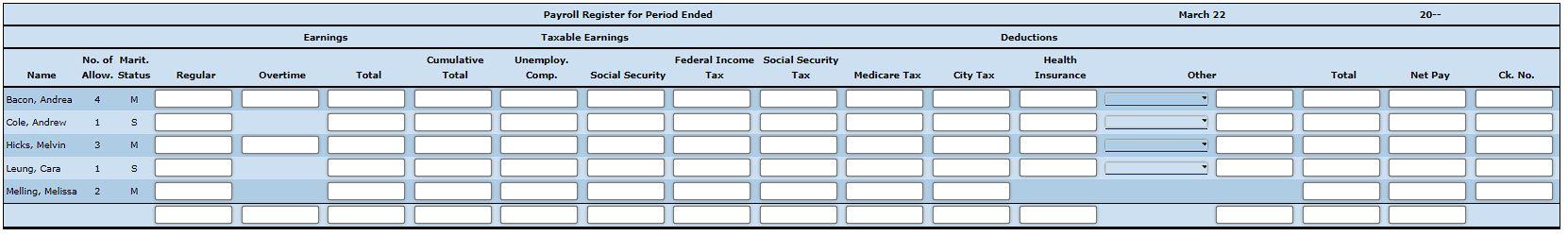

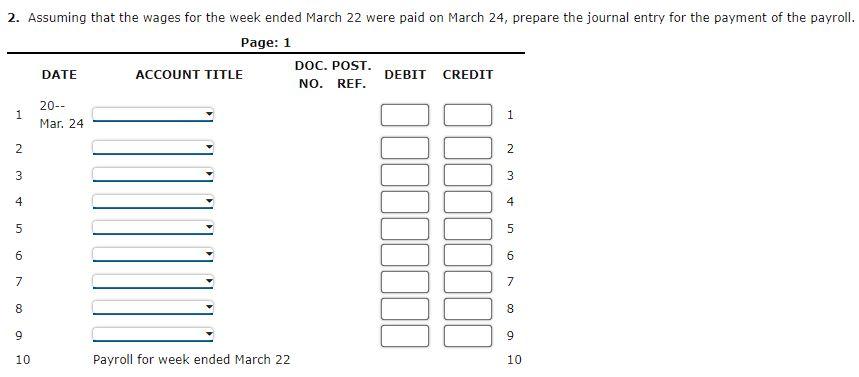

1. Prepare a payroll register for Marys Luxury Travel for the week ended March 22, 20--. (In the Taxable Earnings/Unemployment Compensation column, enter the same amounts as in the Social Security column.) Total the amount columns.

If required, round your answers to the nearest cent.

Below is the tax table (figure8-4).

Below is the tax table (figure8-4).

If you can't do it just say it because false and lame excuses like the images are not clear or information is not complete etcetera is not gonna help for me nor for an expert it'll just make me find another expertise platform. Thank You! plus i'm posting it for sixth time please consider it and solve it correctly.

If you can't do it just say it because false and lame excuses like the images are not clear or information is not complete etcetera is not gonna help for me nor for an expert it'll just make me find another expertise platform. Thank You! plus i'm posting it for sixth time please consider it and solve it correctly.Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started