If you can't do it just say it because false and lame excuses like the images are not clear or information is not complete etcetera is not gonna help for me nor for an expert it'll just make me find another expertise platform. Thank You! plus i'm posting it for eighth time please consider it and solve it correctly.

Payroll Register and Payroll Journal Entry

Mary Losch operates a travel agency called Marys Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, individual employee earnings records, and a general journal.

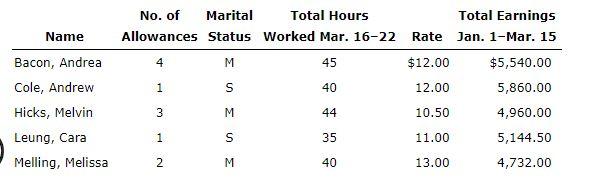

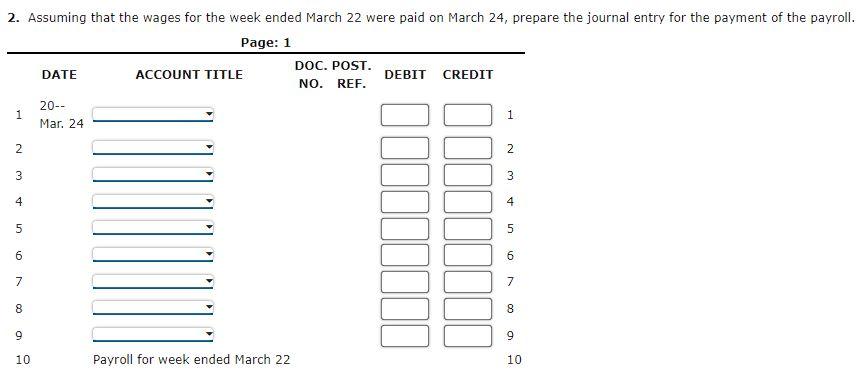

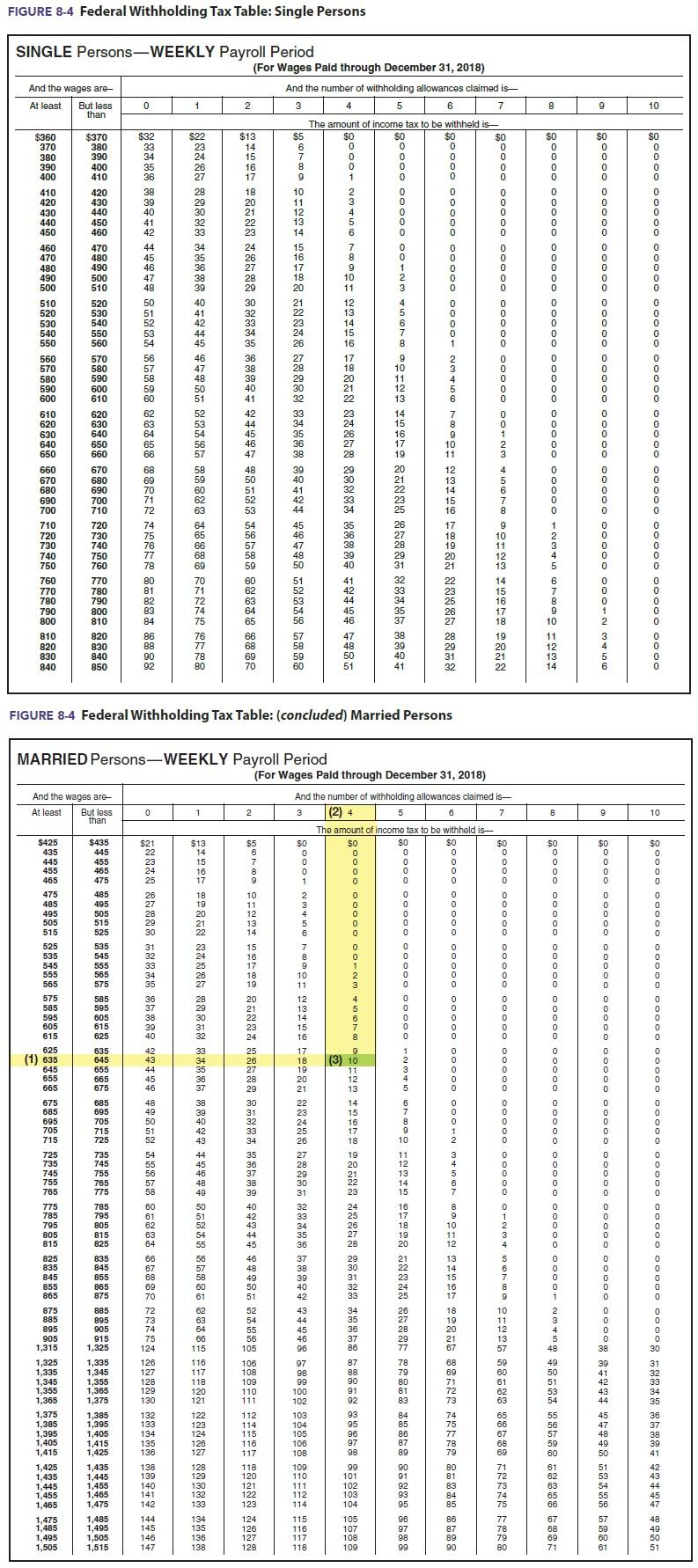

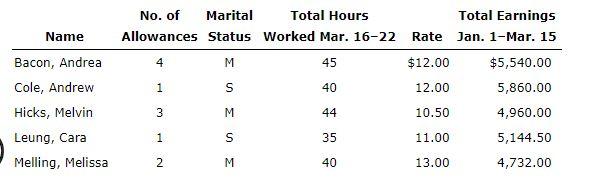

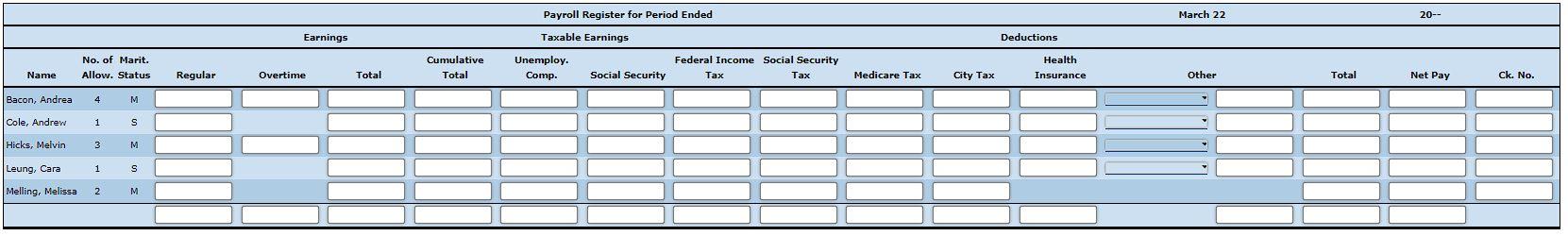

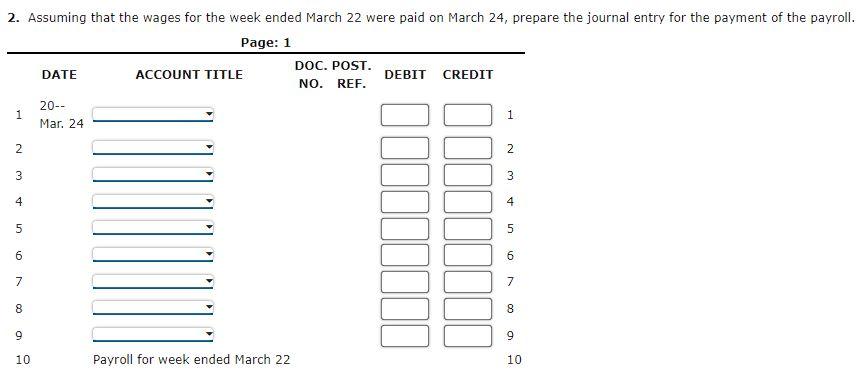

Marys Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20, are shown. Employees are paid 1 times the regular rate for working over 40 hours a week.

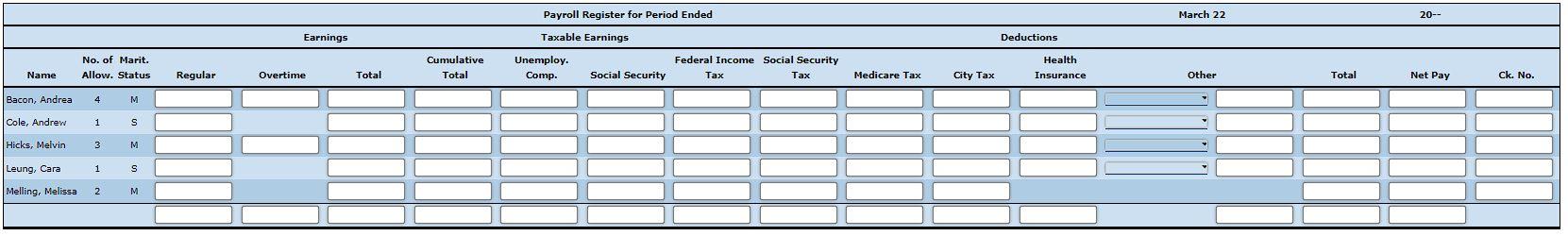

Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Bacon and Leung have $16 withheld and Cole and Hicks have $4 withheld for health insurance. Bacon and Leung have $18 withheld to be invested in the travel agencys credit union. Cole has $39.75 withheld and Hicks has $17.50 withheld under a savings bond purchase plan.

Marys Luxury Travels payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423.

Required:

1. Prepare a payroll register for Marys Luxury Travel for the week ended March 22, 20--. (In the Taxable Earnings/Unemployment Compensation column, enter the same amounts as in the Social Security column.) Total the amount columns.

If required, round your answers to the nearest cent.

Below is the tax table (figure8-4).

If you can't do it just say it because false and lame excuses like the images are not clear or information is not complete etcetera is not gonna help for me nor for an expert it'll just make me find another expertise platform. Thank You! plus i'm posting it for eighth time please consider it and solve it correctly.

No. of Marital Total Hours Allowances Status Worked Mar. 16-22 Name 4 M 45 1 Total Earnings Rate Jan. 1-Mar. 15 $12.00 $5,540.00 12.00 5,860.00 10.50 4,960.00 S Bacon, Andrea Cole, Andrew Hicks, Melvin Leung, Cara Melling, Melissa 40 3 M 44 1 S 35 11.00 5,144.50 2 2 M 40 13.00 4,732.00 Payroll Register for Period Ended March 22 20- Earnings Taxable Earnings Deductions Health No. of Marit. Allow. Status Cumulative Total Unemploy. Comp. Federal Income Social Security Tax Tax Name Regular Overtime Total Social Security Medicare Tax City Tax Insurance Other Total Net Pay Ck. No. Bacon, Andrea M Cole, Andrew 1 S Hicks, Melvin 3 M Leung, Cara 1 s Melling, Melissa 2 M 2. Assuming that the wages for the week ended March 22 were paid on March 24, prepare the journal entry for the payment of the payroll. Page: 1 DATE ACCOUNT TITLE DOC. POST. DEBIT CREDIT NO. REF. 20-- 1 1 Mar. 24 2 N 3 3 4 4 5 6 6 7 7 8 8 9 e 9 10 Payroll for week ended March 22 10 e SE 88 88 BNN 28298 28828 998878988 Sat $8898 88 89 9892 POB 8888 2898 SUN 1888 88888 88898 3898 468 888888883 888888888 9228888 8888 988989898 *** *#88 98848 89888 8828398 SONNO 88888 88888 883 884 ARBA 88888 88888 NOAS FIGURE 8-4 Federal Withholding Tax Table: (concluded) Married Persons FIGURE 8-4 Federal Withholding Tax Table: Single Persons And the wages are At least But loss0|1I MARRIED Persons-WEEKLY Payroll Period amount of income tax to be withheld is 4567 And the number of withholding allowances claimed is (For Wages Paid through December 31, 2018) 556 6 28 28 # = 0 0 | 2888 88888 89% 89% 8888888NON ENNE OG At least And the wages are But less 011 SINGLE Persons-WEEKLY Payroll Period ne tax to be withheld is 3 4 5 6 7 8 9 10 (For Wages Paid through December 31, 2018) And the number of withholding allowances claimed is 888 8 889 88 8 888888888N ONUN 80 OVOG 288 28888 89888 8988989887889883986. Nafaso OVO WI-OOOOOOOO0008 09888888888888888 OG OOO OWN-0008 882 :o wo non-oooooop oooo | GOOOO OOOOO OOOOO OOOOO OOOOO OOOON WOENON & SRAR NORR 8588088 18 NBAN NOU OOO OOON OOOO OOOOO OOOOO OO008 YOONE 88988 88988 9OOOOOOOOOOOOOOOO OOOOO OOOOO OOOOO OOOOO OO008 NOOOOOOWN-00 00000 OOOOO OOOOO OOOOO OOOO8 889 88889 88488 48988 01 10000 OOOOO OOOOO OOOOO OOOOO OOOOO OOOOO OOOOO OO008 8 OOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOENT 9889 88% 89 88 8%.DOO OOOOO OOOOO OOOOO OOOOO OOOOOOOOOOOOOOOOOOOO 00008 9 10 988 968 8898. SOOOO OOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOO OOOO OOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOO008 No. of Marital Total Hours Allowances Status Worked Mar. 16-22 Name 4 M 45 1 Total Earnings Rate Jan. 1-Mar. 15 $12.00 $5,540.00 12.00 5,860.00 10.50 4,960.00 S Bacon, Andrea Cole, Andrew Hicks, Melvin Leung, Cara Melling, Melissa 40 3 M 44 1 S 35 11.00 5,144.50 2 2 M 40 13.00 4,732.00 Payroll Register for Period Ended March 22 20- Earnings Taxable Earnings Deductions Health No. of Marit. Allow. Status Cumulative Total Unemploy. Comp. Federal Income Social Security Tax Tax Name Regular Overtime Total Social Security Medicare Tax City Tax Insurance Other Total Net Pay Ck. No. Bacon, Andrea M Cole, Andrew 1 S Hicks, Melvin 3 M Leung, Cara 1 s Melling, Melissa 2 M 2. Assuming that the wages for the week ended March 22 were paid on March 24, prepare the journal entry for the payment of the payroll. Page: 1 DATE ACCOUNT TITLE DOC. POST. DEBIT CREDIT NO. REF. 20-- 1 1 Mar. 24 2 N 3 3 4 4 5 6 6 7 7 8 8 9 e 9 10 Payroll for week ended March 22 10 e SE 88 88 BNN 28298 28828 998878988 Sat $8898 88 89 9892 POB 8888 2898 SUN 1888 88888 88898 3898 468 888888883 888888888 9228888 8888 988989898 *** *#88 98848 89888 8828398 SONNO 88888 88888 883 884 ARBA 88888 88888 NOAS FIGURE 8-4 Federal Withholding Tax Table: (concluded) Married Persons FIGURE 8-4 Federal Withholding Tax Table: Single Persons And the wages are At least But loss0|1I MARRIED Persons-WEEKLY Payroll Period amount of income tax to be withheld is 4567 And the number of withholding allowances claimed is (For Wages Paid through December 31, 2018) 556 6 28 28 # = 0 0 | 2888 88888 89% 89% 8888888NON ENNE OG At least And the wages are But less 011 SINGLE Persons-WEEKLY Payroll Period ne tax to be withheld is 3 4 5 6 7 8 9 10 (For Wages Paid through December 31, 2018) And the number of withholding allowances claimed is 888 8 889 88 8 888888888N ONUN 80 OVOG 288 28888 89888 8988989887889883986. Nafaso OVO WI-OOOOOOOO0008 09888888888888888 OG OOO OWN-0008 882 :o wo non-oooooop oooo | GOOOO OOOOO OOOOO OOOOO OOOOO OOOON WOENON & SRAR NORR 8588088 18 NBAN NOU OOO OOON OOOO OOOOO OOOOO OO008 YOONE 88988 88988 9OOOOOOOOOOOOOOOO OOOOO OOOOO OOOOO OOOOO OO008 NOOOOOOWN-00 00000 OOOOO OOOOO OOOOO OOOO8 889 88889 88488 48988 01 10000 OOOOO OOOOO OOOOO OOOOO OOOOO OOOOO OOOOO OO008 8 OOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOENT 9889 88% 89 88 8%.DOO OOOOO OOOOO OOOOO OOOOO OOOOOOOOOOOOOOOOOOOO 00008 9 10 988 968 8898. SOOOO OOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOO OOOO OOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOO008