if you could answer all of these, thank u!

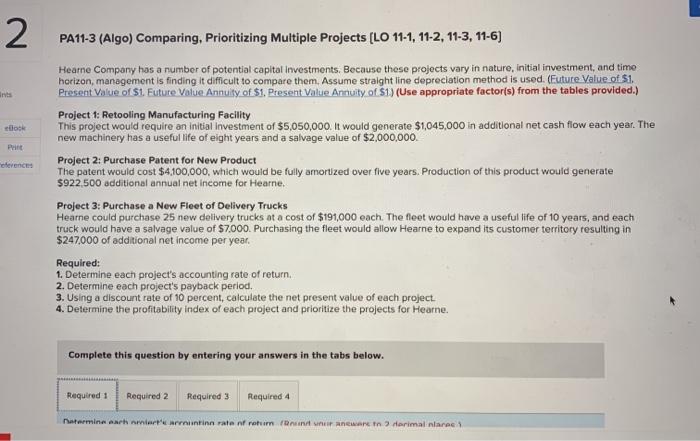

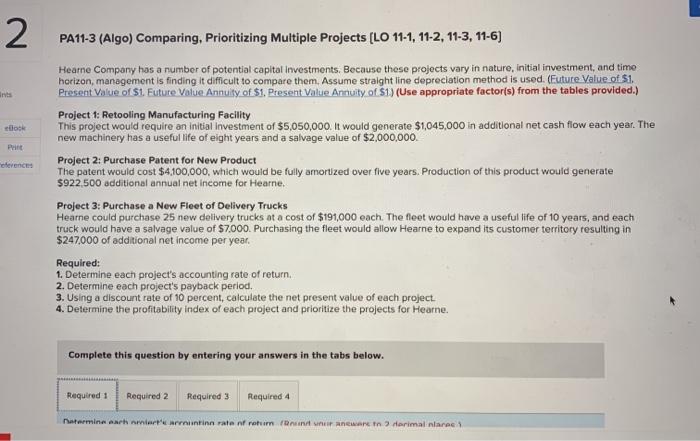

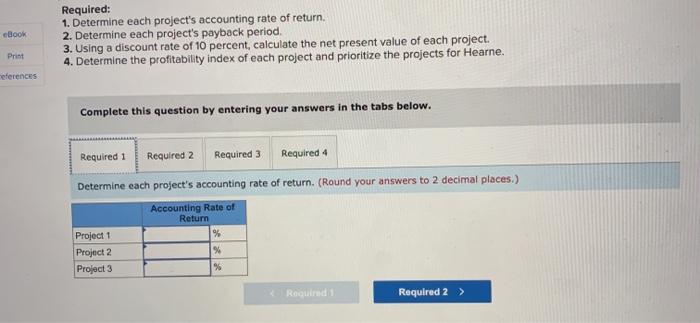

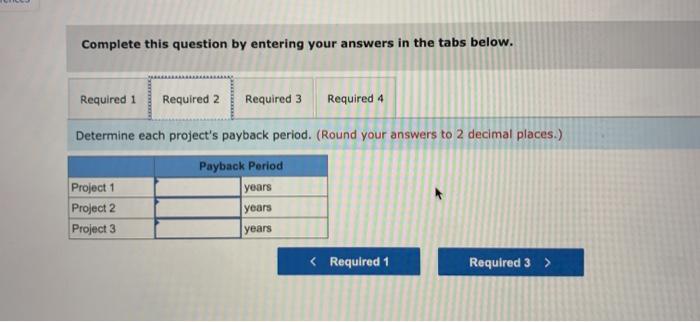

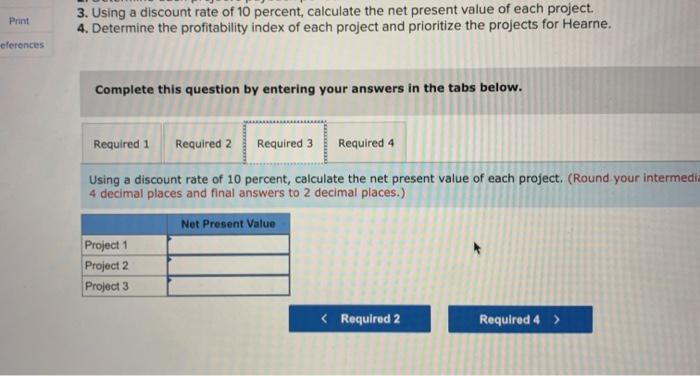

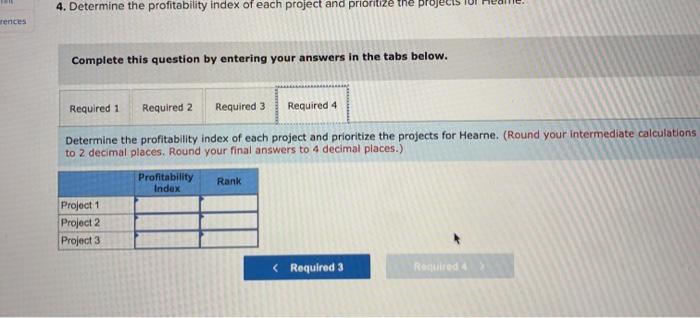

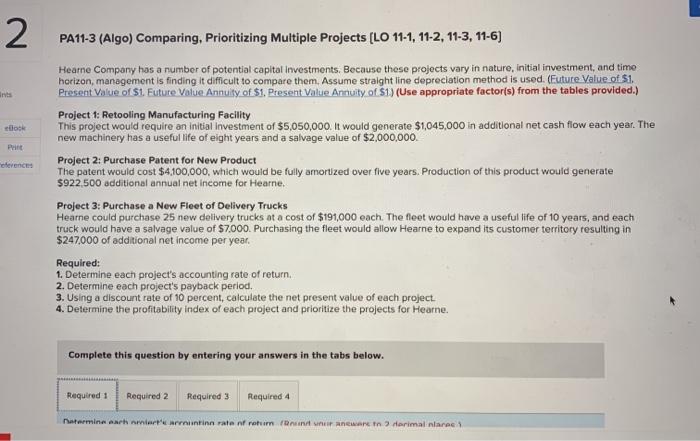

2 PA11-3 (Algo) Comparing, Prioritizing Multiple Projects (LO 11-1, 11-2, 11-3, 11-6) Print ference Hearne Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, management is finding it difficult to compare them. Assume straight line depreciation method is used. (Euture Value of $1. Present Value of $1. Future Value Annuity of S1, Present Value Annuity of $1) (Use appropriate factor(s) from the tables provided.) Project : Retooling Manufacturing Facility This project would require an initial Investment of $5,050,000. It would generate $1,045,000 in additional net cash flow each year. The new machinery has a useful life of eight years and a salvage value of $2,000,000 Project 2: Purchase Patent for New Product The patent would cost $4,100,000, which would be fully amortized over five years. Production of this product would generate 5922.500 additional annual net income for Hearne. Project 3: Purchase a New Fleet of Delivery Trucks Hearne could purchase 25 new delivery trucks at a cost of $191,000 each. The fleet would have a useful life of 10 years, and each truck would have a salvage value of 57.000. Purchasing the fleet would allow Hearne to expand its customer territory resulting in $247000 of additional net income per year. Required: 1. Determine each project's accounting rate of return. 2. Determine each project's payback period. 3. Using a discount rate of 10 percent, calculate the net present value of each project 4. Determine the profitability index of each project and prioritize the projects for Hearne. Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 Required 4 natermine each more arrunting rate from runnur ane tn darimal marec cBook Required: 1. Determine each project's accounting rate of return. 2. Determine each project's payback period. 3. Using a discount rate of 10 percent, calculate the net present value of each project. 4. Determine the profitability index of each project and prioritize the projects for Hearne. Print eferences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Determine each project's accounting rate of return. (Round your answers to 2 decimal places.) Accounting Rate of Return % Project 1 Project 2 Project 3 9 % Round Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Determine each project's payback period. (Round your answers to 2 decimal places.) Project 1 Project 2 Project 3 Payback Period years | years years Print 3. Using a discount rate of 10 percent, calculate the net present value of each project. 4. Determine the profitability index of each project and prioritize the projects for Hearne. eferences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Using a discount rate of 10 percent, calculate the net present value of each project. (Round your intermedi 4 decimal places and final answers to 2 decimal places.) Net Present Value Project 1 Project 2 Project 3 4. Determine the profitability index of each project and prioritize the proje Wences Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Determine the profitability index of each project and prioritize the projects for Hearne. (Round your intermediate calculations to 2 decimal places. Round your final answers to 4 decimal places.) Profitability Index Rank Project 1 Project 2 Project 3