Answered step by step

Verified Expert Solution

Question

1 Approved Answer

if you could label each part that would be great Question# 1-Payroll liabilities: Win-Win company's first weekly pay period of the year ends on January

if you could label each part that would be great

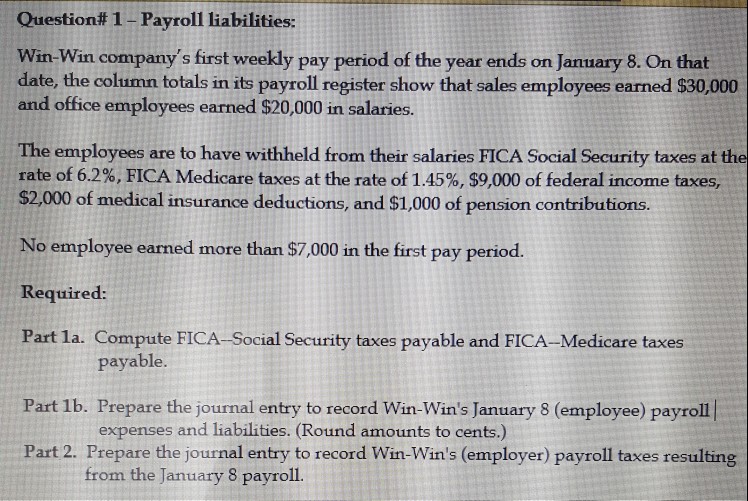

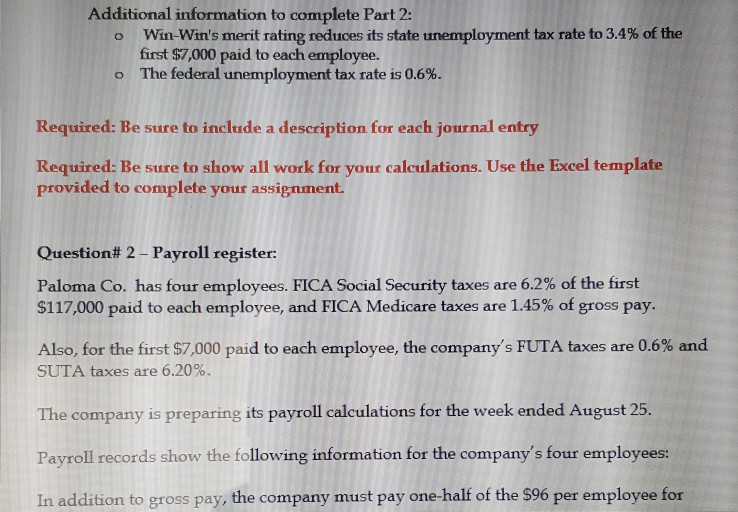

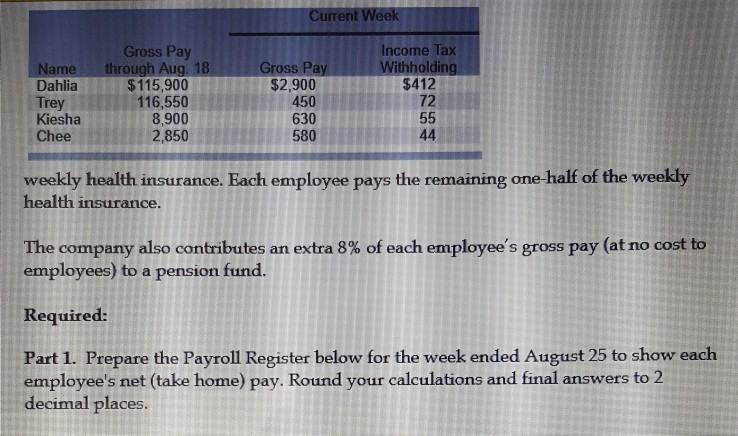

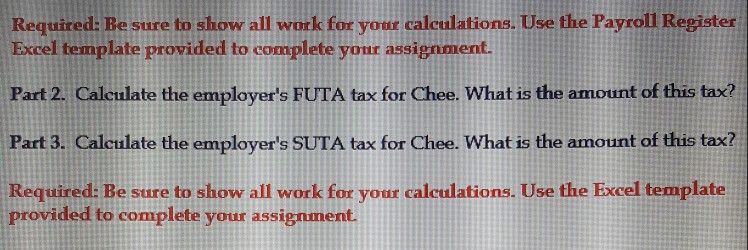

Question# 1-Payroll liabilities: Win-Win company's first weekly pay period of the year ends on January 8. On that date, the column totals in its payroll register show that sales employees earned $30,000 and office employees earned $20,000 in salaries. The employees are to have withheld from their salaries FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $9,000 of federal income taxes, $2,000 of medical insurance deductions, and $1,000 of pension contributions. No employee earned more than $7,000 in the first pay period. Required: Part la. Compute FICA-Social Security taxes payable and FICA-Medicare taxes payable. Part 1b. Prepare the journal entry to record Win-Win's January 8 (employee) payroll expenses and liabilities. (Round amounts to cents.) Part 2. Prepare the journal entry to record Win-Win's (employer) payroll taxes resulting from the January 8 payroll. Question# 1-Payroll liabilities: Win-Win company's first weekly pay period of the year ends on January 8. On that date, the column totals in its payroll register show that sales employees earned $30,000 and office employees earned $20,000 in salaries. The employees are to have withheld from their salaries FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $9,000 of federal income taxes, $2,000 of medical insurance deductions, and $1,000 of pension contributions. No employee earned more than $7,000 in the first pay period. Required: Part la. Compute FICA-Social Security taxes payable and FICA-Medicare taxes payable. Part 1b. Prepare the journal entry to record Win-Win's January 8 (employee) payroll expenses and liabilities. (Round amounts to cents.) Part 2. Prepare the journal entry to record Win-Win's (employer) payroll taxes resulting from the January 8 payroll

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started