If you could please help me with this problem I would really appreciate it. If you could show me the formulas you use for the different cells that would be amazing. Is is possible that you could link the excel file so that I can see the solution? I will make sure to give you a thumbs up.

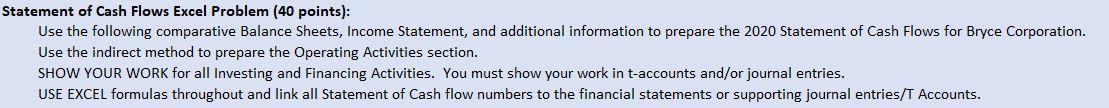

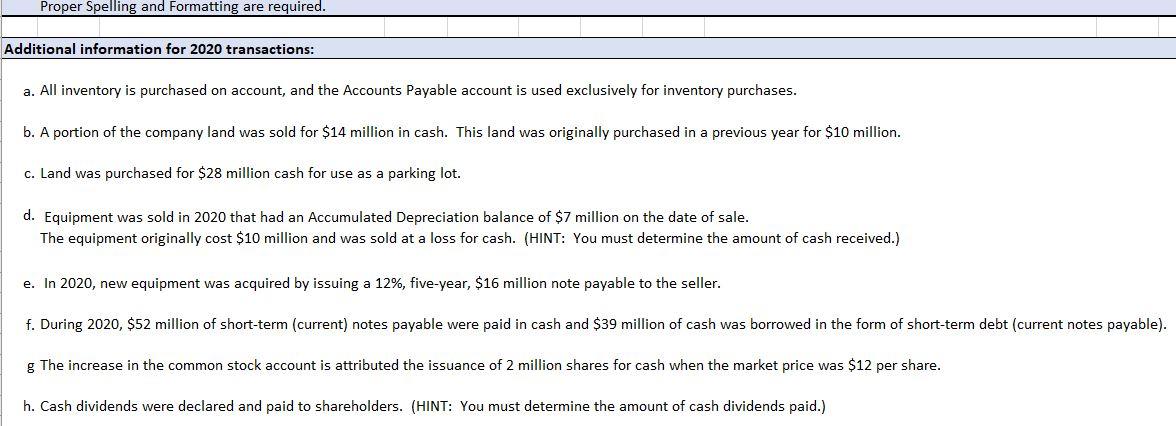

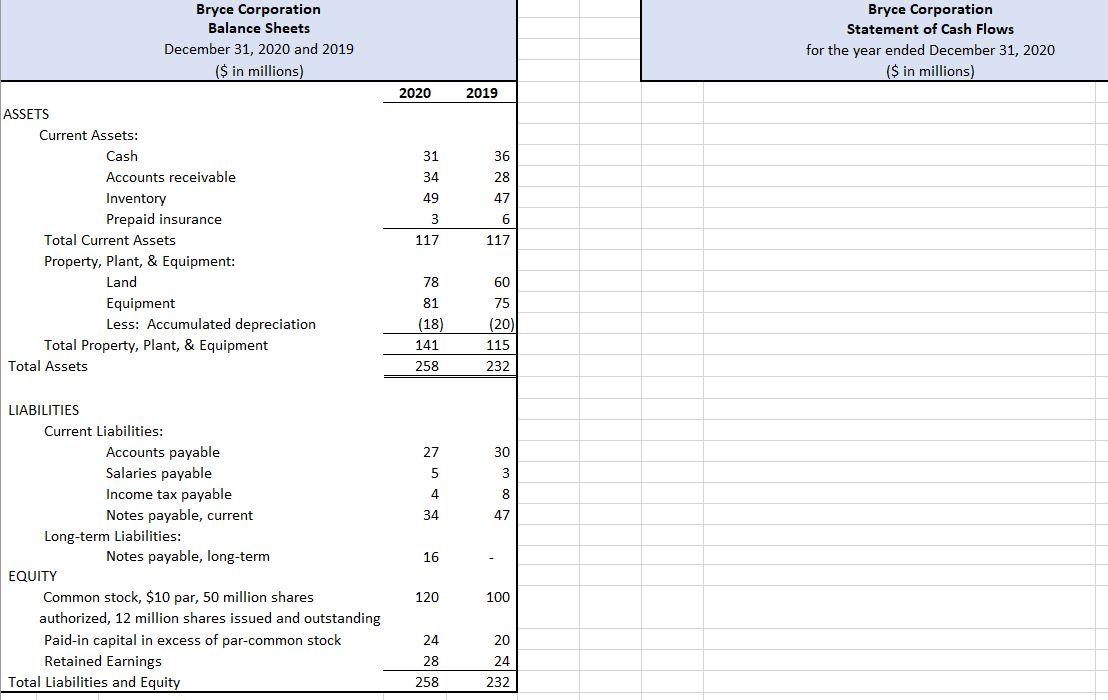

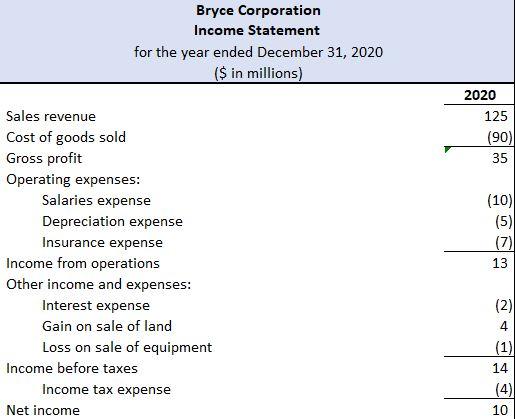

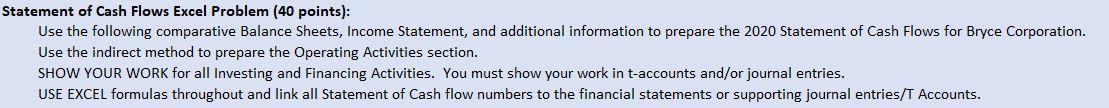

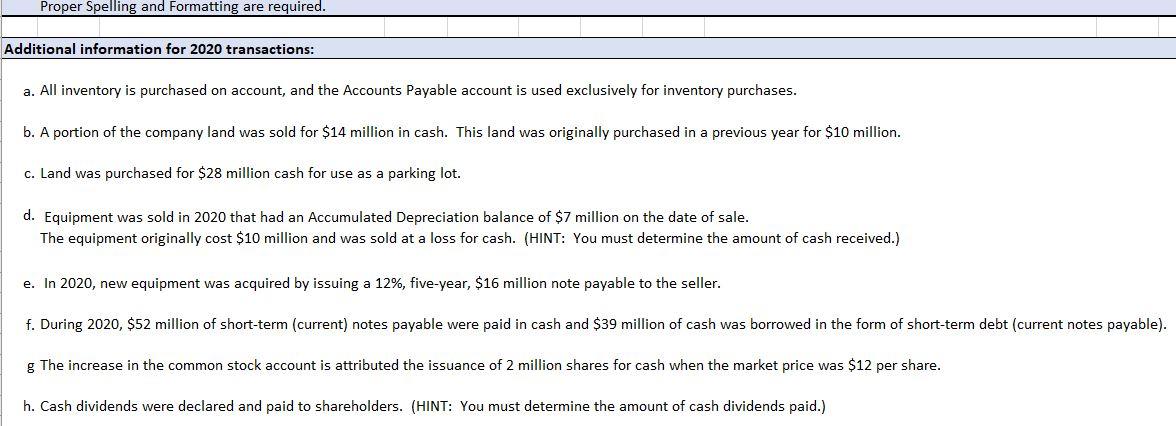

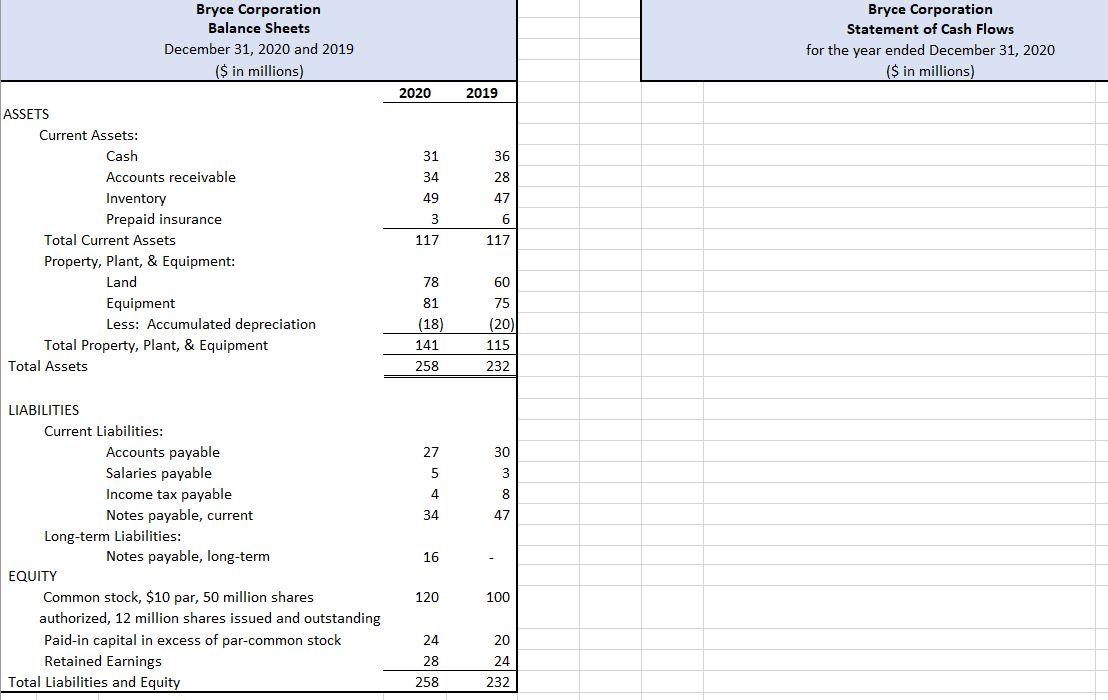

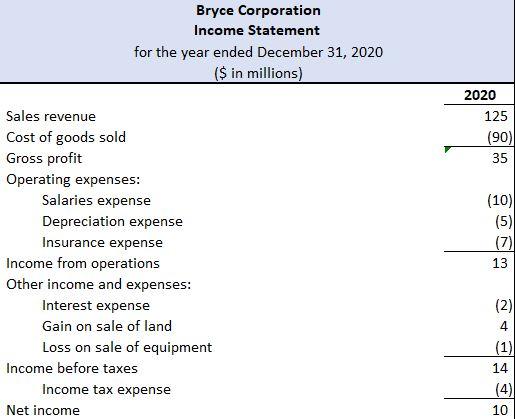

Statement of Cash Flows Excel Problem (40 points): Use the following comparative Balance Sheets, Income Statement, and additional information to prepare the 2020 Statement of Cash Flows for Bryce Corporation. Use the indirect method to prepare the Operating Activities section. SHOW YOUR WORK for all Investing and Financing Activities. You must show your work in t-accounts and/or journal entries. USE EXCEL formulas throughout and link all Statement of Cash flow numbers to the financial statements or supporting journal entries/T Accounts. Proper Spelling and Formatting are required. Additional information for 2020 transactions: a. All inventory is purchased on account, and the Accounts Payable account is used exclusively for inventory purchases. b. A portion of the company land was sold for $14 million in cash. This land was originally purchased in a previous year for $10 million. c. Land was purchased for $28 million cash for use as a parking lot. d. Equipment was sold in 2020 that had an Accumulated Depreciation balance of $7 million on the date of sale. The equipment originally cost $10 million and was sold at a loss for cash. (HINT: You must determine the amount of cash received.) e. In 2020, new equipment was acquired by issuing a 12%, five-year, $16 million note payable to the seller. f. During 2020, $52 million of short-term (current) notes payable were paid in cash and $39 million of cash was borrowed in the form of short-term debt (current notes payable). g The increase in the common stock account is attributed the issuance of 2 million shares for cash when the market price was $12 per share. h. Cash dividends were declared and paid to shareholders. (HINT: You must determine the amount of cash dividends paid.) Bryce Corporation Balance Sheets December 31, 2020 and 2019 ($ in millions) Bryce Corporation Statement of Cash Flows for the year ended December 31, 2020 ($ in millions) 2020 2019 31 34 49 36 28 47 3 6 ASSETS Current Assets: Cash Accounts receivable Inventory Prepaid insurance Total Current Assets Property, Plant, & Equipment: Land Equipment Less: Accumulated depreciation Total Property, plant, & Equipment Total Assets 117 117 78 60 81 (18) 141 258 75 (20) 115 232 30 3 27 5 4 34 8 47 LIABILITIES Current Liabilities: Accounts payable Salaries payable Income tax payable Notes payable, current Long-term Liabilities: Notes payable, long-term EQUITY Common stock, $10 par, 50 million shares authorized, 12 million shares issued and outstanding Paid-in capital in excess of par-common stock Retained Earnings Total Liabilities and Equity 16 - 120 100 20 24 28 258 24 232 Bryce Corporation Income Statement for the year ended December 31, 2020 ($ in millions) 2020 125 (90) 35 Sales revenue Cost of goods sold Gross profit Operating expenses: Salaries expense Depreciation expense Insurance expense Income from operations Other income and expenses: Interest expense Gain on sale of land Loss on sale of equipment Income before taxes Income tax expense Net income (10) (5) (7) 13 (2) (1) 14 10