If you could show the formula used, I would greatly appreciate it. I am missing something or not putting my numbers where they need to be. Thank you!!

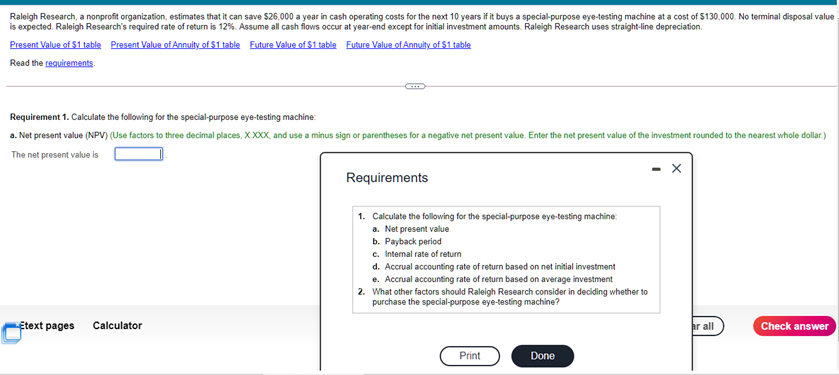

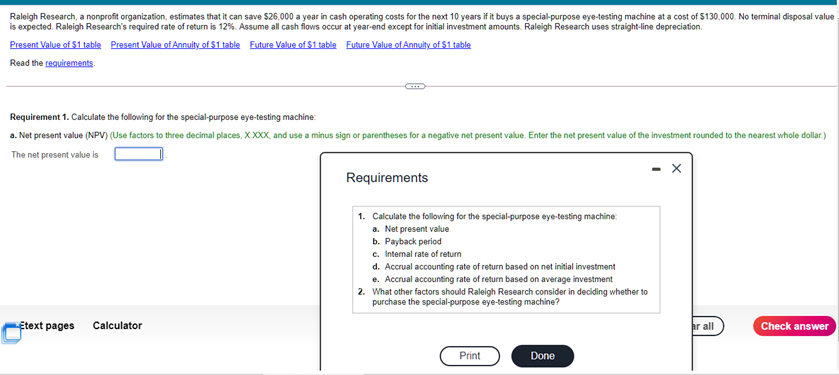

Raleigh Research, a nonprofit organization, estimates that it can save $25,000 a year in cash operating costs for the next 10 years if it buys a special-purpose eye-testing machine at a cost of $130,000. No terminal disposal value is expected. Raleigh Research's required rate of return is 12%. Assume all cash flows occur at year-end except for initial investment amounts. Raleigh Research uses straight-line depreciation Present Value of $1 table Present Value of Annuity of 51 table Future Value of $1 table Future Value of Annuity of 51 table Read the requirements Requirement 1. Calculate the following for the special-purpose eye-testing machine a. Net present value (NPV) (Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for a negative net present value. Enter the net present value of the investment rounded to the nearest whole dollar.) The net present value is Requirements 1. Calculate the following for the special-purpose eye-testing machine a. Net present value b. Payback period c. Internal rate of return d. Accrual accounting rate of return based on net initial investment e. Accrual accounting rate of return based on average investment 2. What other factors should Raleigh Research consider in deciding whether to purchase the special-purpose eye-testing machine? Etext pages Calculator hr all Check answer Print Done Raleigh Research, a nonprofit organization, estimates that it can save $25,000 a year in cash operating costs for the next 10 years if it buys a special-purpose eye-testing machine at a cost of $130,000. No terminal disposal value is expected. Raleigh Research's required rate of return is 12%. Assume all cash flows occur at year-end except for initial investment amounts. Raleigh Research uses straight-line depreciation Present Value of $1 table Present Value of Annuity of 51 table Future Value of $1 table Future Value of Annuity of 51 table Read the requirements Requirement 1. Calculate the following for the special-purpose eye-testing machine a. Net present value (NPV) (Use factors to three decimal places, X.XXX, and use a minus sign or parentheses for a negative net present value. Enter the net present value of the investment rounded to the nearest whole dollar.) The net present value is Requirements 1. Calculate the following for the special-purpose eye-testing machine a. Net present value b. Payback period c. Internal rate of return d. Accrual accounting rate of return based on net initial investment e. Accrual accounting rate of return based on average investment 2. What other factors should Raleigh Research consider in deciding whether to purchase the special-purpose eye-testing machine? Etext pages Calculator hr all Check answer Print Done