Answered step by step

Verified Expert Solution

Question

1 Approved Answer

if you could type it out would be appreciated ! Cash Perkins Company acquired 100% of Schultz Company on January 1, 2017, for $161,500. On

if you could type it out would be appreciated !

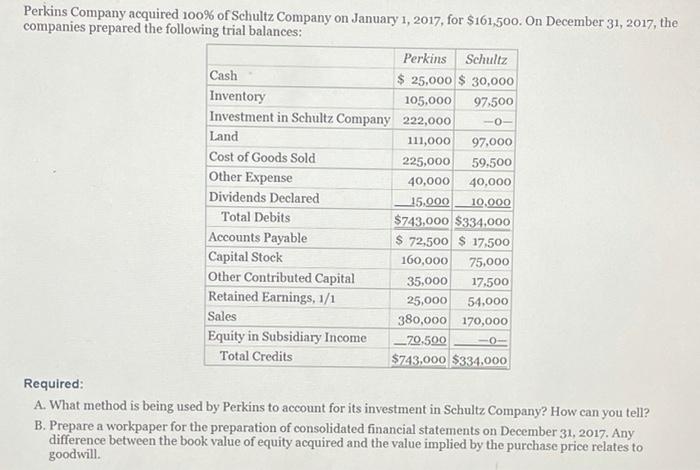

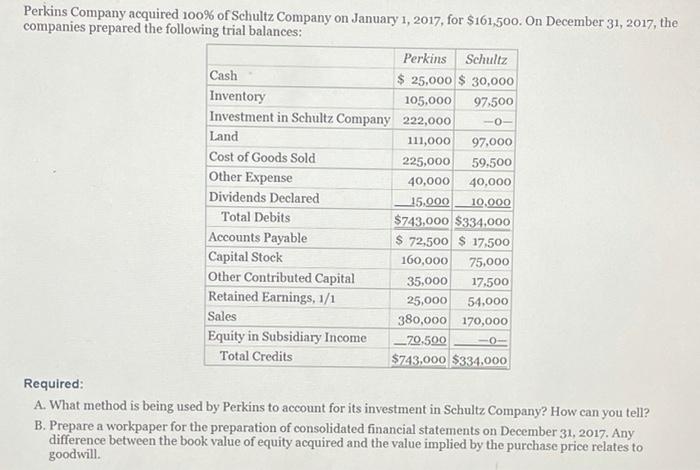

Cash Perkins Company acquired 100% of Schultz Company on January 1, 2017, for $161,500. On December 31, 2017, the companies prepared the following trial balances: Perkins Schultz $ 25,000 $ 30,000 Inventory 105,000 97,500 Investment in Schultz Company 222,000 Land 111,000 97,000 Cost of Goods Sold 225,000 59.500 Other Expense 40,000 40,000 Dividends Declared 15.000 10.000 Total Debits $743,000 $334.000 Accounts Payable $ 72,500 $ 17.500 Capital Stock 160,000 75,000 Other Contributed Capital 35,000 17.500 Retained Earnings, 1/1 25,000 54.000 Sales 380,000 170,000 Equity in Subsidiary Income - 70,500 Total Credits $743,000 $334.000 Required: A. What method is being used by Perkins to account for its investment in Schultz Company? How can you tell? B. Prepare a workpaper for the preparation of consolidated financial statements on December 31, 2017. Any difference between the book value of equity acquired and the value implied by the purchase price relates to goodwill. Cash Perkins Company acquired 100% of Schultz Company on January 1, 2017, for $161,500. On December 31, 2017, the companies prepared the following trial balances: Perkins Schultz $ 25,000 $ 30,000 Inventory 105,000 97,500 Investment in Schultz Company 222,000 Land 111,000 97,000 Cost of Goods Sold 225,000 59.500 Other Expense 40,000 40,000 Dividends Declared 15.000 10.000 Total Debits $743,000 $334.000 Accounts Payable $ 72,500 $ 17.500 Capital Stock 160,000 75,000 Other Contributed Capital 35,000 17.500 Retained Earnings, 1/1 25,000 54.000 Sales 380,000 170,000 Equity in Subsidiary Income - 70,500 Total Credits $743,000 $334.000 Required: A. What method is being used by Perkins to account for its investment in Schultz Company? How can you tell? B. Prepare a workpaper for the preparation of consolidated financial statements on December 31, 2017. Any difference between the book value of equity acquired and the value implied by the purchase price relates to goodwill

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started