Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you decide to use futures on CHF, which position (Long or Short) will you take on futures and how many contracts will you need

If you decide to use futures on CHF, which position (Long or Short) will you take on futures and how many contracts will you need to fully hedge?

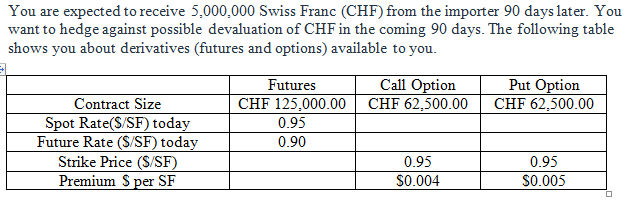

You are expected to receive 5,000,000 Swiss Franc (CHF) from the importer 90 days later. You want to hedge against possible devaluation of CHF in the coming 90 days. The following table shows you about derivatives (futures and options) available to you. Call Option CHF 125,000.00CHF 62,500.00CHF 62,500.00 utures Put Option Contract Size Spot Rate(S/SF) today Future Rate (S/SF) today Strike Price (S/SF) Premium S per SH 0.95 0.90 0.95 S0.004 0.95Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started