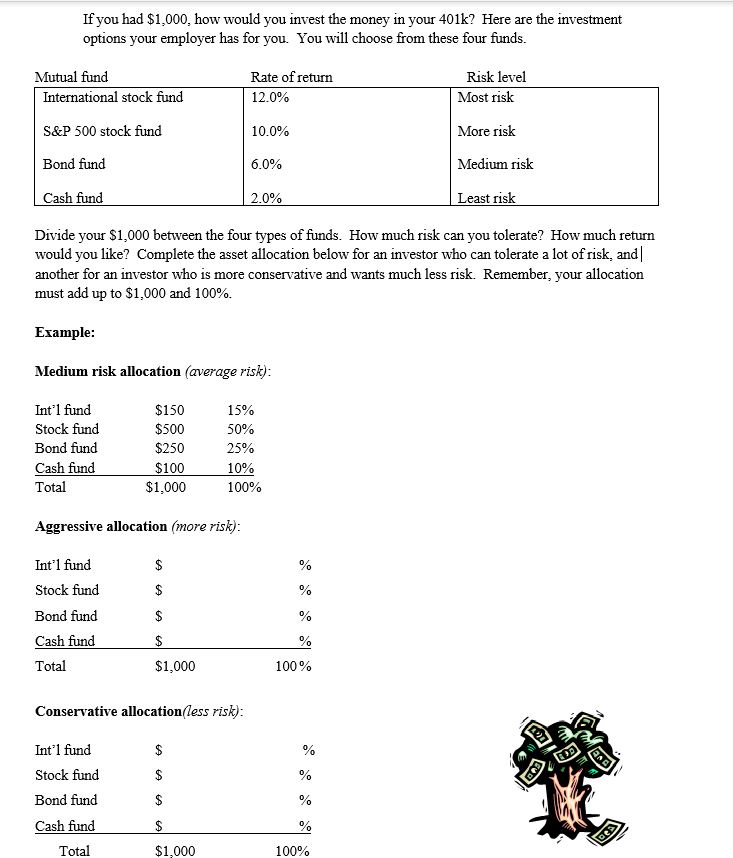

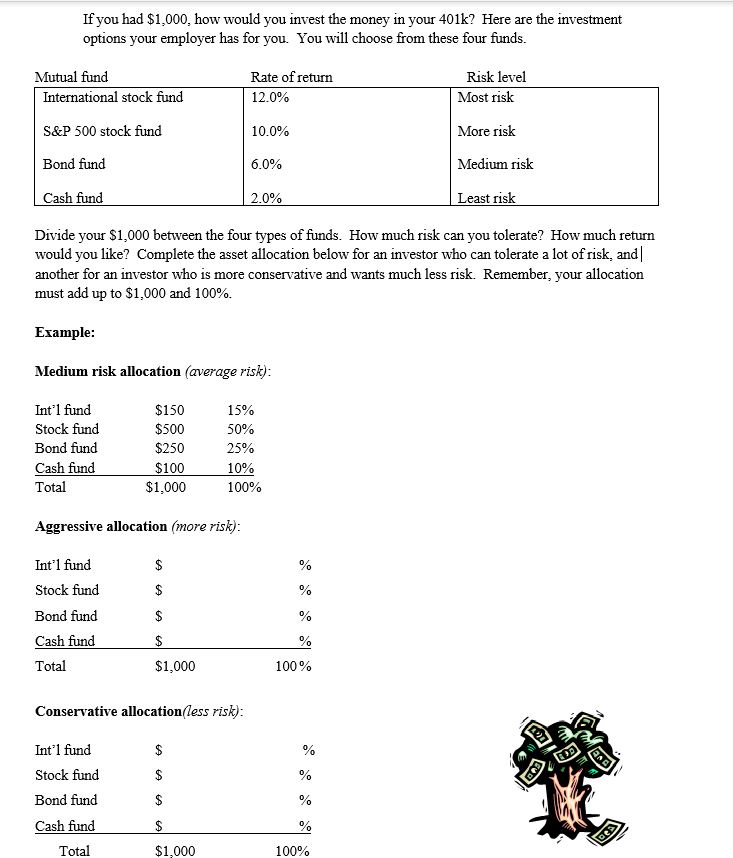

If you had $1,000, how would you invest the money in your 401k? Here are the investment options your employer has for you. You will choose from these four funds. Mutual fund International stock fund Rate of return 12.0% Risk level Most risk S&P 500 stock fund 10.0% More risk Bond fund 6.0% Medium risk Cash fund 2.0% Least risk Divide your $1,000 between the four types of funds. How much risk can you tolerate? How much return would you like? Complete the asset allocation below for an investor who can tolerate a lot of risk, and| another for an investor who is more conservative and wants much less risk. Remember, your allocation must add up to $1,000 and 100%. Example: Medium risk allocation (average risk): Int'l fund Stock fund Bond fund Cash fund Total $150 $500 $250 $100 $1,000 15% 50% 25% 10% 100% Aggressive allocation (more risk): $ % $ % Int'l fund Stock fund Bond fund Cash fund Total $ % % $1,000 100% Conservative allocation less risk): $ % % $ Int'l fund Stock fund Bond fund Cash fund Total $ % $ % 100% Qe2 $1,000 If you had $1,000, how would you invest the money in your 401k? Here are the investment options your employer has for you. You will choose from these four funds. Mutual fund International stock fund Rate of return 12.0% Risk level Most risk S&P 500 stock fund 10.0% More risk Bond fund 6.0% Medium risk Cash fund 2.0% Least risk Divide your $1,000 between the four types of funds. How much risk can you tolerate? How much return would you like? Complete the asset allocation below for an investor who can tolerate a lot of risk, and| another for an investor who is more conservative and wants much less risk. Remember, your allocation must add up to $1,000 and 100%. Example: Medium risk allocation (average risk): Int'l fund Stock fund Bond fund Cash fund Total $150 $500 $250 $100 $1,000 15% 50% 25% 10% 100% Aggressive allocation (more risk): $ % $ % Int'l fund Stock fund Bond fund Cash fund Total $ % % $1,000 100% Conservative allocation less risk): $ % % $ Int'l fund Stock fund Bond fund Cash fund Total $ % $ % 100% Qe2 $1,000