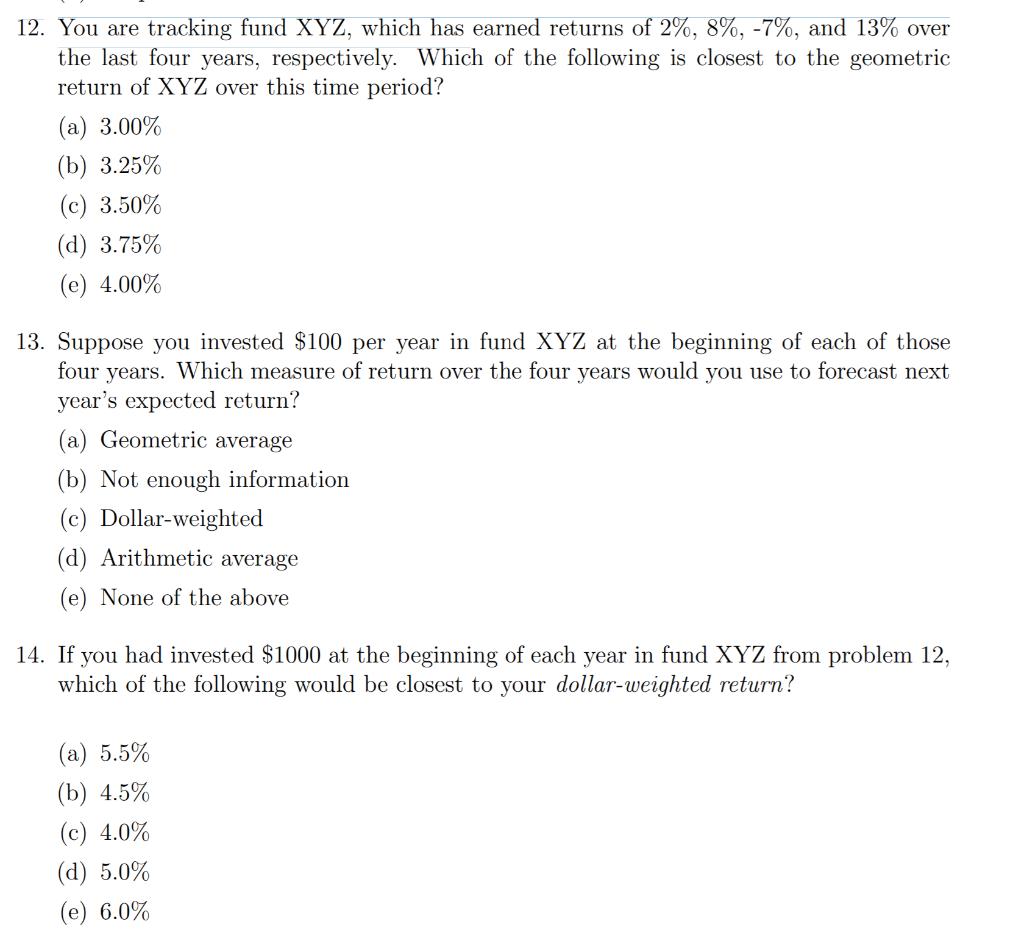

12. You are tracking fund XYZ, which has earned returns of 2%, 8%, -7%, and 13% over the last four years, respectively. Which of

12. You are tracking fund XYZ, which has earned returns of 2%, 8%, -7%, and 13% over the last four years, respectively. Which of the following is closest to the geometric return of XYZ over this time period? () 3.00% (b) 3.25% () 3.50% (d) 3.75% (e) 4.00% 13. Suppose you invested $100 per year in fund XYZ at the beginning of each of those four years. Which measure of return over the four years would you use to forecast next year's expected return? (a) Geometric average (b) Not enough information (c) Dollar-weighted (d) Arithmetic average (e) None of the above 14. If you had invested $1000 at the beginning of each year in fund XYZ from problem 12, which of the following would be closest to your dollar-weighted return? () 5.5% (b) 4.5% () 4.0% (d) 5.0% (e) 6.0%

Step by Step Solution

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

The geometric return of XYZ over this time periodOption d 375 Stepbys...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started