Answered step by step

Verified Expert Solution

Question

1 Approved Answer

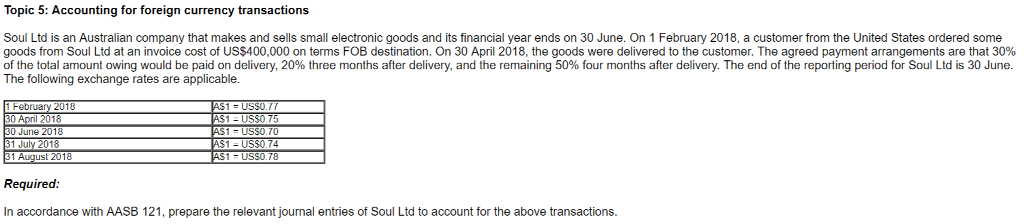

If you know AASB then please help me with one! Thanks! Topic 5: Accounting for foreign currency transactions Soul Ltd is an Australian company that

If you know AASB then please help me with one! Thanks!

Topic 5: Accounting for foreign currency transactions Soul Ltd is an Australian company that makes and sells small electronic goods and its financial year ends on 30 June. On 1 February 2018, a customer from the United States ordered some goods from Soul Ltd at an invoice cost of US$400,000 on terms FOB destination. On 30 April 2018, the goods were delivered to the customer. The agreed payment arrangements are that 30% f the total amount owing would be paid on delivery, 20% three months after delivery, and the rema ning 50 our months after delivery. The end o there o ng nod or so Ltd S 3 June The following exchange rates are applicable. 1 US 30 Apri June 2 Required: In accordance with AASB 121, prepare the relevant journal entries of Soul Ltd to account for the above transactionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started