Answered step by step

Verified Expert Solution

Question

1 Approved Answer

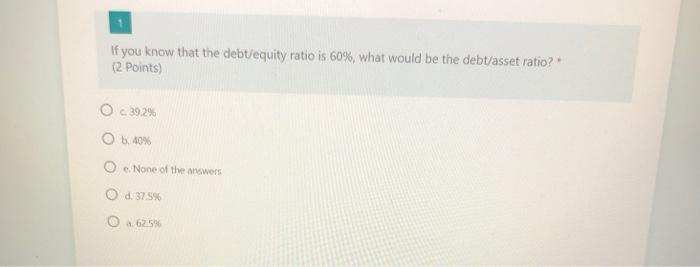

If you know that the debt/equity ratio is 60%, what would be the debt/asset ratio? (2 points) O c.39.2% O b. 40% O None of

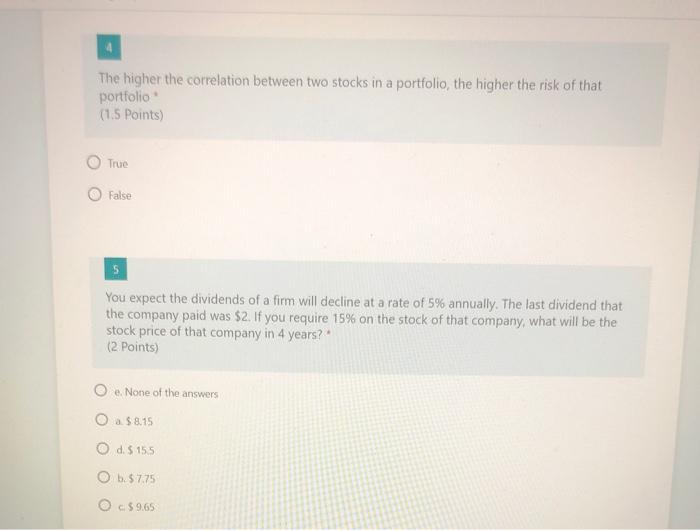

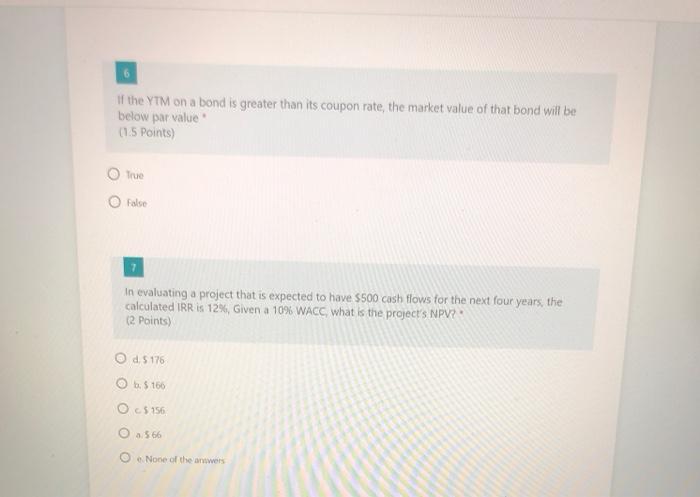

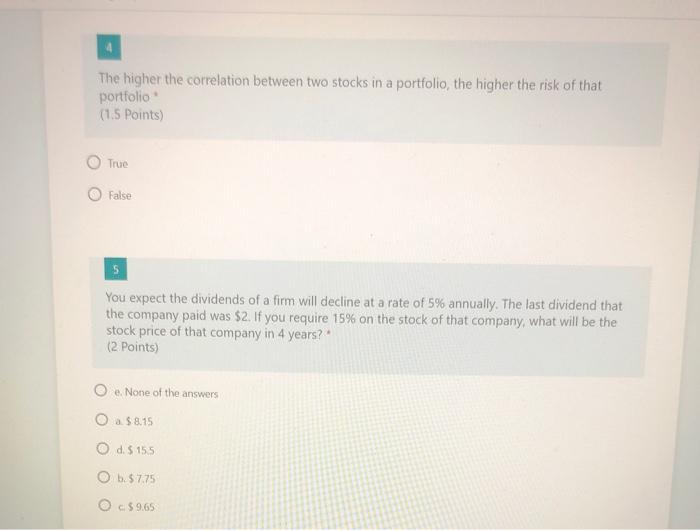

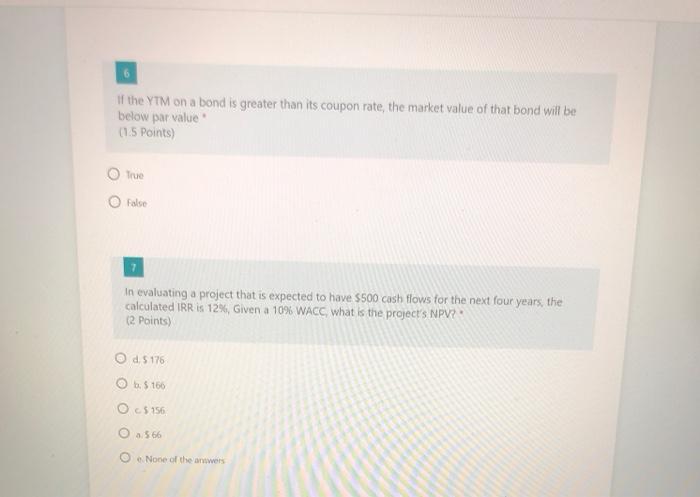

If you know that the debt/equity ratio is 60%, what would be the debt/asset ratio? (2 points) O c.39.2% O b. 40% O None of the answers O d. 375% O 262.5% The higher the correlation between two stocks in a portfolio, the higher the risk of that portfolio (1.5 points) True False You expect the dividends of a firm will decline at a rate of 5% annually. The last dividend that the company paid was $2. If you require 15% on the stock of that company, what will be the stock price of that company in 4 years? (2 points) O e None of the answers O a $ 8.15 O d. 5155 O :57.75 O c$9.65 if the YTM on a bond is greater than its coupon rate, the market value of that bond will be below par value (1.5 points) True O False In evaluating a project that is expected to have 500 cash flows for the next four years, the calculated IRR is 12%, Given a 10% WACC, what is the project's NPV? (2 points) Od 5 176 O . $ 150 O c5156 0.566 None of the answers

If you know that the debt/equity ratio is 60%, what would be the debt/asset ratio? (2 points) O c.39.2% O b. 40% O None of the answers O d. 375% O 262.5% The higher the correlation between two stocks in a portfolio, the higher the risk of that portfolio (1.5 points) True False You expect the dividends of a firm will decline at a rate of 5% annually. The last dividend that the company paid was $2. If you require 15% on the stock of that company, what will be the stock price of that company in 4 years? (2 points) O e None of the answers O a $ 8.15 O d. 5155 O :57.75 O c$9.65 if the YTM on a bond is greater than its coupon rate, the market value of that bond will be below par value (1.5 points) True O False In evaluating a project that is expected to have 500 cash flows for the next four years, the calculated IRR is 12%, Given a 10% WACC, what is the project's NPV? (2 points) Od 5 176 O . $ 150 O c5156 0.566 None of the answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started