Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you were given annual rate of return data for AMD or any other company's stock and you were asked to estimate the average annual

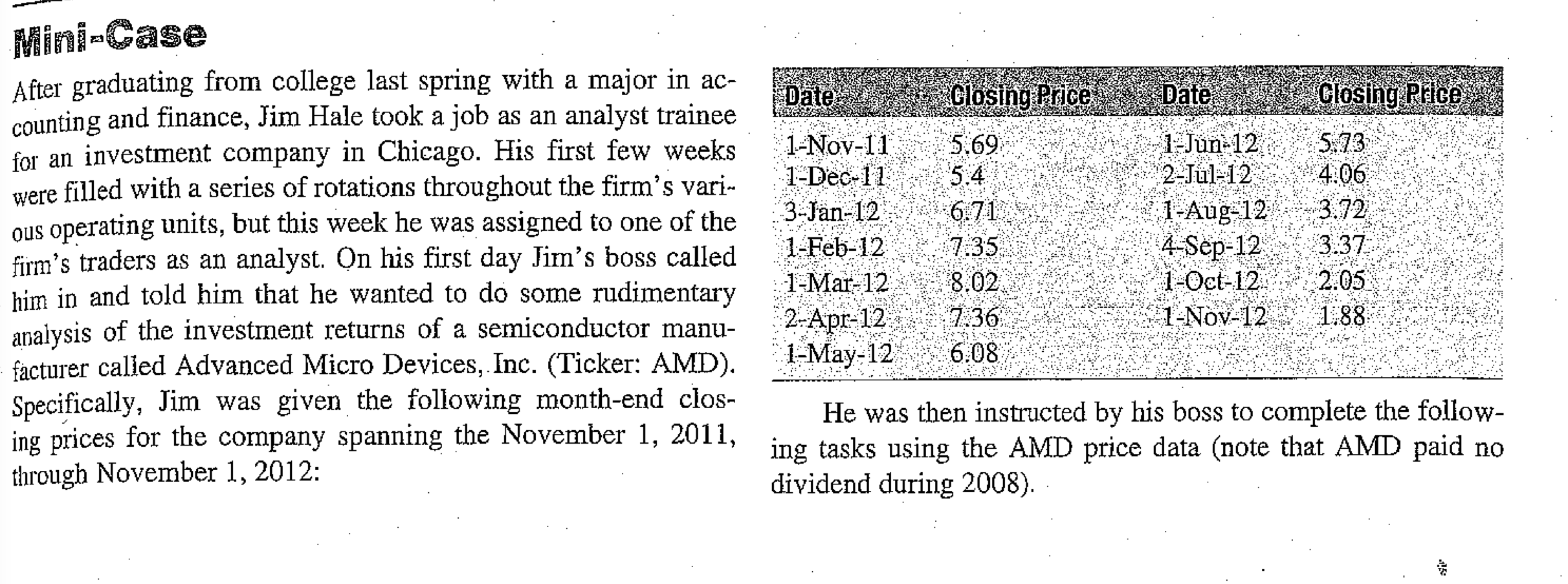

If you were given annual rate of return data for AMD or any other company's stock and you were asked to estimate the average annual rate of return an investor would have earned over the sample period by holding the stock, would you use an arithmetic or geometric average of the historical rates of return? Explain your response as if you were talking to a client who has no formal training in finance or investments.

If you were given annual rate of return data for AMD or any other company's stock and you were asked to estimate the average annual rate of return an investor would have earned over the sample period by holding the stock, would you use an arithmetic or geometric average of the historical rates of return? Explain your response as if you were talking to a client who has no formal training in finance or investments.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started