Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you were President of NPM Technologies, what could be your balanced scorecard at the end of 2007. Previously, explain in a short note, what

If you were President of NPM Technologies, what could be your balanced scorecard at the end of 2007. Previously, explain in a short note, what is a balanced scorecard.

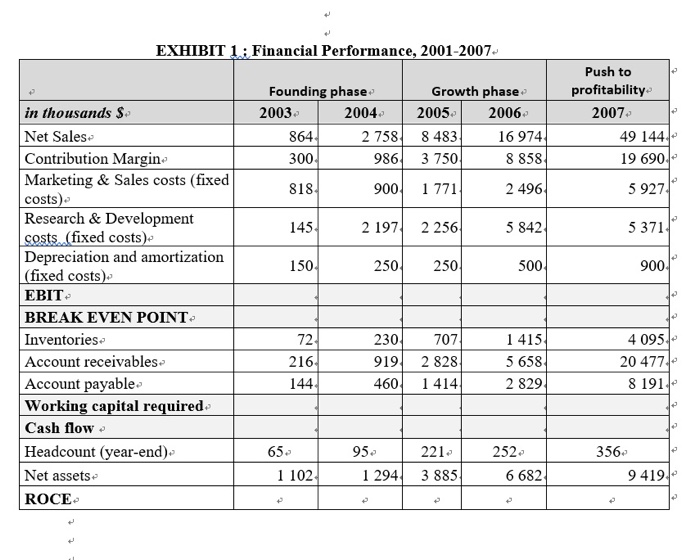

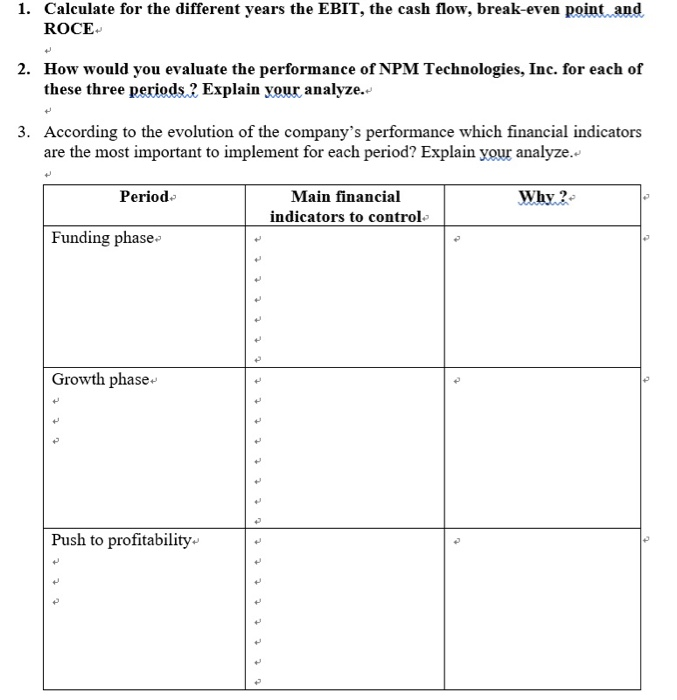

EXHIBIT 1: Financial Performance, 2001-2007 Push to profitability 2007 Founding phase 2003- Growth phase 2006 in thousands S Net Sales Contribution Margin Marketing & Sales costs (fixed costs) Research & Development 2004 2005 864 300 818 2 758 8 483 6 974 8 858 2 496 5 842 49 144 690 5 927 5 371 900 9863 750 900 771 2 1972 256 250 250 145 osts (fixed costs) Depreciation and amortization fixed costs) EBIT. BREAKEVEN POINT Inventories Account receivables Account pavable Working capital required Cash flow Headcount (year-end) Net assets ROCE 150 500 230 919 2828 4601414 72 216 144 1 415 5 658 2 829 707 4 0954* 20477 8191 95- 221 252 356 65. 1 102 6 682 294 3 885 9 419 1. Calculate for the different years the EBIT, the cash flow, break-even pointand ROCE. 2. How would you evaluate the performance of NPM Technologies, Inc. for each of these three periods.2 Explain vour analyze.. 3. According to the evolution of the company's performance which financial indicators are the most important to implement for each period? Explain your analyze.. Period Main financial indicators to control Funding phase Growth phase Push to profitability Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started