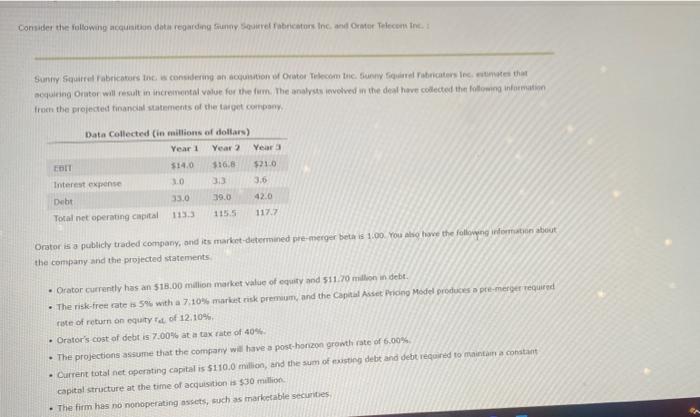

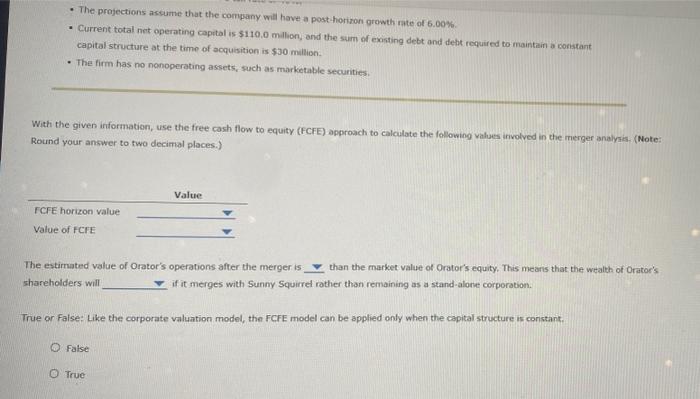

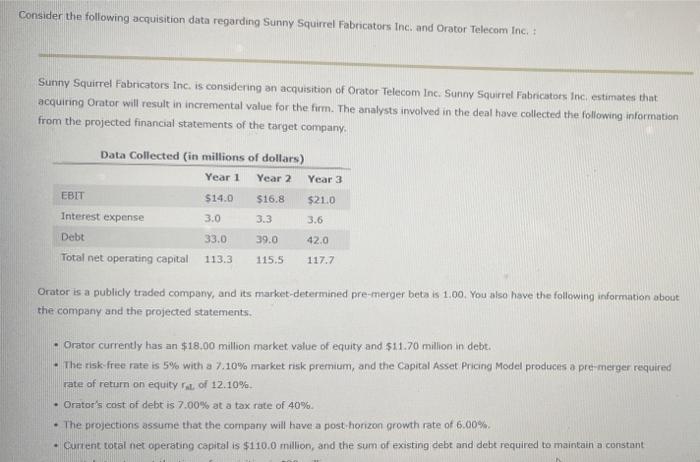

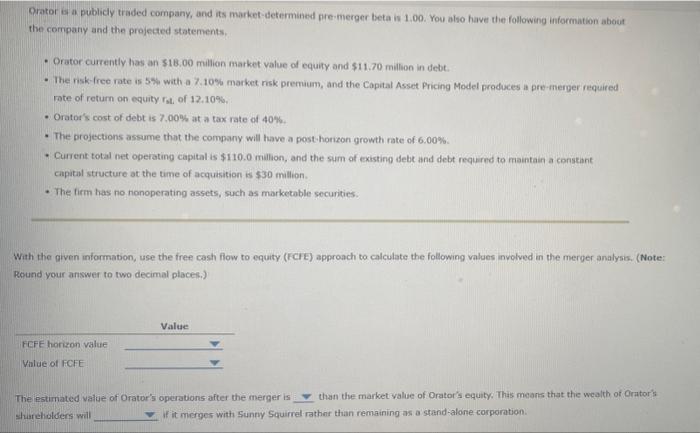

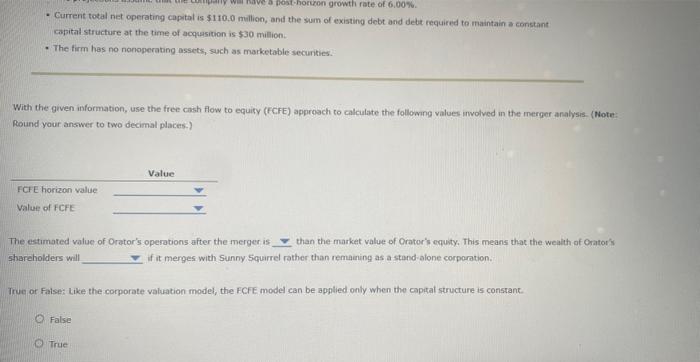

Ifuch the proyected firamcin satements of the target corrpber. the corfipany and the projected staterrents - Orator currently has an $1 B.00 mulion market value of equity and 511 .ro mallon in debt. rive of return on cquaty rat of 12,10%2. - Orator's cost of debt is 7.0076 ati in tax fate of 40\%4. - The projections assumme that the compramy will have a post-horizon gromtr rate of 6.00m. - Current total net merting copital is 5110.0 mullion, and the sum of masting debt and debt required to mathintirt an cohstant capital structure at the time of acgusution is $30 mitlion: - The firm has no nonoperating assets, much as marketable secugities - The projections arsume that the company will have a post-horizon growth rate of 6.00%. - Current total net operating capital is $110,0 milliony and the sum of existing debt and deht roquired to maintain a constant capital structure at the time of scquisition is 530 miltion. - The firm has no nonoperating assets, such as marketable securities. With the given information, use the free cash flow to equity (FCFE) approach to calculate the following values involved in the merger analysis. (Note: Round your answer to two decimal places.) The estirnated value of Orator's operations after the merger is than the market value of Orator's equity. This means that the wealth of Orator's shareholders will if it merges with Sunny Squirret rother than remaining as a stand-alone corporation. True or False: Like the corporate valuation model, the FCFE model can be applied only when the capital structure is constant. Fatse True Consider the following acquisition data regarding Sunny Squirrel Fabricators Inc. and Orator Telecom Inc. Sunny Squirrel Fabricators Inc. is considering an acquisition of Orator Telecom Inc. Sunny Squirrel Fabricators Inc, estimates that acquiring Orator will result in incremental value for the firm. The analysts involved in the deal have collected the following information from the projected financial statements of the target company. Orator is a publicly traded company, and its market-determined pre-merger beta is 1.00 . You also have the following information about the company and the projected statements. - Orator currently has an $18.00 million market value of equity and $11.70 million in debt. - The risk-free rate is 5% with a 7.10% market risk premium, and the Capital Asset Pricing Model produces a pre-merger required rate of return on equity rsl of 12.10% - Orator's cast of debt is 7,00% at a tax rate of 40% - The projections assume that the company will have a post-honzon growth rate of 6.00%. - Cuntent total net operating capical is $110.0 million, and the sum of existing debt and debt required to maintain a constant Crator is a publicly traded company, and its market-determined pre-merger beta is 1.00. You also have the following information about the company and the projected statements. - Orator currently has an 518.00 milion market value of equity and $11.70 million in debt. - The risk-free rate is 5% with a 7.10% market risk premuim, and the Capital Asset Pricing Model produces in pre-merger required rote of return on equity ral. of 12,109%. - Orator's cost of debt is 7,00% at a tax rate of 40%. - The projections assume that the company will have a post-homicon growth rate of 6.00%. * Current total net operating capital is $110.0 million, and the sum of existing debt and debt requered to maintain a coristant capital structure at the time of acquisition is $30 million. - The firm has no nonoperating assets, such as marketable securities. With the grven intormabion, use the free cash flow to equity (FCFE) approach to calculate the following values involved in the merger analysis. (Note: Round your answer to two decimal places,) The estimated vatue of Orator's operations after the merger is than the market value of Orator's equity. Ths meanis that the wealth of Orator's shureholdersisil wise If it micrges with Sunny Squirrel rathor thain remaining as a stand-alone-corporation. - Current total net operating capital is $110,0 million, and the sum of existing debt and debt required te maintain a constant cobital structure at the time of acqussition is $30 million. - The firm has no nonoperating assets, such as marketable securities. With the given information, use the free cash flow to equity (FCFE) approach to calculate the following values anvolved in the merger analysis. (Wote: Round your answer to two decimal places-) The estimated value of Orator's operations aiter the merger is than the market value of Orator's equity. This means that the wealith of Orator's hhareholders will if it merges with Sunny Squirrel rather than remaining as a stand-alone corporation. rui or False: like the corporate valuation model, the FCFE model can be applied only when the captal structure is constane. False True Ifuch the proyected firamcin satements of the target corrpber. the corfipany and the projected staterrents - Orator currently has an $1 B.00 mulion market value of equity and 511 .ro mallon in debt. rive of return on cquaty rat of 12,10%2. - Orator's cost of debt is 7.0076 ati in tax fate of 40\%4. - The projections assumme that the compramy will have a post-horizon gromtr rate of 6.00m. - Current total net merting copital is 5110.0 mullion, and the sum of masting debt and debt required to mathintirt an cohstant capital structure at the time of acgusution is $30 mitlion: - The firm has no nonoperating assets, much as marketable secugities - The projections arsume that the company will have a post-horizon growth rate of 6.00%. - Current total net operating capital is $110,0 milliony and the sum of existing debt and deht roquired to maintain a constant capital structure at the time of scquisition is 530 miltion. - The firm has no nonoperating assets, such as marketable securities. With the given information, use the free cash flow to equity (FCFE) approach to calculate the following values involved in the merger analysis. (Note: Round your answer to two decimal places.) The estirnated value of Orator's operations after the merger is than the market value of Orator's equity. This means that the wealth of Orator's shareholders will if it merges with Sunny Squirret rother than remaining as a stand-alone corporation. True or False: Like the corporate valuation model, the FCFE model can be applied only when the capital structure is constant. Fatse True Consider the following acquisition data regarding Sunny Squirrel Fabricators Inc. and Orator Telecom Inc. Sunny Squirrel Fabricators Inc. is considering an acquisition of Orator Telecom Inc. Sunny Squirrel Fabricators Inc, estimates that acquiring Orator will result in incremental value for the firm. The analysts involved in the deal have collected the following information from the projected financial statements of the target company. Orator is a publicly traded company, and its market-determined pre-merger beta is 1.00 . You also have the following information about the company and the projected statements. - Orator currently has an $18.00 million market value of equity and $11.70 million in debt. - The risk-free rate is 5% with a 7.10% market risk premium, and the Capital Asset Pricing Model produces a pre-merger required rate of return on equity rsl of 12.10% - Orator's cast of debt is 7,00% at a tax rate of 40% - The projections assume that the company will have a post-honzon growth rate of 6.00%. - Cuntent total net operating capical is $110.0 million, and the sum of existing debt and debt required to maintain a constant Crator is a publicly traded company, and its market-determined pre-merger beta is 1.00. You also have the following information about the company and the projected statements. - Orator currently has an 518.00 milion market value of equity and $11.70 million in debt. - The risk-free rate is 5% with a 7.10% market risk premuim, and the Capital Asset Pricing Model produces in pre-merger required rote of return on equity ral. of 12,109%. - Orator's cost of debt is 7,00% at a tax rate of 40%. - The projections assume that the company will have a post-homicon growth rate of 6.00%. * Current total net operating capital is $110.0 million, and the sum of existing debt and debt requered to maintain a coristant capital structure at the time of acquisition is $30 million. - The firm has no nonoperating assets, such as marketable securities. With the grven intormabion, use the free cash flow to equity (FCFE) approach to calculate the following values involved in the merger analysis. (Note: Round your answer to two decimal places,) The estimated vatue of Orator's operations after the merger is than the market value of Orator's equity. Ths meanis that the wealth of Orator's shureholdersisil wise If it micrges with Sunny Squirrel rathor thain remaining as a stand-alone-corporation. - Current total net operating capital is $110,0 million, and the sum of existing debt and debt required te maintain a constant cobital structure at the time of acqussition is $30 million. - The firm has no nonoperating assets, such as marketable securities. With the given information, use the free cash flow to equity (FCFE) approach to calculate the following values anvolved in the merger analysis. (Wote: Round your answer to two decimal places-) The estimated value of Orator's operations aiter the merger is than the market value of Orator's equity. This means that the wealith of Orator's hhareholders will if it merges with Sunny Squirrel rather than remaining as a stand-alone corporation. rui or False: like the corporate valuation model, the FCFE model can be applied only when the captal structure is constane. False True