Answered step by step

Verified Expert Solution

Question

1 Approved Answer

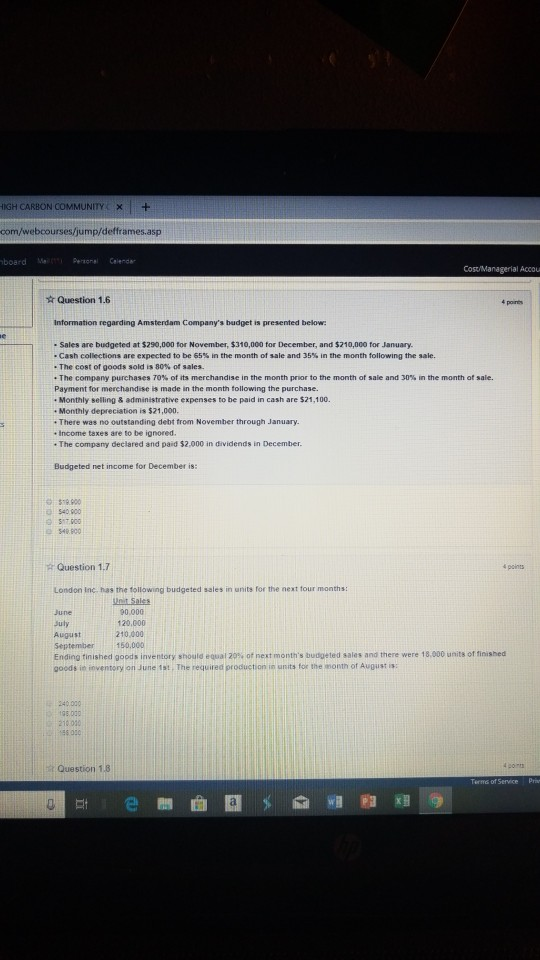

IGH CARBON COMMUNITY | + com/webcourses/jump/defframes.asp board M PertonlCelend Question 1.6 4 poires Information regarding Amsterdam Company's budget is presented below - Sales are budgeted

IGH CARBON COMMUNITY | + com/webcourses/jump/defframes.asp board M PertonlCelend Question 1.6 4 poires Information regarding Amsterdam Company's budget is presented below - Sales are budgeted at $290,000 for November, $310,000 for December, and $210,000 for January. Cash collections are expected to be 65% in the month of sale and 35% in the month following the sale. The cost of goods sold is 80% of sales. The company purchases 70% of its merchandise in the month prior to the month of sale and 30% in the month of sale. Payment for merchandise is made in the month following the purchase. Monthly selling & administrative expenses to be paid in cash are $21,100. Monthly depreciation is $21,000. . There was no outstanding debt trom November through January . Income taxes are t . The company declared and paid $2,000 in dividends in December be ignored Budgeted net income for December is: Question 1.7 4points London Inc has the tollowing budgeted sales in units for the next four months Unit Sale June Suly August September 150,000 Ending finished goods inventory should equal 20% of next month's budgeted sales and there were 18.000 units of finished goods in inventory on June 1st The required production in units for the anonth of August is: 120,000 210,000 240.000 198.030 210:010 26 020 : Question 1.8 Terma of Service Priv

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started