Question

Ignore Questions 6-10 those questions are not applicable at the present moment. The question I am looking for an answer to is question 11. I

Ignore Questions 6-10 those questions are not applicable at the present moment.

The question I am looking for an answer to is question 11. I have the information from those answers already I would just like assistance in solving the final question stated below. That is the one question I am asking.

Refer to the data above. Assume that after two years, the corporation decides to sell the building contributed by Gilbert that it has used for its operating space during the first two years. The basis of the building at the time of sale is $200,000 and the net sales price received is $360,000 (part in cash and part for the buyers assumption of the remaining liability). At the time of the sale, Gilberts stock basis is $320,000. What is Gilberts stock basis after adjusting for the sale of the building?

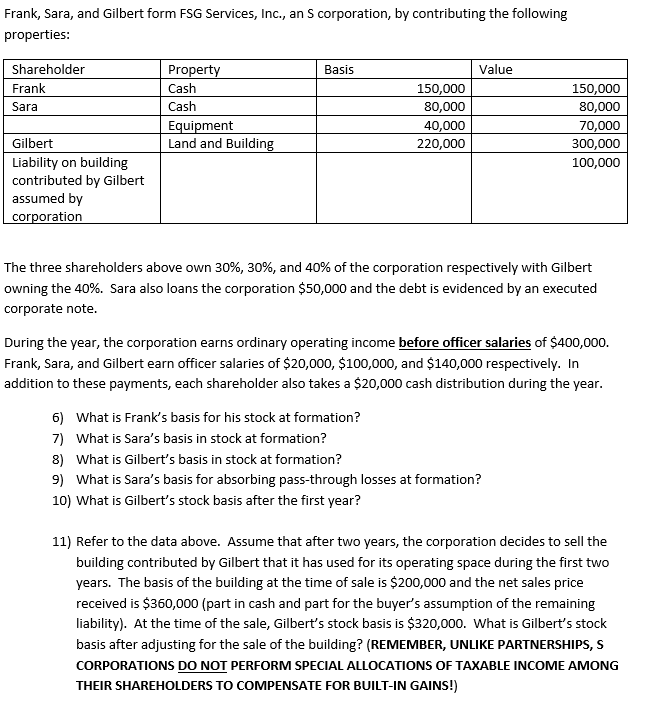

Frank, Sara, and Gilbert form FSG Services, Inc., an S corporation, by contributing the following properties: The three shareholders above own 30\%, 30\%, and 40% of the corporation respectively with Gilbert owning the 40%. Sara also loans the corporation $50,000 and the debt is evidenced by an executed corporate note. During the year, the corporation earns ordinary operating income before officer salaries of $400,000. Frank, Sara, and Gilbert earn officer salaries of $20,000,$100,000, and $140,000 respectively. In addition to these payments, each shareholder also takes a $20,000 cash distribution during the year. 6) What is Frank's basis for his stock at formation? 7) What is Sara's basis in stock at formation? 8) What is Gilbert's basis in stock at formation? 9) What is Sara's basis for absorbing pass-through losses at formation? 10) What is Gilbert's stock basis after the first year? 11) Refer to the data above. Assume that after two years, the corporation decides to sell the building contributed by Gilbert that it has used for its operating space during the first two years. The basis of the building at the time of sale is $200,000 and the net sales price received is $360,000 (part in cash and part for the buyer's assumption of the remaining liability). At the time of the sale, Gilbert's stock basis is $320,000. What is Gilbert's stock basis after adjusting for the sale of the building? (REMEMBER, UNLIKE PARTNERSHIPS, S CORPORATIONS DO NOT PERFORM SPECIAL ALLOCATIONS OF TAXABLE INCOME AMONG THEIR SHAREHOLDERS TO COMPENSATE FOR BUILT-IN GAINS!)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started