Answered step by step

Verified Expert Solution

Question

1 Approved Answer

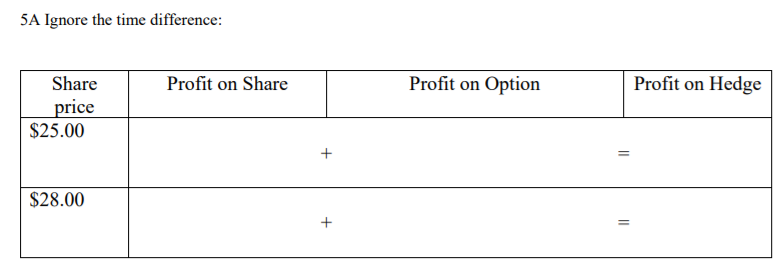

Ignore the time difference between the purchase of options and their expiry, and provide your answer in the table below. Jill short sells 1,000 ANZ

Ignore the time difference between the purchase of options and their expiry, and provide your answer in the table below.

Jill short sells 1,000 ANZ shares at a price of $26.00 and decides to construct a hedge by writing an equal number ofputoptions, with an exercise price of $27.00 and a premium of $1.40 per option.Calculateher profit (per share) for the alternative expiry share-prices of $25.00 and $28.00 for theshort shareposition, theshort putposition, and thehedgedposition.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started