Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ignore VAT. Shushubeza Limited, is a company manufacturing and distributing woollen clothing products in bulk to supply the retail industry. The financial year end is

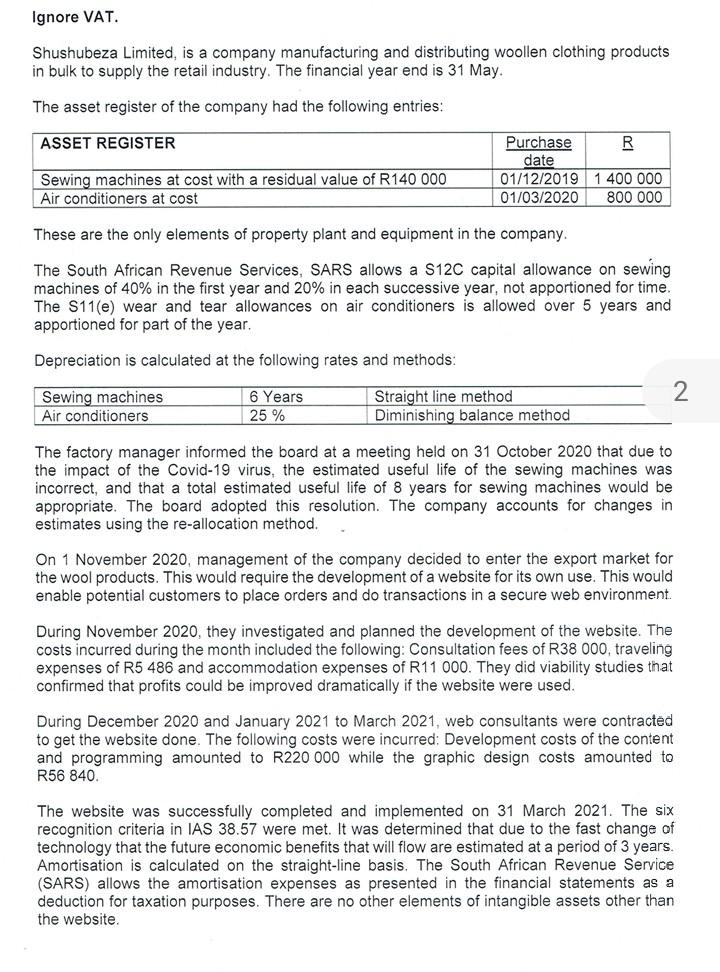

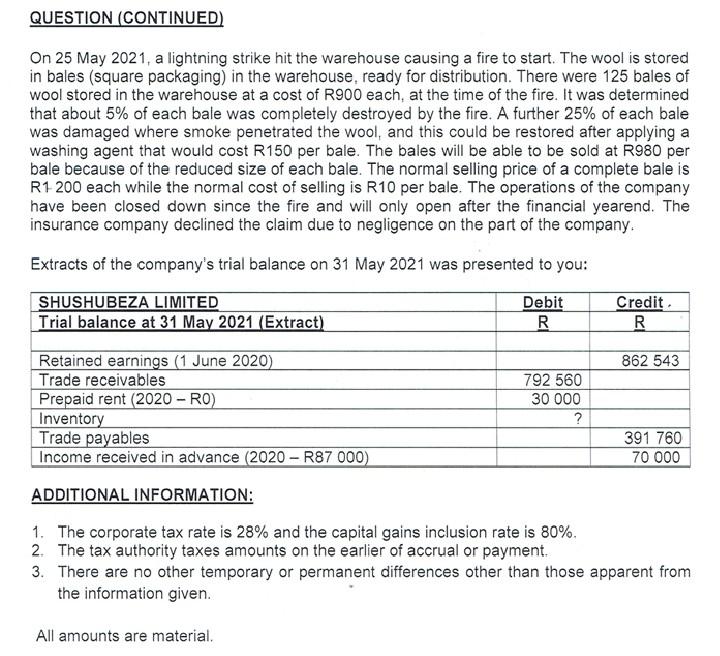

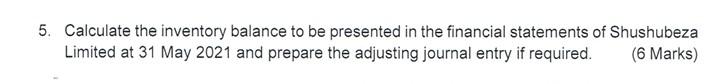

Ignore VAT. Shushubeza Limited, is a company manufacturing and distributing woollen clothing products in bulk to supply the retail industry. The financial year end is 31 May. The asset register of the company had the following entries: ASSET REGISTER Sewing machines at cost with a residual value of R140 000 Air conditioners at cost Purchase R date 01/12/2019 1 400 000 01/03/2020 800 000 These are the only elements of property plant and equipment in the company. The South African Revenue Services, SARS allows a S12C capital allowance on sewing machines of 40% in the first year and 20% in each successive year, not apportioned for time. The S11(e) wear and tear allowances on air conditioners is allowed over 5 years and apportioned for part of the year. Depreciation is calculated at the following rates and methods: 2 Sewing machines Air conditioners 6 Years 25 % Straight line method Diminishing balance method The factory manager informed the board at a meeting held on 31 October 2020 that due to the impact of the Covid-19 virus, the estimated useful life of the sewing machines was incorrect, and that a total estimated useful life of 8 years for sewing machines would be appropriate. The board adopted this resolution. The company accounts for changes in estimates using the re-allocation method. On 1 November 2020, management of the company decided to enter the export market for the wool products. This would require the development of a website for its own use. This would enable potential customers to place orders and do transactions in a secure web environment During November 2020, they investigated and planned the development of the website. The costs incurred during the month included the following: Consultation fees of R38 000, traveling expenses of R5 486 and accommodation expenses of R11 000. They did viability studies that confirmed that profits could be improved dramatically if the website were used. During December 2020 and January 2021 to March 2021, web consultants were contracted to get the website done. The following costs were incurred: Development costs of the content and programming amounted to R220 000 while the graphic design costs amounted to R56 840. The website was successfully completed and implemented on 31 March 2021. The six recognition criteria in IAS 38.57 were met. It was determined that due to the fast change of technology that the future economic benefits that will flow are estimated at a period of 3 years. Amortisation is calculated on the straight-line basis. The South African Revenue Service (SARS) allows the amortisation expenses as presented in the financial statements as a deduction for taxation purposes. There are no other elements of intangible assets other than the website. QUESTION (CONTINUED) On 25 May 2021, a lightning strike hit the warehouse causing a fire to start. The wool is stored in bales (square packaging) in the warehouse, ready for distribution. There were 125 bales of wool stored in the warehouse at a cost of R900 each, at the time of the fire. It was determined that about 5% of each bale was completely destroyed by the fire. A further 25% of each bale was damaged where smoke penetrated the wool, and this could be restored after applying a washing agent that would cost R150 per bale. The bales will be able to be sold at R980 per bale because of the reduced size of each bale. The normal selling price of a complete bale is R1 200 each while the normal cost of selling is R10 per bale. The operations of the company have been closed down since the fire and will only open after the financial yearend. The insurance company declined the claim due to negligence on the part of the company. Extracts of the company's trial balance on 31 May 2021 was presented to you: SHUSHUBEZA LIMITED Trial balance at 31 May 2021 (Extract) Debit R Credit R 862 543 Retained earnings (1 June 2020) Trade receivables Prepaid rent (2020 - RO) Inventory Trade payables Income received in advance (2020 - R87 000) 792 560 30 000 ? 391 760 70 000 ADDITIONAL INFORMATION: 1. The corporate tax rate is 28% and the capital gains inclusion rate is 80%. 2. The tax authority taxes amounts on the earlier of accrual or payment. 3. There are no other temporary or permanent differences other than those apparent from the information given. All amounts are material. 5. Calculate the inventory balance to be presented in the financial statements of Shushubeza Limited at 31 May 2021 and prepare the adjusting journal entry if required. (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started