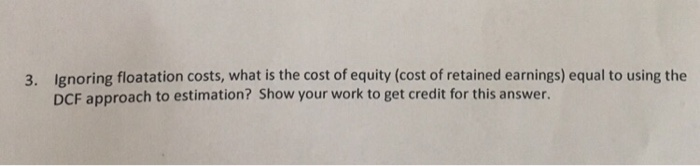

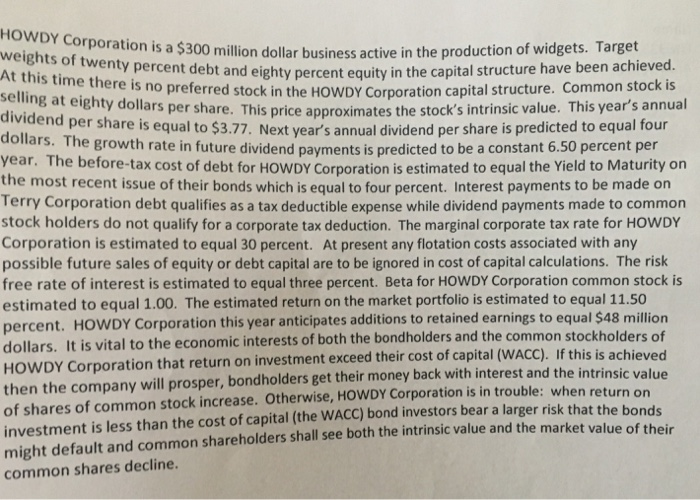

Ignoring floatation costs, what is the cost of equity (cost of retained earnings) equal to using the DCF approach to estimation? Show your work to get credit for this answer. 3. orporation is saoo paiten tollar business active in the production of wigechi HOWDY C weights of t on is a $300 million dollar business active in the production of widgets. Target wenty percent debt and eighty percent equity in the capital structure have been achieved re is no preferred stock in the HOwDY Corporation capital structure. Common stock is ening at eighty dollars per share. This price approximates the stock's intrinsic value. This year's annual dividend per share is equal to $3.77. Next year's annual dividend per share is predicted to equal four ollars. The growth rate in future dividend payments is predicted to be a constant 6.50 percent per ear. The before-tax cost of debt for HOWDY Corporation is estimated to equal the Yield to Maturity on the most recent issue of their bonds which is equal to four percent. Interest payments to be made on Terry Corporation debt qualifies as a tax deductible expense while dividend payments made to common stock holders do not qualify for a corporate tax deduction. The marginal corporate tax rate for HOWDY Corporation is estimated to equal 30 percent. At present any flotation costs associated with any possible future sales of equity or debt capital are to be ignored in cost of capital calculations. The risk free rate of interest is estimated to equal three percent. Beta for HOWDY Corporation common stock is estimated to equal 1.00. The estimated return on the market portfolio is estimated to equal 11.50 percent. HOWDY Corporation this year anticipates additions to retained earnings to equal $48 million dollars. It is HOWDY Corporation that return on investment exceed their cost of capital (WACC). If this is a then the company will prosper, bondholders get their money back with interest and the intrinsic of shares of common stock increase. investment is less than the cost of capital (the WACC) bond investors bear a larger risk that the bond might default and common shareholders shall see both the intrinsic value and the market value of their common shares decline vital to the economic interests of both the bondholders and the common stockholders of chieved value Otherwise, HOWDY Corporation is in trouble: when return on