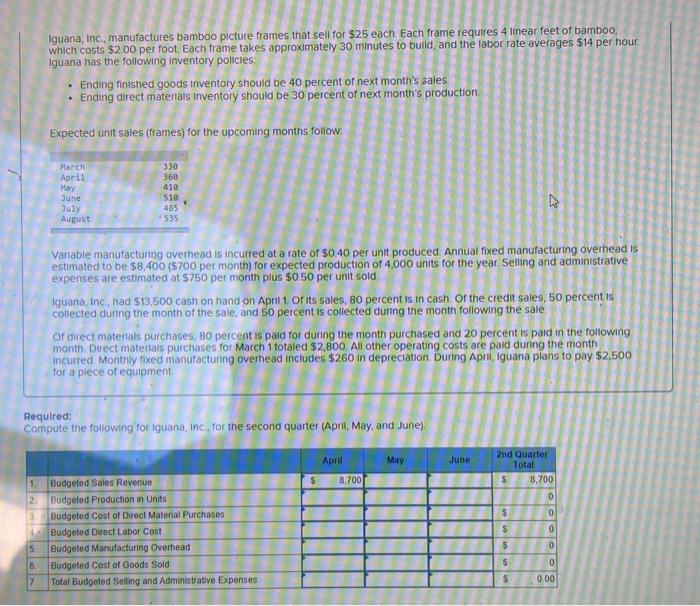

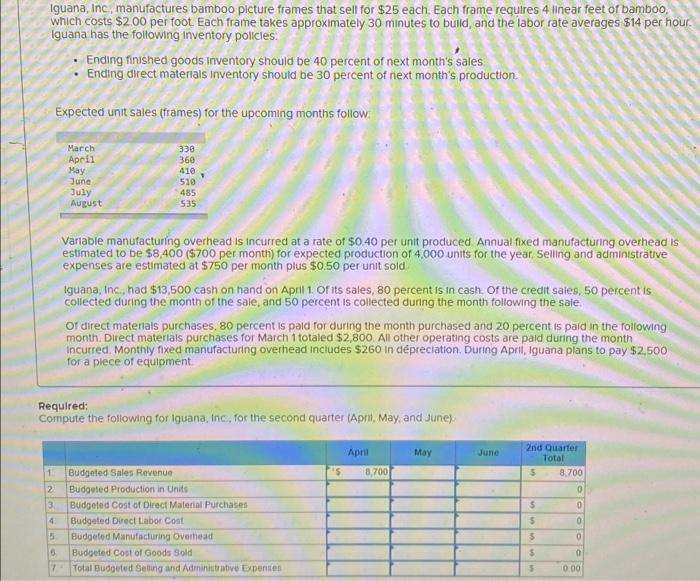

Iguana, Inc. manutactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo. which costs $2.00 per foot. Each frame takes approximately 30 minutes to buld, and the labor rate averages $14 per hour Iguana has the following inventory policies: - Ending finished goods inventory should be 40 percent of next month's sales - Ending direct materials inventory should be 30 percent of next month's production. Expected untt sales (frames) for the upcoming months follow: Variable manufacturing overhead is incurred at a rate of $0.40 per unit produced. Annual fixed manufacturing overhead is estimated to be $8,400 (\$700 per month) for expected production of 4,000 units for the year. Selling and administrative expenses are estimated at $750 per month plus $0.50 per unit sold Iguana, Inc, nad $13,500 cash on hand on Aptil 1 . Or its sales, 80 percent is in cash. Or the credit sales, 50 percent is collected diring the month of the sale, and 50 percent is collected during the month following the sale. Of direct materials purchases, 80 percent is paid for during the month purchased and 20 percent is paid in the following month. Direct matertals purchases for March 1 totaled $2,800. All other operating costs are pard during the month incurred. Monthly fixed manufacturing overhead includes $260 in depreciation. During Apri, Iguana plans to pay $2.500 for a piece of equipment Required: Compute the following for Iguana, Inc, for the second quarter (Aprili, May, and June) Iguana, Inc, manufactures bamboo picture frames that sell for $25 each. Each frame requilres 4 linear feet of bamboo. which costs $2.00 per foot Each frame takes approximately 30 minutes to bulid, and the labor rate averages $14 per hour. Iguana has the following inventory policles: - Ending finished goods inventory should be 40 percent of next month's sales - Ending direct materials inventory should be 30 percent of next month's production. Expected unit sales (frames) for the upcoming months follow. Variable manufacturing overhead is incurred at a rate of $0.40 per unit produced. Annual fixed manufacturing overhead is estimated to be $8,400 ( $700 per month) for expected production of 4,000 units for the year Selling and administrative expenses are estimated at $750 per month plus $0.50 per unit sold Iguana, Inc., had $13,500 cash on hand on April 1. Of its sales, 80 percent is in cash. Of the credit saies, 50 percent is collected during the month of the sale, and 50 percent is collected during the month following the saie. Of direct materlals purchases, 80 percent is paid for during the month purchased and 20 percent is paid in the following month. Direct materlals purchases for March 1 totaled $2,800. All other operating costs are pald during the month incurred. Monthly fixed manufacturing overhead includes $260 in depreciation. During April, 1guana plans to pay $2,500 for a plece of equipment Required: Compute the following for Iguana, Inc, for the second quarter (Apri, May, and June)