Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(ii) A bank has estimated that the expected value of its portfolio in two weeks' time will be $50 million, with a standard deviation

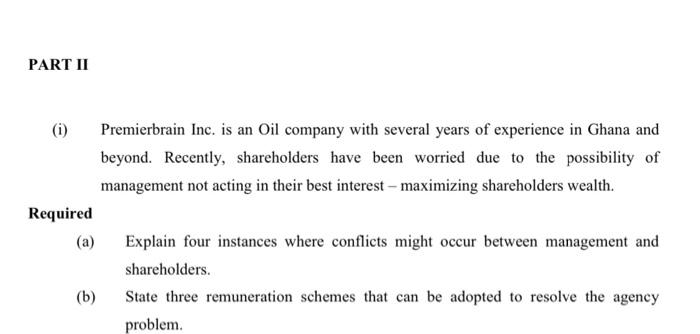

(ii) A bank has estimated that the expected value of its portfolio in two weeks' time will be $50 million, with a standard deviation of $4.85 million. Required: Calculate and comment upon the value at risk of the portfolio, assuming a 95% confidence level PART II (i) Premierbrain Inc. is an Oil company with several years of experience in Ghana and beyond. Recently, shareholders have been worried due to the possibility of management not acting in their best interest maximizing shareholders wealth. Required (a) Explain four instances where conflicts might occur between management and shareholders. (b) State three remuneration schemes that can be adopted to resolve the agency problem.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A 95 confidence level will identify th reduced value of the portfolio that has a 5 chance of occurin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started