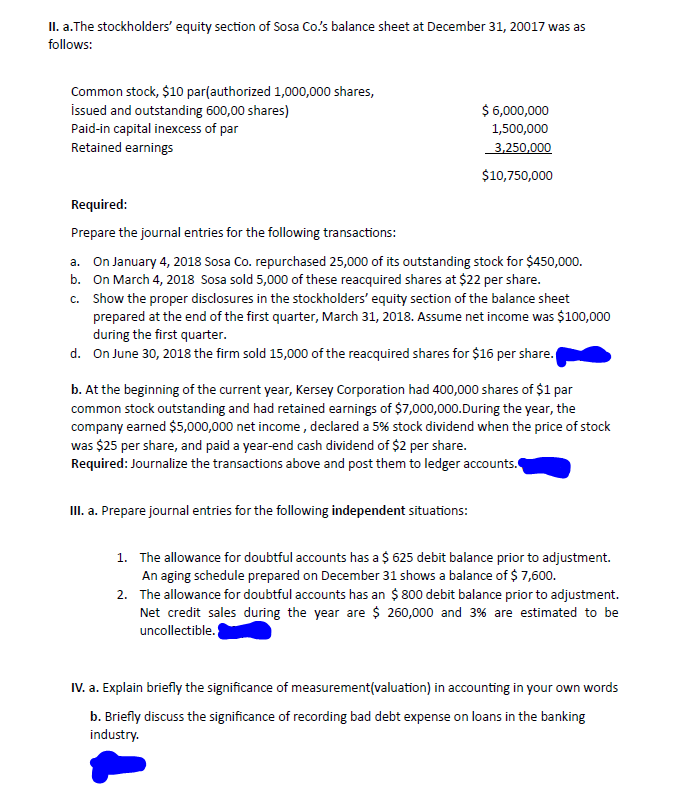

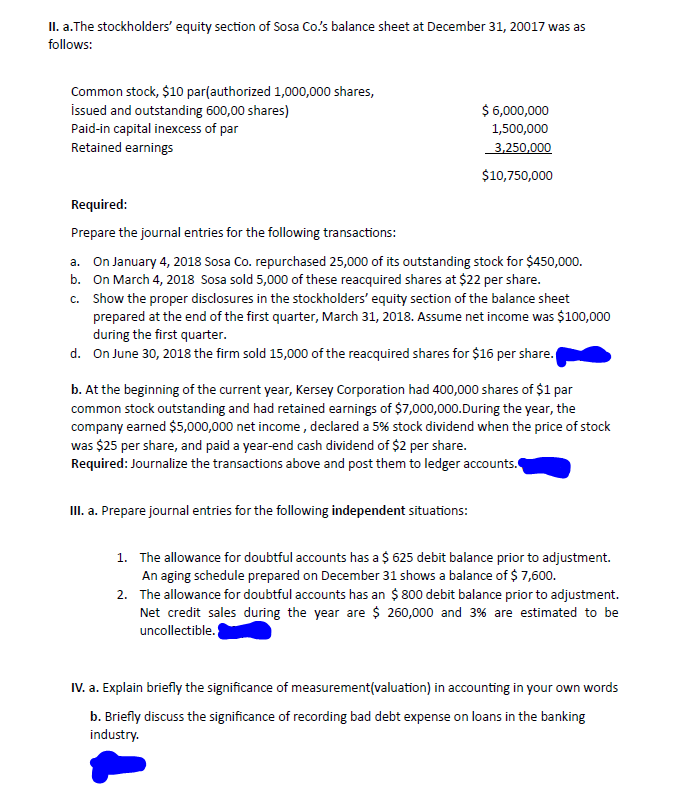

II. a. The stockholders' equity section of Sosa Co.'s balance sheet at December 31, 20017 was as follows: Required: Prepare the journal entries for the following transactions: a. On January 4, 2018 Sosa Co. repurchased 25,000 of its outstanding stock for $450,000. b. On March 4, 2018 Sosa sold 5,000 of these reacquired shares at $22 per share. c. Show the proper disclosures in the stockholders' equity section of the balance sheet prepared at the end of the first quarter, March 31, 2018. Assume net income was $100,000 during the first quarter. d. On June 30,2018 the firm sold 15,000 of the reacquired shares for $16 per share. b. At the beginning of the current year, Kersey Corporation had 400,000 shares of $1 par common stock outstanding and had retained earnings of $7,000,000.During the year, the company earned $5,000,000 net income, declared a 5% stock dividend when the price of stock was $25 per share, and paid a year-end cash dividend of $2 per share. Required: Journalize the transactions above and post them to ledger accounts. III. a. Prepare journal entries for the following independent situations: 1. The allowance for doubtful accounts has a $625 debit balance prior to adjustment. An aging schedule prepared on December 31 shows a balance of $7,600. 2. The allowance for doubtful accounts has an $800 debit balance prior to adjustment. Net credit sales during the year are $260,000 and 3% are estimated to be uncollectible. IV. a. Explain briefly the significance of measurement(valuation) in accounting in your own words b. Briefly discuss the significance of recording bad debt expense on loans in the banking industry. II. a. The stockholders' equity section of Sosa Co.'s balance sheet at December 31, 20017 was as follows: Required: Prepare the journal entries for the following transactions: a. On January 4, 2018 Sosa Co. repurchased 25,000 of its outstanding stock for $450,000. b. On March 4, 2018 Sosa sold 5,000 of these reacquired shares at $22 per share. c. Show the proper disclosures in the stockholders' equity section of the balance sheet prepared at the end of the first quarter, March 31, 2018. Assume net income was $100,000 during the first quarter. d. On June 30,2018 the firm sold 15,000 of the reacquired shares for $16 per share. b. At the beginning of the current year, Kersey Corporation had 400,000 shares of $1 par common stock outstanding and had retained earnings of $7,000,000.During the year, the company earned $5,000,000 net income, declared a 5% stock dividend when the price of stock was $25 per share, and paid a year-end cash dividend of $2 per share. Required: Journalize the transactions above and post them to ledger accounts. III. a. Prepare journal entries for the following independent situations: 1. The allowance for doubtful accounts has a $625 debit balance prior to adjustment. An aging schedule prepared on December 31 shows a balance of $7,600. 2. The allowance for doubtful accounts has an $800 debit balance prior to adjustment. Net credit sales during the year are $260,000 and 3% are estimated to be uncollectible. IV. a. Explain briefly the significance of measurement(valuation) in accounting in your own words b. Briefly discuss the significance of recording bad debt expense on loans in the banking industry