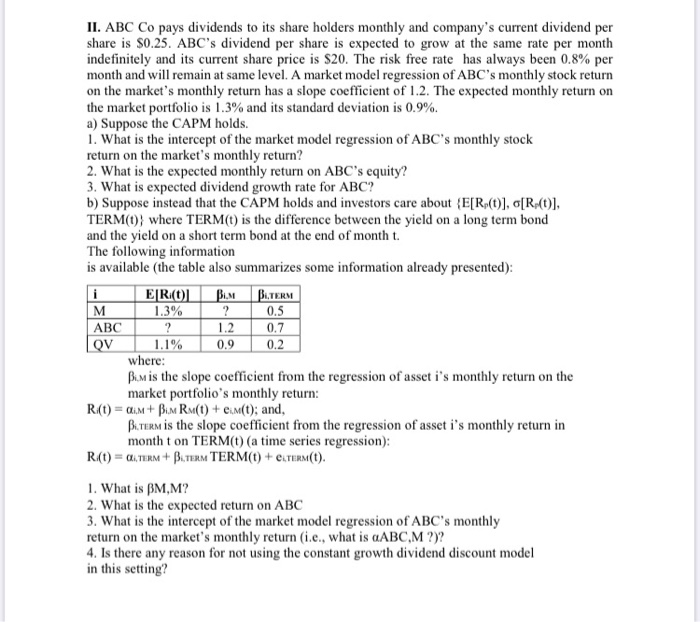

II. ABC Co pays dividends to its share holders monthly and company's current dividend per share is $0.25. ABC's dividend per share is expected to grow at the same rate per month indefinitely and its current share price is $20. The risk free rate has always been 0.8% per month and will remain at same level. A market model regression of ABC's monthly stock return on the market's monthly return has a slope coefficient of 1.2. The expected monthly return on the market portfolio is 1.3% and its standard deviation is 0.9%. a) Suppose the CAPM holds. 1. What is the intercept of the market model regression of ABC's monthly stock return on the market's monthly return? 2. What is the expected monthly return on ABC's equity? 3. What is expected dividend growth rate for ABC? b) Suppose instead that the CAPM holds and investors care about {E[R.(t)], [R.(], TERM(t)} where TERM(t) is the difference between the yield on a long term bond and the yield on a short term bond at the end of month t. The following information is available (the table also summarizes some information already presented): i ERO BIM BETERM M 1.3% ? ABC ? 1.2 0.7 QV 1.1% 0.9 0.2 where: Bim is the slope coefficient from the regression of asset i's monthly return on the market portfolio's monthly return: R:(t) = c.im + Bum Rm(t) + e.m(t); and, Biter is the slope coefficient from the regression of asset i's monthly return in month ton TERM() (a time series regression) R.(t) = , TERM+ B.TERM TERM(t) + exterm(t). 1. What is BM,M? 2. What is the expected return on ABC 3. What is the intercept of the market model regression of ABC's monthly return on the market's monthly return (i.e., what is aABC,M ?)? 4. Is there any reason for not using the constant growth dividend discount model in this setting? 0.5 II. ABC Co pays dividends to its share holders monthly and company's current dividend per share is $0.25. ABC's dividend per share is expected to grow at the same rate per month indefinitely and its current share price is $20. The risk free rate has always been 0.8% per month and will remain at same level. A market model regression of ABC's monthly stock return on the market's monthly return has a slope coefficient of 1.2. The expected monthly return on the market portfolio is 1.3% and its standard deviation is 0.9%. a) Suppose the CAPM holds. 1. What is the intercept of the market model regression of ABC's monthly stock return on the market's monthly return? 2. What is the expected monthly return on ABC's equity? 3. What is expected dividend growth rate for ABC? b) Suppose instead that the CAPM holds and investors care about {E[R.(t)], [R.(], TERM(t)} where TERM(t) is the difference between the yield on a long term bond and the yield on a short term bond at the end of month t. The following information is available (the table also summarizes some information already presented): i ERO BIM BETERM M 1.3% ? ABC ? 1.2 0.7 QV 1.1% 0.9 0.2 where: Bim is the slope coefficient from the regression of asset i's monthly return on the market portfolio's monthly return: R:(t) = c.im + Bum Rm(t) + e.m(t); and, Biter is the slope coefficient from the regression of asset i's monthly return in month ton TERM() (a time series regression) R.(t) = , TERM+ B.TERM TERM(t) + exterm(t). 1. What is BM,M? 2. What is the expected return on ABC 3. What is the intercept of the market model regression of ABC's monthly return on the market's monthly return (i.e., what is aABC,M ?)? 4. Is there any reason for not using the constant growth dividend discount model in this setting? 0.5