Answered step by step

Verified Expert Solution

Question

1 Approved Answer

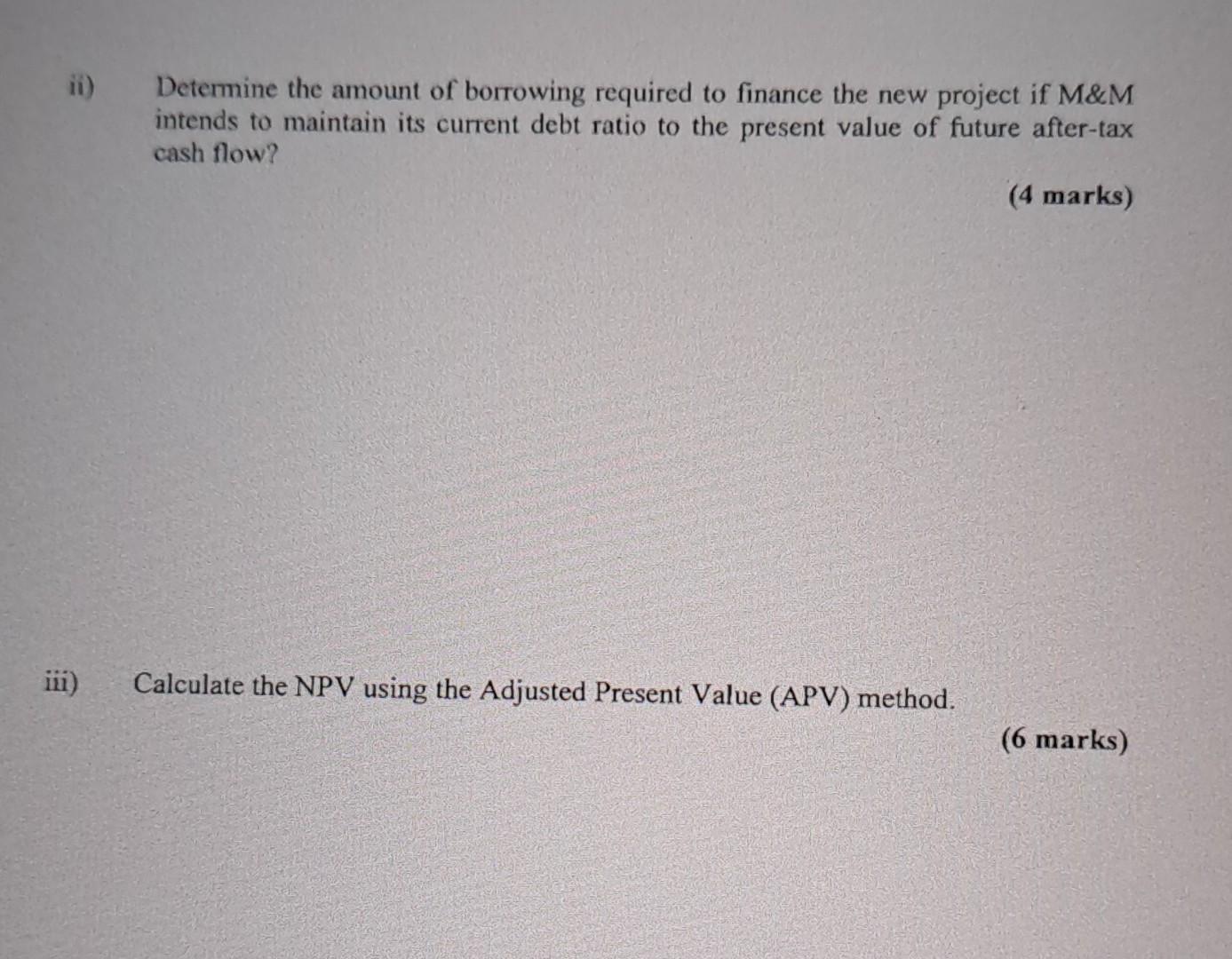

ii) Determine the amount of borrowing required to finance the new project if M&M intends to maintain its current debt ratio to the present value

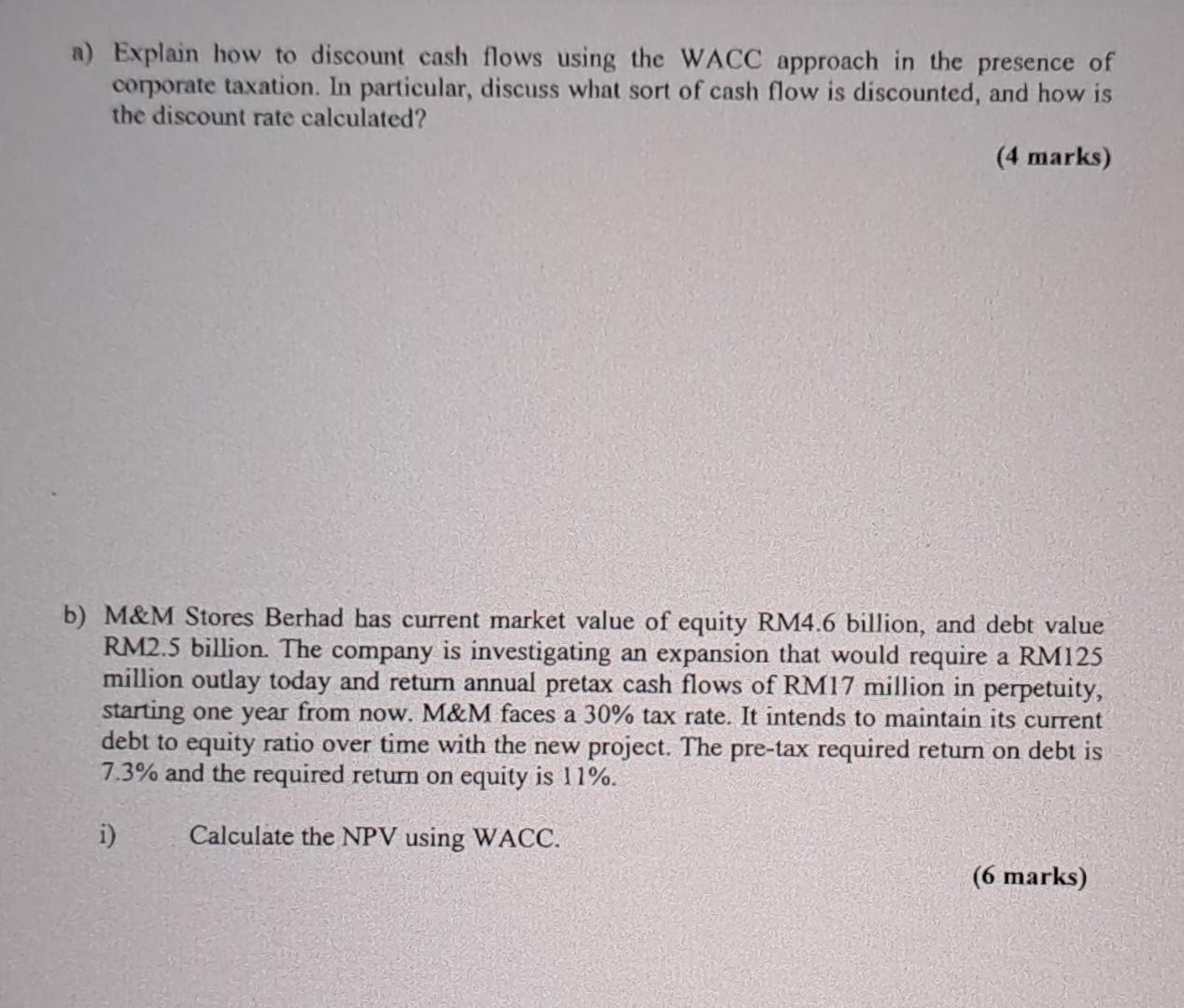

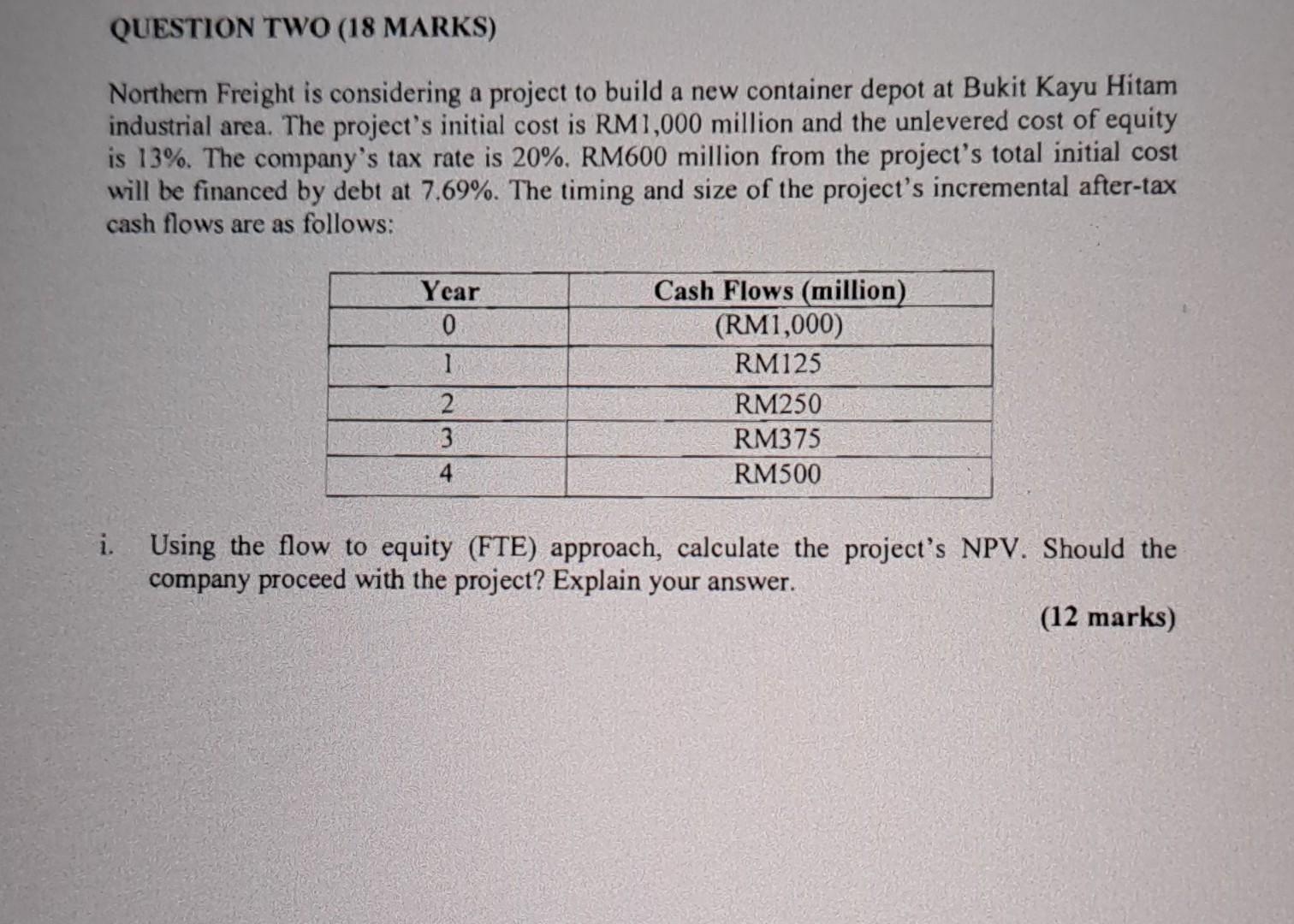

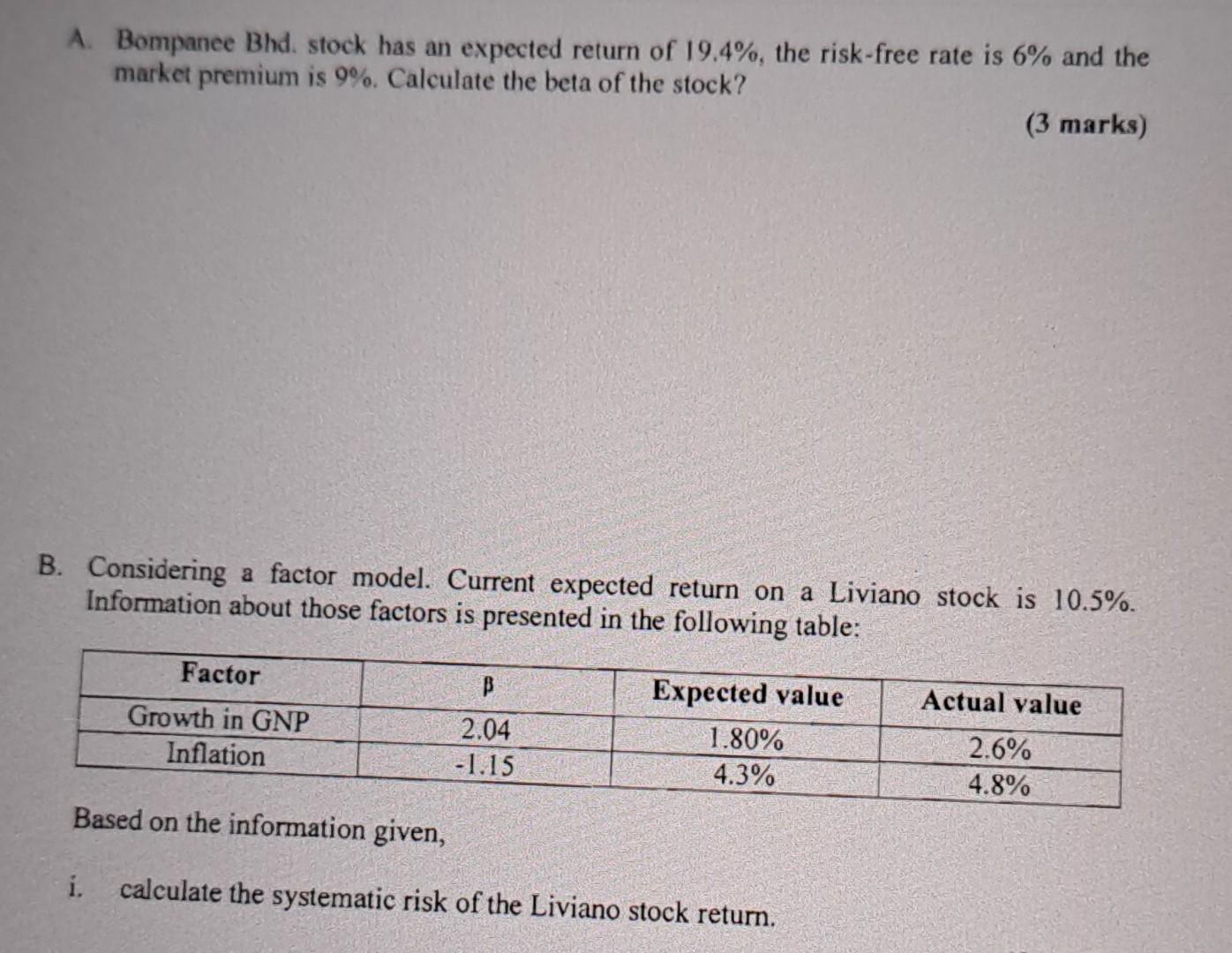

ii) Determine the amount of borrowing required to finance the new project if M&M intends to maintain its current debt ratio to the present value of future after-tax cash flow? (4 marks) i) Calculate the NPV using the Adjusted Present Value (APV) method. Northern Freight is considering a project to build a new container depot at Bukit Kayu Hitam industrial area. The project's initial cost is RM1,000 million and the unlevered cost of equity is 13%. The company's tax rate is 20%. RM600 million from the project's total initial cost will be financed by debt at 7.69%. The timing and size of the project's incremental after-tax cash flows are as follows: i. Using the flow to equity (FTE) approach, calculate the project's NPV. Should the company proceed with the project? Explain your answer. (12 marks) a) Explain how to discount cash flows using the WACC approach in the presence of corporate taxation. In particular, discuss what sort of cash flow is discounted, and how is the discount rate calculated? (4 marks) b) M\&M Stores Berhad bas current market value of equity RM4.6 billion, and debt value RM2.5 billion. The company is investigating an expansion that would require a RM125 million outlay today and return annual pretax cash flows of RM17 million in perpetuity, starting one year from now. M\&M faces a 30% tax rate. It intends to maintain its current debt to equity ratio over time with the new project. The pre-tax required return on debt is 7.3% and the required return on equity is 11%. i) Calculate the NPV using WACC. ii. Liviano announced that its market share had unexpectedly increased from 23% to 27%. Investors know from the past experience that the stock return will increase by 0.45% for every 1% increase in its market share. Calculate the unsystematic risk of the stock. (5 marks) iii. Calculate the total return on this stock. A. Northern Pizza is planning on merging with Southern Pizza. Northern Pizza will pay Southern Pizza's stockholders the current value of their stock in shares of Northern Pizza. Northern Pizza currently has 2,300 shares of stock outstanding at a market price of RM20 a share. Southern Pizza has 1,800 shares outstanding at a price of RM15 a share. The after-merger earnings will be RM6,500. What will the earnings per share be after the merger? (4 marks) B. The Ezio Corporation is unlevered and is valued at RM640,000. Ezio Corporation is currently deciding whether including debt in its capital structure would increase its value. The current cost of equity is 12%. Under consideration is issuing RM300,000 in new debt with an 8% interest rate. Ezio Corporation would repurchase RM300,000 of stock with the proceeds of the debt issue. There are currently 32,000 shares outstanding and effective marginal tax bracket is zero. What will Ezio Corporation's new weighted average cost of capital (WACC) be? A. Bompance Bhd. stock has an expected return of 19.4%, the risk-free rate is 6% and the market premium is 9%. Calculate the beta of the stock? (3 marks) 3. Considering a factor model. Current expected return on a Liviano stock is 10.5%. Information about those factors is presented in the following table: Based on the information given, i. calculate the systematic risk of the Liviano stock return. ii. Northern Freight's target debt to equity ratio is 1.50 . Using the weighted average cost of capital (WACC) approach, calculate the project's NPV. Should the company proceed with the project? Explain your answer. (4 marks) iii. Briefly explain the major difference between the Adjusted Present Value technique (APV) and the FTE and WACC technique. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started