Answered step by step

Verified Expert Solution

Question

1 Approved Answer

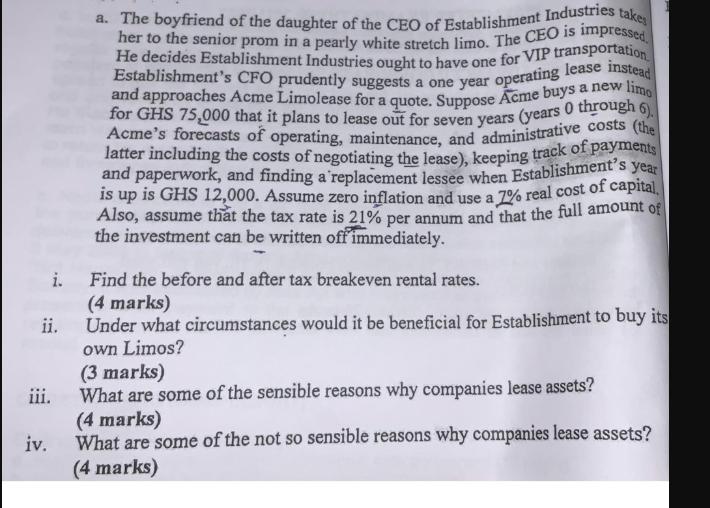

ii. i. Find the before and after tax breakeven rental rates. (4 marks) Under what circumstances would it be beneficial for Establishment to buy

ii. i. Find the before and after tax breakeven rental rates. (4 marks) Under what circumstances would it be beneficial for Establishment to buy its own Limos? iii. iv. a. The boyfriend of the daughter of the CEO of Establishment Industries takes her to the senior prom in a pearly white stretch limo. The CEO is impressed. He decides Establishment Industries ought to have one for VIP transportation Establishment's CFO prudently suggests a one year operating lease instead for GHS 75,000 that it plans to lease out for seven years (years 0 through 6). and approaches Acme Limolease for a quote. Suppose Acme buys a new limo Acme's forecasts of operating, maintenance, and administrative costs (the and paperwork, and finding a 'replacement lessee when Establishment's year latter including the costs of negotiating the lease), keeping track of payments is up is GHS 12,000. Assume zero inflation and use a 7% real cost of capital. Also, assume that the tax rate is 21% per annum and that the full amount of the investment can be written off immediately. (3 marks) What are some of the sensible reasons why companies lease assets? (4 marks) What are some of the not so sensible reasons why companies lease assets? (4 marks)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

i Beforetax breakeven rental rate PV CFr 75000 12000007 r 1200075000 016 16 Aftertax breakeven renta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started