Question

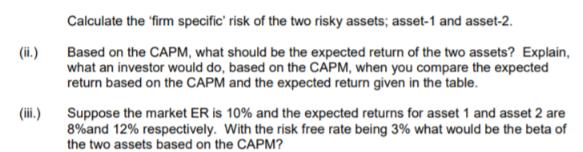

(ii.) (iii.) Calculate the firm specific' risk of the two risky assets; asset-1 and asset-2. Based on the CAPM, what should be the expected

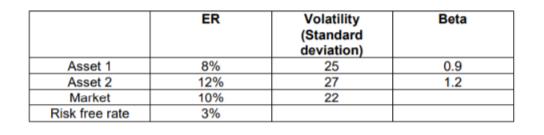

(ii.) (iii.) Calculate the firm specific' risk of the two risky assets; asset-1 and asset-2. Based on the CAPM, what should be the expected return of the two assets? Explain, what an investor would do, based on the CAPM, when you compare the expected return based on the CAPM and the expected return given in the table. Suppose the market ER is 10% and the expected returns for asset 1 and asset 2 are 8% and 12% respectively. With the risk free rate being 3% what would be the beta of the two assets based on the CAPM? Asset 1 Asset 2 Market Risk free rate ER 8% 12% 10% 3% Volatility (Standard deviation) 25 27 22 Beta 0.9 1.2

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

i The firmspecific risk of an asset can be calculated by subtracting the square of the assets correl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing a risk based approach to conducting a quality audit

Authors: Karla Johnstone, Audrey Gramling, Larry Rittenberg

9th edition

9781133939160, 1133939155, 1133939163, 978-1133939153

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App