Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ii) Now assume that HWI plc does not classify the bond as amortised cost (AC) but as fair value through other comprehensive income (FVOCI) and

ii) Now assume that HWI plc does not classify the bond as amortised cost (AC) but as fair value through other comprehensive income (FVOCI) and that HWI sells the bond on 1 January 2022 for a price of 9,320. Calculate the relevant amounts and prepare the journal entries for initial recognition, subsequent measurement and sale of the bond in fiscal years 2021 and 2022. Where appropriate, you can refer to your answer from i). Explain each of your steps.

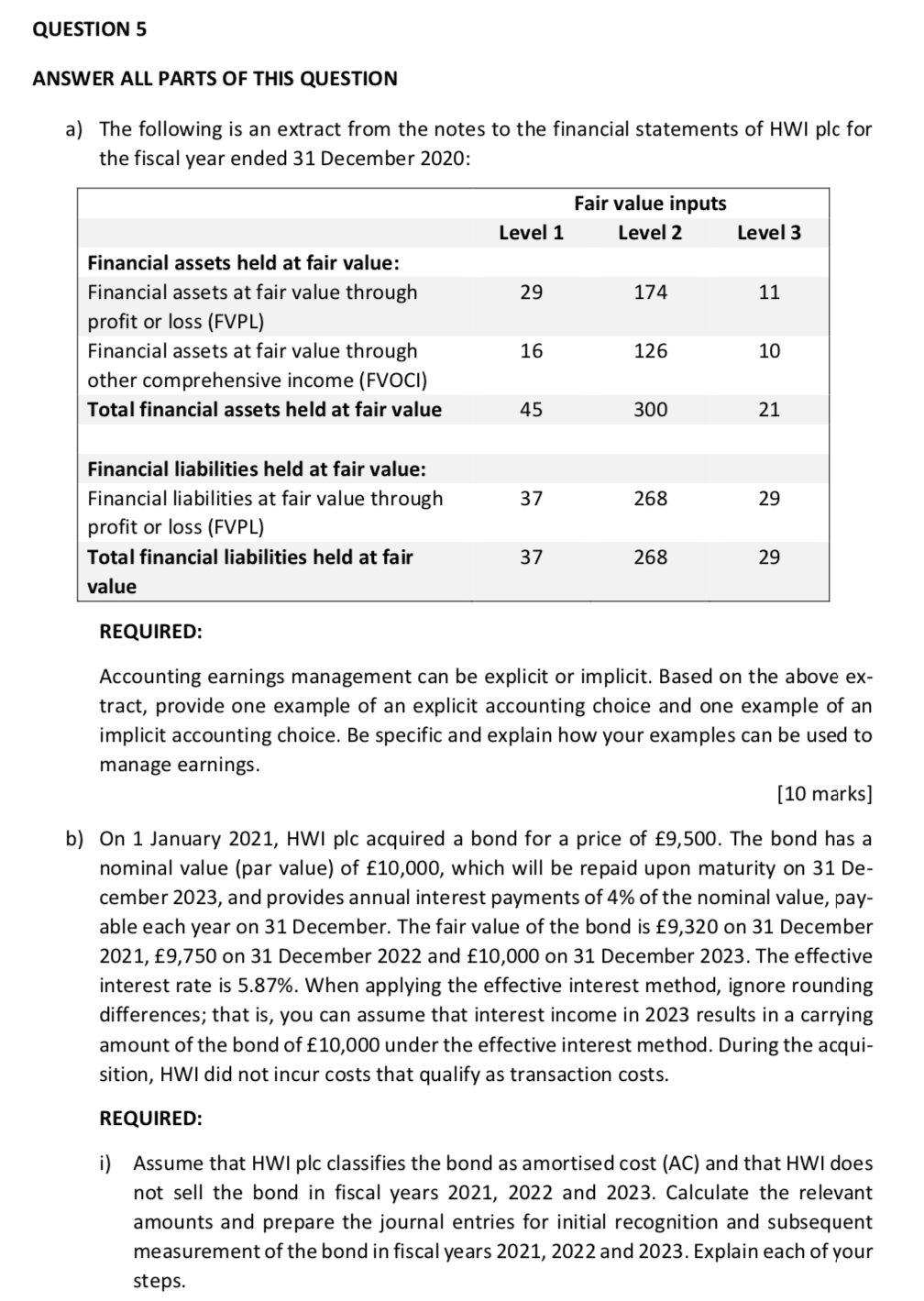

QUESTION 5 ANSWER ALL PARTS OF THIS QUESTION a) The following is an extract from the notes to the financial statements of HWI plc for the fiscal year ended 31 December 2020: Fair value inputs Level 2 Level 1 Level 3 29 174 11 Financial assets held at fair value: Financial assets at fair value through profit or loss (FVPL) Financial assets at fair value through other comprehensive income (FVOCI) Total financial assets held at fair value 16 126 10 45 300 21 37 268 29 Financial liabilities held at fair value: Financial liabilities at fair value through profit or loss (FVPL) Total financial liabilities held at fair value 37 268 29 REQUIRED: Accounting earnings management can be explicit or implicit. Based on the above ex- tract, provide one example of an explicit accounting choice and one example of an implicit accounting choice. Be specific and explain how your examples can be used to manage earnings. (10 marks) b) On 1 January 2021, HWI plc acquired a bond for a price of 9,500. The bond has a nominal value (par value) of 10,000, which will be repaid upon maturity on 31 De- cember 2023, and provides annual interest payments of 4% of the nominal value, pay- able each year on 31 December. The fair value of the bond is 9,320 on 31 December 2021, 9,750 on 31 December 2022 and 10,000 on 31 December 2023. The effective interest rate is 5.87%. When applying the effective interest method, ignore rounding differences; that is, you can assume that interest income in 2023 results in a carrying amount of the bond of 10,000 under the effective interest method. During the acqui- sition, HWI did not incur costs that qualify as transaction costs. REQUIRED: i) Assume that HWI plc classifies the bond as amortised cost (AC) and that HWI does not sell the bond in fiscal years 2021, 2022 and 2023. Calculate the relevant amounts and prepare the journal entries for initial recognition and subsequent measurement of the bond in fiscal years 2021, 2022 and 2023. Explain each of your steps. QUESTION 5 ANSWER ALL PARTS OF THIS QUESTION a) The following is an extract from the notes to the financial statements of HWI plc for the fiscal year ended 31 December 2020: Fair value inputs Level 2 Level 1 Level 3 29 174 11 Financial assets held at fair value: Financial assets at fair value through profit or loss (FVPL) Financial assets at fair value through other comprehensive income (FVOCI) Total financial assets held at fair value 16 126 10 45 300 21 37 268 29 Financial liabilities held at fair value: Financial liabilities at fair value through profit or loss (FVPL) Total financial liabilities held at fair value 37 268 29 REQUIRED: Accounting earnings management can be explicit or implicit. Based on the above ex- tract, provide one example of an explicit accounting choice and one example of an implicit accounting choice. Be specific and explain how your examples can be used to manage earnings. (10 marks) b) On 1 January 2021, HWI plc acquired a bond for a price of 9,500. The bond has a nominal value (par value) of 10,000, which will be repaid upon maturity on 31 De- cember 2023, and provides annual interest payments of 4% of the nominal value, pay- able each year on 31 December. The fair value of the bond is 9,320 on 31 December 2021, 9,750 on 31 December 2022 and 10,000 on 31 December 2023. The effective interest rate is 5.87%. When applying the effective interest method, ignore rounding differences; that is, you can assume that interest income in 2023 results in a carrying amount of the bond of 10,000 under the effective interest method. During the acqui- sition, HWI did not incur costs that qualify as transaction costs. REQUIRED: i) Assume that HWI plc classifies the bond as amortised cost (AC) and that HWI does not sell the bond in fiscal years 2021, 2022 and 2023. Calculate the relevant amounts and prepare the journal entries for initial recognition and subsequent measurement of the bond in fiscal years 2021, 2022 and 2023. Explain each of your stepsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started