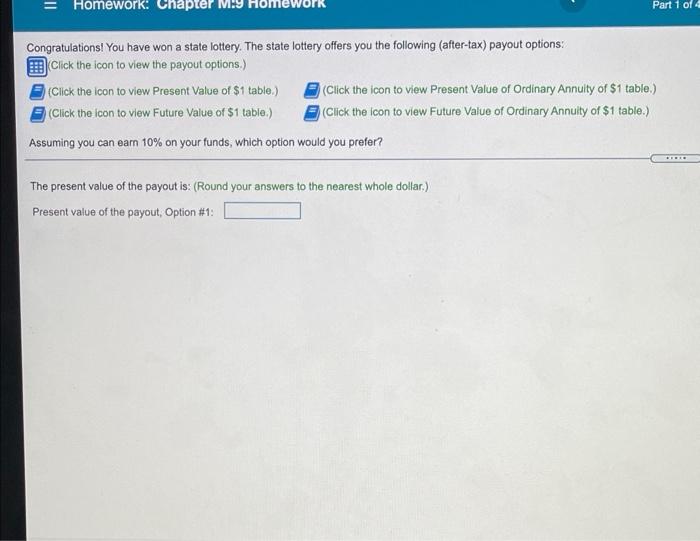

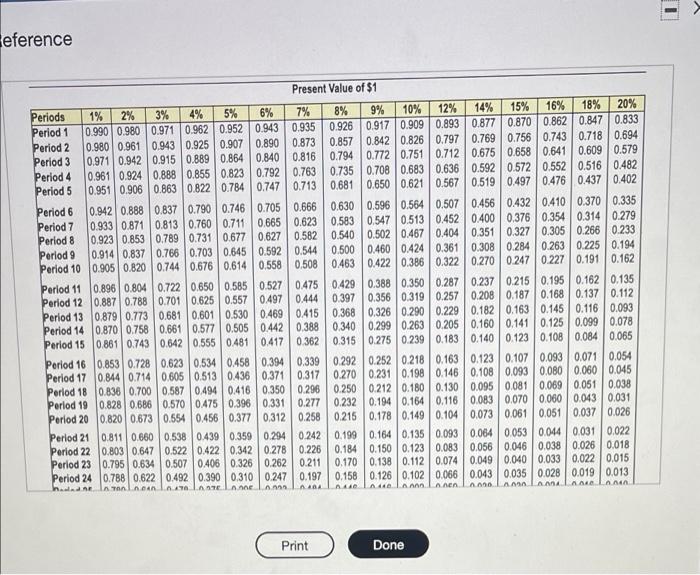

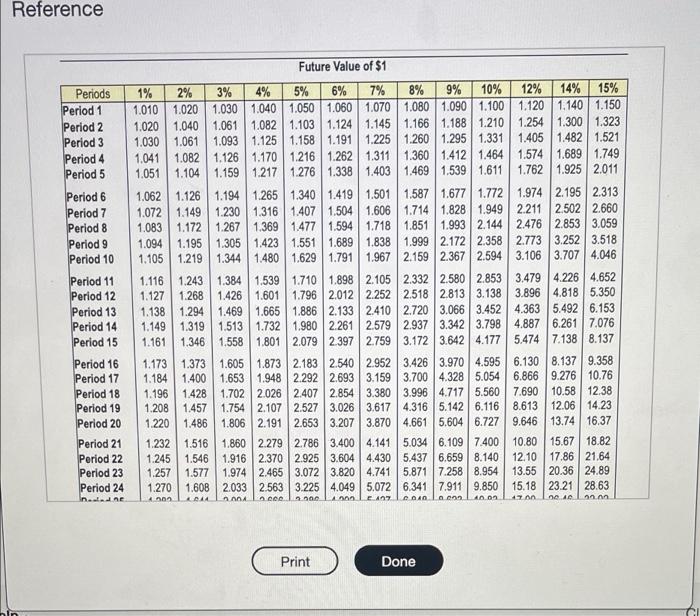

II Part 1 of 4 Homework: Chapter M. Congratulations! You have won a state lottery. The state lottery offers you the following (after-tax) payout options: Click the icon to view the payout options.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the loon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Assuming you can earn 10% on your funds, which option would you prefer? The present value of the payout is: (Round your answers to the nearest whole dollar) Present value of the payout, Option #1: eference Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.9090.893 0.877 0.870 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.7430.7180.694 Period 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 Period 4 0.961 0.924 0.888 0.855 0.8230.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.7470.713 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.404 0.351 0.32 0.305 0.266 0.233 Perlod 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.2700 2470 227 0.191 0.162 Period 11 0.896 0.804 0.722 0.650 0.585 0.5270475 0.429 0.388 0.350 0.287 0.237 0.215 0.1950.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112 Period 13 0.879 0.773 0.681 0.601 0.530 0.4690415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 Period 14 0.8700.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.1600.141 0.125 0.099 0.078 Period 15 0861 0.743 0.642 0,555 0481 0.417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 Period 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054 Period 17 0.844 0.714 0.605 0.513 0.436 0.371 0.3170.270 0.231 0.1980.146 0.108 0.093 0.080 0.060 0.045 Period 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.1800.130 0.095 0.081 0.069 0.051 0.038 Period 19 0.828 0.686 0.570 0475 0.396 0.331 0.277 0.232 0.194 0.1640.116 0.0830.070 0.000 0.043 0.031 Period 20 0.8200.673 0.554 0.456 0.377 0,3120.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 Period 0.811 0.660 0.538 0.439 0.359 0.2040.242 0.199 0.1640.135 0.093 0.064 0.053 0.044 0.031 0.022 period 22 0.803 0.647 0.522 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0.018 Period 23 0.795 0.6340.50704060.326 0.262 0.211 0.170 0.138 0.112 0.074 0.049 0.040 0.033 0.022 0.015 Period 24 0.788 0.622 0.492 0.390 0.310 0.247 0.197 0.158 0.126 0.1020.066 0.043 0.035 0.028 0.019 0.013 ha Innan LA AA AA AA Anen AAA A AR AME AMA Print Done Reference Future Value of $1 Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 nen 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.120 1.140 1.150 1.020 1.040 1.061 1.0821.103 1.1241.145 1.166 1.1881.210 1.254 1.300 1.323 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.405 1.482 1.521 1.041 1.0821.126 1.170 1.216 1.262 1.311 1.360 1.412 1.464 1.574 1.689 1.749 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.762 1.925 2.011 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.677 1.772 1.974 2.195 2.313 1.072 1.149 1.230 1.316 1.407 1.5041.606 1.714 1.828 1.949 2.211 2.502 2.660 1.083 1.1721.267 1.369 1.4771.594 1.7181.851 1.993 2.144 2.476 2.853 3.059 1.094 1.1951.305 1.423 1.551 1.689 1.838 1.999 2.172 2.3582.7733.252 3.518 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.367 2.594 3.106 3.707 4.046 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 2.580 2.853 3.479 4.2264.652 1.127 1.268 1.426 1.601 1.796 2.012 2.252 2.518 2.813 3.138 3.896 4.818 5.350 1.1381.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 4.363 5.492 6.153 1.149 1.319 1.513 1.732 1.980 2.261 2.579 2.937 3.342 3.798 4.887 6.261 | 7.076 1.161 1.346 1.558 1.801 2.079 2.3972.759 3.172 3.642 4.177 5.474 | 7.138 8.137 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 6.130 8.1379.358 1.184 1.400 1.653 1.948 2.292 2.6933.159 3.700 4.328 5.054 6.866 9.276 10.76 1.1961.4281.702 2.0262.407 2.854 3.380 3.996 4.717 5.560 7.690 10.58 12.38 1.208 1.457 1.754 2.107 2.527 3.026 3.6174.316 5.142 6.116 8.613 12.06 14.23 1.220 1.486 1.806 2.1912.653 3.2073.870 4.661 5.604 6.727 9.646 13.74 16.37 1.232 1.516 1.860 2.279 2.786 3.400 4.141 5.034 6.1097.400 10.80 15.67 18.82 1.245 1.546 1.916 2.370 2.925 3.604 4.430 5.437 6.659 8.140 12.10 17.86 21.64 1.257 1.5771.974 2.465 3.072 3.820 4.741 5.871 7.258 8.954 13.55 20.36 | 24.89 1.270 1.608 2.033 2.563 3.225 4.049 | 5.0726.3417.911 9.850 15.18 23.21 28.63 4002 AA MA 100 17 nnnn 2000 009 A. Print Done Present Value of Ordinary Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.9430.935 0.926 0.917 0.9090.893 0.877 0.870 0.862 0.847 0.833 Period 2 1.970 1.942 1.913 1.886 1.859 1.833 1.8081.783 1.759 1.736 1.6901.647 1.626 1.605 1.566 1.528 Period 3 2.9412.884 2.8292.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 2.246 2.174 2.106 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3,037 2.914 2.855 2.798 2.690 2.589 Period 5 4.8534.7134.580 4.452 4.329 4.212 4.100 3.9933.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991 Period 6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.4864.355 4.111 3.889 3.784 3.685 3.498 3.326 Period 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.1604.039 3.812 3.605 Period 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.9684.639 4487 4.344 4.078 3.837 Porlod 9 8.566 8.1627.786 7.4357.108 6.802 6.515 6.247 5.9955.759 5.3284.946 4.7724.607 4.303 4.031 Period 10 9.471 8.9838.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.6505.216 5,019 4.833 4.494 4.192 Period 11 10.368 9.7879.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5 234 5.0294.656 4.327 Period 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.1616.814 6.194 5.660 5.421 5.1974.7934,439 Period 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.424 5.8425.583 5.3424.910 4.533 Period 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 | 6.628 6.002 5.724 5.468 5.008 4.611 Period 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 6.811 6.142 5.847 5,575 5.092 4.675 Period 16 14.718 13.578 12.561 11.652 10.838 10.106) 9.447 8.851 8.313 7.824 6.9746.265 5954 5.6695.1624.730 Period 17 15,562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.5448.022 7.1206.373 6.047 5.749 5.222 4.775 Period 18 16.398 14.992 13.754 12.659 11.690 10.828 10.0599.372 8.7568.201 7.250 6.4676.128 5.818 5.2734.812 Period 19 17 226 15.678 14.32413.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.5506.1985.877 5.316 4.844 Period 20 18.046 16.351 14.877 13.590 12.462 11.470 10.5949.818 9.1298.514 7.469 6.623 6.259 5.9295.353 4.870 Period 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.6497.5626.6876.312 5.973 5.384 4.891 Period 22 19.660 17.658 15,937 14.451 13.163 12.042 11.061 10.2019.4428.772 7.645 6.743 6.359 6.011 5.410 4.909 Period 23 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.5808.883 7.718 6.792 6,399 6.044 5.432 4.925 Period 24 21243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.7078.985 7.784 6,835 6.4346.073 5.451 4.937 In. o no. L.Leckan sol. Linonnan Lazy 70 com 07 nan Print Done e help Clear 9% Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 Indledne Future Value of Ordinary Annuity of S1 1% 2% 3% 4% 5% 6% 7% 8% 10% 12% 14% 15% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 2.020 2030 2040 2050 2.060 2.070 2.080 2.090 2.100 2.120 2.140 2.150 3.030 3.060 3.091 3.122 3.153 3.1843.215 3.246 3.278 3.310 3.374 3.440 3.473 4.060 4.122 4.184 4.246 4.3104.375 4.440 4.506 4.573 4.641 4.779 4.921 4.993 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.8675.985 6.105 6.353 6.610 6.742 6.152 6.308 6.468 6.633 6.802 6.9757.1537.336 7.523 7.716 8.115 8.536 8.754 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.9239.2009.487 10.09 10.73 11.07 8.286 8.583 8.8929.214 9.549 9.897 10.260 10.64 11.03 11.44 12.30 13.23 13.73 9.369 9.755 10.16 10.58 11.03 11.49 11.98 12.49 13.02 13.58 14.78 16.09 16.79 10.46 10.95 11.46 12.01 12.58 13.18 13.82 14.49 15.19 15.94 | 17.55 19.34 20.30 11.57 12.17 12.81 13.49 14.21 14.97 15.78 16.65 17.56 18.53 20.65 23.04 24.35 12.68 13.41 14.19 15.03 15.92 16.87 17.8918.98 20.14 21.38 24.13 27.27 29.00 13.81 14.68 15.62 16.63 17.71 18.88 20.14 21.50 22.95 24.52 28.03 32.09 34.35 14.95 15.97 17.09 18.29 19.60 21.02 22.55 24.21 26.02 27.98 32.39 37.58 40.50 16.10 17.29 18.60 20.02 21.58 23.28 25.13 27.15 29.36 31.77 37.28 43.84 47.58 17.26 18.64 20.16 21.8223.66 25.67 27.89 30.32 33.00 35.95 42.75 50.98 55.72 18.43 20.01 21.76 23.70 25.84 28.21 30.84 33.75 36.97 40.54 48.88 59.12 65.08 19.61 21.41 23.41 25.65 28.13 30.91 | 34.00 37.45 41.30 45.60 55.75 68.39 75.84 20.81 22.84 25.12 27.67 30.54 33.76 37.38 41.45 46.02 51.16 63.44 78.97 88.21 22.02 24.30 26.87 29.78 33.07 36.79 41.00 45.76 51.16 57.28 72.05 91.02 1024 23.24 25.78 28.68 31.97 35.72 39.99 44.87 50.42 56.76 64.00 81.70 104.8 118.8 24.47 27.30 30.5434.25 38.51 43.39 49.01 55.46 62.87 71.40 92.50 120.4 137.6 25.72 28.85 32.45 36.62 41.4347.00 53.44 60.89 69.53 79.54 104.6 138.3 159.3 26.97 30.42 34.43 39.08 44.50 50.82 58.18 66.76 76.79 88.50 118.2 158.7184.2 20.0 . 10 10 AAOC CADA On OE 04 ne 4 404 47. Print Done of Ordinary Annuity of $1 table.) Ordinary Annuity of $1 table.) BE Data table Can Option #1: $14,000,000 after five years Option #2: $2,050,000 per year for five years Option #3: $13,000,000 after three years Print Done afer? (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary wholi Annuity of $1 table.) Assuming you can earn 6% on your funds, which option would you prefer? (years) row. (Enter the factor to three decimal places. X.XXX.) BEBE Option #1: The present value of $1 paid at the end of five years, at 6% is 0.747. Now determine the present value of $1 for Option #3. Use the Present Value of $1 factor table provided, and identify the factor that intersects the 6% column and the 3 period (years) row. (Enter the factor to three decimal places. X.XXX.) Option #3: The present value of $1 paid at the end of three years, at 6% is 0.840 Option #2 is an annuity. The sum of $2,050,000 is to be paid at the end of each year for the next five years. Use the Present Value of Ordinary Annuity of $1 factor table provided, and identify the factor that intersects the 6% column and the 5 period (years) row. (Enter the factor to three decimal places. X.XXX.) Option #2: The present value of an annuity of $1 paid each year for five years, at 6% per year is 4.212 Now calculate the present value under each of the three options. (Round your answers to nearest whole dollar.) Payment X PV factor Present value Calculator Print Close X.XXX.) 0.840 Option #3: The present value of $1 paid at the end of three years, at 6% is Option #2 is an annuity. The sum of $2,050,000 is to be paid at the end of each year for the Present Value of Ordinary Annuity of $1 factor table provided, and identify the factor that int and the 5 period (years) row. (Enter the factor to three decimal places. X.XXX.) Option #2: The present value of an annuity of $1 paid each year for five years, at 6% per ye Now calculate the present value under each of the three options. (Round your answers to n x PV factor = 0.747 Option #1 Option #2 Option #3 Payment $ 15,000,000 $ 2,050,000 $ 11,000,000 Present value $ 11,205,000 = $ 8,634,600 = $ 9,240,000 X 4.212 0.840 The payout option with the highest present value using the 6% discount rate should be the m Calculator Print