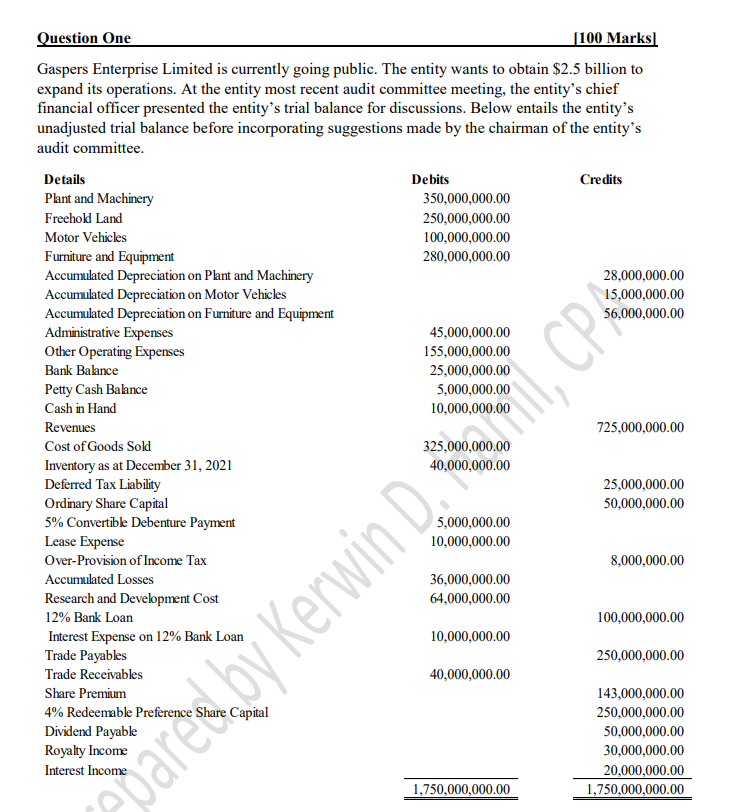

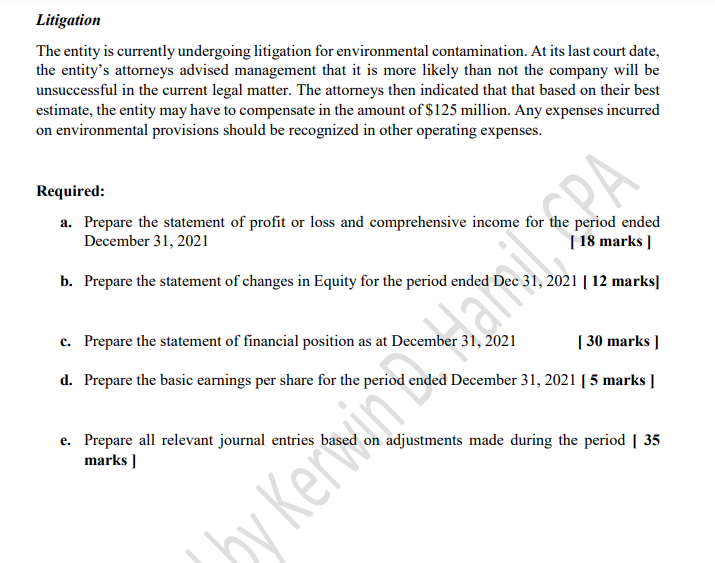

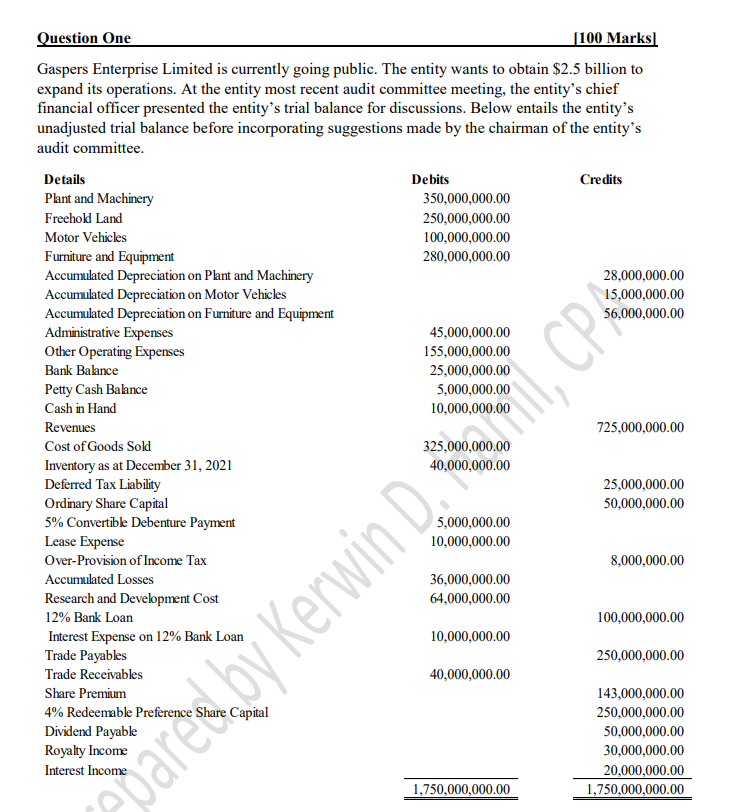

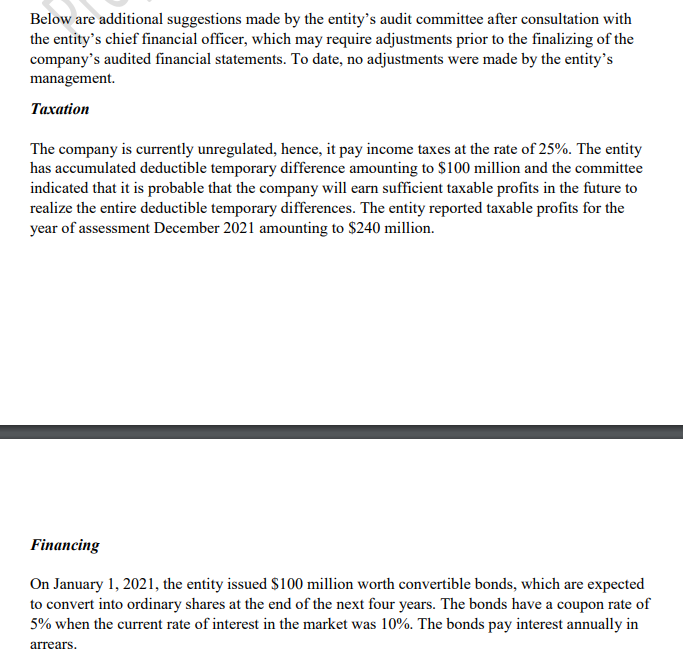

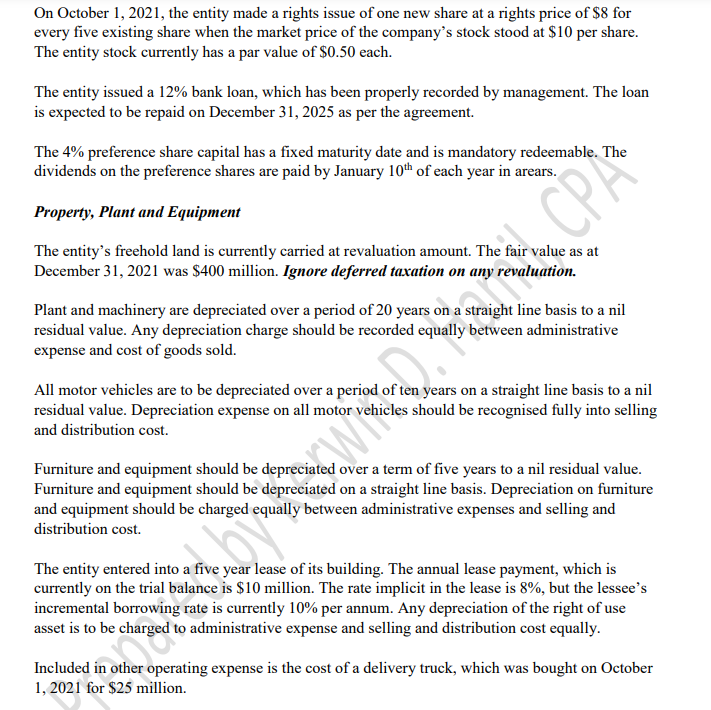

, II, Question One [100 Marks Gaspers Enterprise Limited is currently going public. The entity wants to obtain $2.5 billion to expand its operations. At the entity most recent audit committee meeting, the entity's chief financial officer presented the entity's trial balance for discussions. Below entails the entity's unadjusted trial balance before incorporating suggestions made by the chairman of the entity's audit committee. Details De bits Credits Plant and Machinery 350,000,000.00 Freehold Land 250,000,000.00 Motor Vehicles 100,000,000.00 Furniture and Equipment 280,000,000.00 Accumulated Depreciation on Plant and Machinery 28,000,000.00 Accumulated Depreciation on Motor Vehicles 15,000,000.00 Accumulated Depreciation on Furniture and Equipment 56,000,000.00 Administrative Expenses 45,000,000.00 Other Operating Expenses 155,000,000.00 Bank Balance 25,000,000.00 Petty Cash Balance 5,000,000.00 Cash in Hand 10,000,000.00 Revenues 725,000,000.00 Cost of Goods Sold 325,000,000.00 Inventory as at December 31, 2021 40,000,000.00 Deferred Tax Liability 25,000,000.00 Ordinary Share Capital 50,000,000.00 5% Convertible Debenture Payment 5,000,000.00 Lease Expense 10,000,000.00 Over-Provision of Income Tax 8,000,000.00 Accumulated Losses 36,000,000.00 Research and Development Cost 64,000,000.00 12% Bank Loan 100,000,000.00 Interest Expense on 12% Bank Loan 10,000,000.00 Trade Payables 250,000,000.00 Trade Receivables 40,000,000.00 Share Premium 143,000,000.00 4% Redeemable Preference 250,000,000.00 Dividend Payable 50,000,000.00 Royalty Income 30,000,000.00 20,000,000.00 1,750,000,000.00 1,750,000,000.00 daresa by Kerwin D. Below are additional suggestions made by the entity's audit committee after consultation with the entity's chief financial officer, which may require adjustments prior to the finalizing of the company's audited financial statements. To date, no adjustments were made by the entity's management. Taxation The company is currently unregulated, hence, it pay income taxes at the rate of 25%. The entity has accumulated deductible temporary difference amounting to $100 million and the committee indicated that it is probable that the company will earn sufficient taxable profits in the future to realize the entire deductible temporary differences. The entity reported taxable profits for the year of assessment December 2021 amounting to $240 million. Financing On January 1, 2021, the entity issued $100 million worth convertible bonds, which are expected to convert into ordinary shares at the end of the next four years. The bonds have a coupon rate of 5% when the current rate of interest in the market was 10%. The bonds pay interest annually in arrears. On October 1, 2021, the entity made a rights issue of one new share at a rights price of $8 for every five existing share when the market price of the company's stock stood at $10 per share. The entity stock currently has a par value of $0.50 each. The entity issued a 12% bank loan, which has been properly recorded by management. The loan is expected to be repaid on December 31, 2025 as per the agreement. The 4% preference share capital has a fixed maturity date and is mandatory redeemable. The dividends on the preference shares are paid by January 10th of each year in arears. Property, Plant and Equipment CPA The entity's freehold land is currently carried at revaluation amount. The fair value as at December 31, 2021 was $400 million. Ignore deferred taxation on any revaluation. Plant and machinery are depreciated over a period of 20 years on a night line basis to a nil residual value. Any depreciation charge should be recorded equally between administrative expense and cost of goods sold. All motor vehicles are to be depreciated over a period of ten years on a straight line basis to a nil residual value. Depreciation expense on all motor vehicles should be recognised fully into selling and distribution cost. Furniture and equipment should be depreciated over a term of five years to a nil residual value. Furniture and equipment should be depreciated on a straight line basis. Depreciation on furniture and equipment should be charged equally between administrative expenses and selling and distribution cost. The entity entered into a five year lease of its building. The annual lease payment, which is currently on the trial balance is $10 million. The rate implicit in the lease is 8%, but the lessee's incremental borrowing rate is currently 10% per annum. Any depreciation of the right of use asset is to be charged to administrative expense and selling and distribution cost equally. be Included in other operating expense is the cost of a delivery truck, which was bought on October 1, 2021 for $25 million. desde Research and Development Cost Of the total R&D cost, $24 million is specifically research related. Of the remainder, which is development cost, 40% reach the stage of technological and financial feasibility as of October 1, 2021. Any R&D cost not capitalize should be charged to cost of goods sold, meanwhile any amortization shall be recognised in cost of goods sold. Intangible Asset On August 1, 2021, the entity purchased a brand paying by cash amounting to $20 million. To date, the brand has not been recorded by management, but is expected to have a useful life of 20 years and amortized on a straight line basis to a nil residual value. Any amortization on the brand should be recognised in selling and distribution expense. Dividends The entity paid interim dividends amounting to $10 million dollars in cash, which has not been recorded to date. On December 31, 2021, the entity declared dividends of $0.10 per share. The dividends are expected to be paid on March 15, 2022. Litigation The entity is currently undergoing litigation for environmental contamination. At its last court date, the entity's attorneys advised management that it is more likely than not the company will be unsuccessful in the current legal matter. The attorneys then indicated that that based on their best estimate, the entity may have to compensate in the amount of $125 million. Any expenses incurred on environmental provisions should be recognized in other operating expenses. Required: a. Prepare the statement of profit or loss and comprehensive income for the period ended December 31, 2021 (18 marks SPA b. Prepare the statement of changes in Equity for the period ended Dec 31, 2021 [12 marks] c. Prepare the statement of financial position as at December 31, 2021 [ 30 marks d. Prepare the basic earnings per share for the period ended December 31, 2021 [ 5 marks] wan e. Prepare all relevant journal entries based on adjustments made during the period [ 35 marks by Kern , II, Question One [100 Marks Gaspers Enterprise Limited is currently going public. The entity wants to obtain $2.5 billion to expand its operations. At the entity most recent audit committee meeting, the entity's chief financial officer presented the entity's trial balance for discussions. Below entails the entity's unadjusted trial balance before incorporating suggestions made by the chairman of the entity's audit committee. Details De bits Credits Plant and Machinery 350,000,000.00 Freehold Land 250,000,000.00 Motor Vehicles 100,000,000.00 Furniture and Equipment 280,000,000.00 Accumulated Depreciation on Plant and Machinery 28,000,000.00 Accumulated Depreciation on Motor Vehicles 15,000,000.00 Accumulated Depreciation on Furniture and Equipment 56,000,000.00 Administrative Expenses 45,000,000.00 Other Operating Expenses 155,000,000.00 Bank Balance 25,000,000.00 Petty Cash Balance 5,000,000.00 Cash in Hand 10,000,000.00 Revenues 725,000,000.00 Cost of Goods Sold 325,000,000.00 Inventory as at December 31, 2021 40,000,000.00 Deferred Tax Liability 25,000,000.00 Ordinary Share Capital 50,000,000.00 5% Convertible Debenture Payment 5,000,000.00 Lease Expense 10,000,000.00 Over-Provision of Income Tax 8,000,000.00 Accumulated Losses 36,000,000.00 Research and Development Cost 64,000,000.00 12% Bank Loan 100,000,000.00 Interest Expense on 12% Bank Loan 10,000,000.00 Trade Payables 250,000,000.00 Trade Receivables 40,000,000.00 Share Premium 143,000,000.00 4% Redeemable Preference 250,000,000.00 Dividend Payable 50,000,000.00 Royalty Income 30,000,000.00 20,000,000.00 1,750,000,000.00 1,750,000,000.00 daresa by Kerwin D. Below are additional suggestions made by the entity's audit committee after consultation with the entity's chief financial officer, which may require adjustments prior to the finalizing of the company's audited financial statements. To date, no adjustments were made by the entity's management. Taxation The company is currently unregulated, hence, it pay income taxes at the rate of 25%. The entity has accumulated deductible temporary difference amounting to $100 million and the committee indicated that it is probable that the company will earn sufficient taxable profits in the future to realize the entire deductible temporary differences. The entity reported taxable profits for the year of assessment December 2021 amounting to $240 million. Financing On January 1, 2021, the entity issued $100 million worth convertible bonds, which are expected to convert into ordinary shares at the end of the next four years. The bonds have a coupon rate of 5% when the current rate of interest in the market was 10%. The bonds pay interest annually in arrears. On October 1, 2021, the entity made a rights issue of one new share at a rights price of $8 for every five existing share when the market price of the company's stock stood at $10 per share. The entity stock currently has a par value of $0.50 each. The entity issued a 12% bank loan, which has been properly recorded by management. The loan is expected to be repaid on December 31, 2025 as per the agreement. The 4% preference share capital has a fixed maturity date and is mandatory redeemable. The dividends on the preference shares are paid by January 10th of each year in arears. Property, Plant and Equipment CPA The entity's freehold land is currently carried at revaluation amount. The fair value as at December 31, 2021 was $400 million. Ignore deferred taxation on any revaluation. Plant and machinery are depreciated over a period of 20 years on a night line basis to a nil residual value. Any depreciation charge should be recorded equally between administrative expense and cost of goods sold. All motor vehicles are to be depreciated over a period of ten years on a straight line basis to a nil residual value. Depreciation expense on all motor vehicles should be recognised fully into selling and distribution cost. Furniture and equipment should be depreciated over a term of five years to a nil residual value. Furniture and equipment should be depreciated on a straight line basis. Depreciation on furniture and equipment should be charged equally between administrative expenses and selling and distribution cost. The entity entered into a five year lease of its building. The annual lease payment, which is currently on the trial balance is $10 million. The rate implicit in the lease is 8%, but the lessee's incremental borrowing rate is currently 10% per annum. Any depreciation of the right of use asset is to be charged to administrative expense and selling and distribution cost equally. be Included in other operating expense is the cost of a delivery truck, which was bought on October 1, 2021 for $25 million. desde Research and Development Cost Of the total R&D cost, $24 million is specifically research related. Of the remainder, which is development cost, 40% reach the stage of technological and financial feasibility as of October 1, 2021. Any R&D cost not capitalize should be charged to cost of goods sold, meanwhile any amortization shall be recognised in cost of goods sold. Intangible Asset On August 1, 2021, the entity purchased a brand paying by cash amounting to $20 million. To date, the brand has not been recorded by management, but is expected to have a useful life of 20 years and amortized on a straight line basis to a nil residual value. Any amortization on the brand should be recognised in selling and distribution expense. Dividends The entity paid interim dividends amounting to $10 million dollars in cash, which has not been recorded to date. On December 31, 2021, the entity declared dividends of $0.10 per share. The dividends are expected to be paid on March 15, 2022. Litigation The entity is currently undergoing litigation for environmental contamination. At its last court date, the entity's attorneys advised management that it is more likely than not the company will be unsuccessful in the current legal matter. The attorneys then indicated that that based on their best estimate, the entity may have to compensate in the amount of $125 million. Any expenses incurred on environmental provisions should be recognized in other operating expenses. Required: a. Prepare the statement of profit or loss and comprehensive income for the period ended December 31, 2021 (18 marks SPA b. Prepare the statement of changes in Equity for the period ended Dec 31, 2021 [12 marks] c. Prepare the statement of financial position as at December 31, 2021 [ 30 marks d. Prepare the basic earnings per share for the period ended December 31, 2021 [ 5 marks] wan e. Prepare all relevant journal entries based on adjustments made during the period [ 35 marks by Kern