Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(ii) State Wilkie's updating equation in respect of the force of inflation and explain carefully what each of the components of the equation represents.

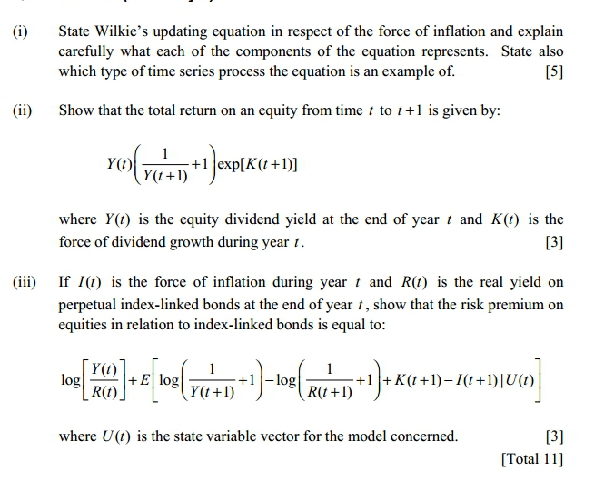

(ii) State Wilkie's updating equation in respect of the force of inflation and explain carefully what each of the components of the equation represents. State also which type of time series process the equation is an example of. [5] Show that the total return on an equity from time to 1+1 is given by: Y() 1 Y(1+1) +1 exp[K(t+1)] (iii) where Y(t) is the equity dividend yield at the end of year and K() is the force of dividend growth during year 1. [3] If (1) is the force of inflation during year and R(t) is the real yield on perpetual index-linked bonds at the end of year i, show that the risk premium on equities in relation to index-linked bonds is equal to: Y(t) log +E log R(t) Y(t+1 -1)-101 1 log +1+K(1+1)I(t+1)|U(t) R(t+1) where U(t) is the state variable vector for the model concerned. [3] [Total 11]

Step by Step Solution

★★★★★

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Excel Model Design Sheet Layout Input Section Clearly label cells for inputs like investment weights riskfree rate and target return Data Section Orga...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started