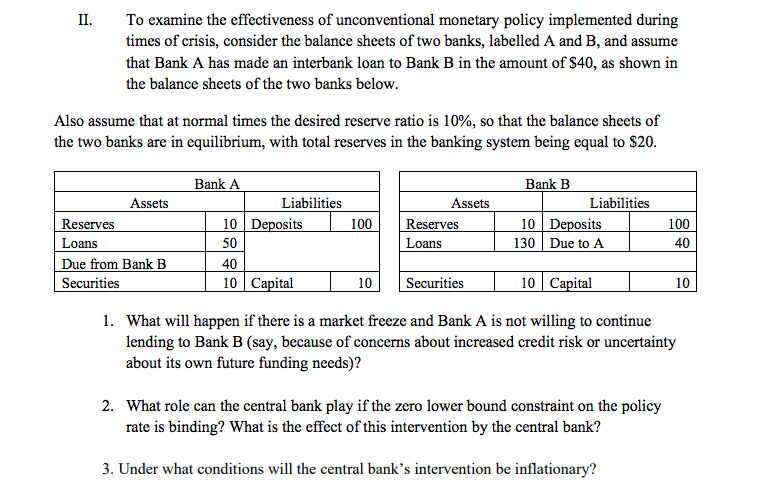

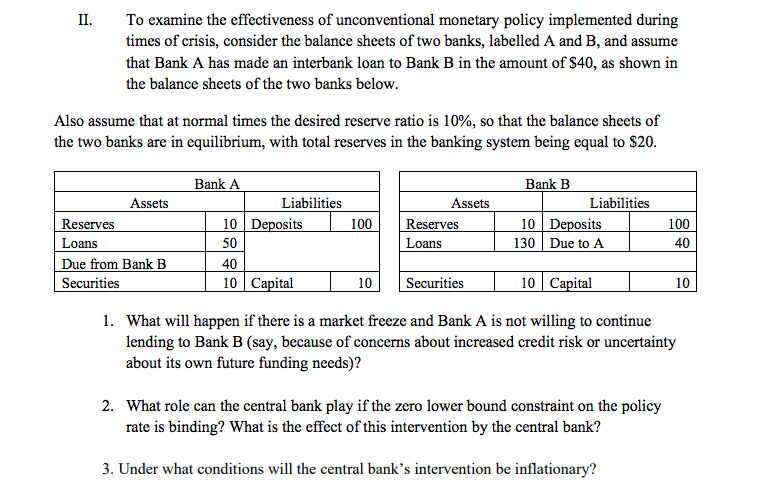

II. To examine the effectiveness of unconventional monetary policy implemented during times of crisis, consider the balance sheets of two banks, labelled A and B, and assume that Bank A has made an interbank loan to Bank B in the amount of $40, as shown in the balance sheets of the two banks below. Also assume that at normal times the desired reserve ratio is 10%, so that the balance sheets of the two banks are in equilibrium, with total reserves in the banking system being equal to $20. Bank B Assets Assets Liabilities Bank A Liabilities 10 Deposits 50 100 Reserves Loans 10 Deposits 130 Due to A 100 40 Reserves Loans Due from Bank B Securities 40 10 Capital 10 Securities 10 Capital 10 1. What will happen if there is a market freeze and Bank A is not willing to continue lending to Bank B (say, because of concerns about increased credit risk or uncertainty about its own future funding needs)? 2. What role can the central bank play if the zero lower bound constraint on the policy rate is binding? What is the effect of this intervention by the central bank? 3. Under what conditions will the central bank's intervention be inflationary? II. To examine the effectiveness of unconventional monetary policy implemented during times of crisis, consider the balance sheets of two banks, labelled A and B, and assume that Bank A has made an interbank loan to Bank B in the amount of $40, as shown in the balance sheets of the two banks below. Also assume that at normal times the desired reserve ratio is 10%, so that the balance sheets of the two banks are in equilibrium, with total reserves in the banking system being equal to $20. Bank B Assets Assets Liabilities Bank A Liabilities 10 Deposits 50 100 Reserves Loans 10 Deposits 130 Due to A 100 40 Reserves Loans Due from Bank B Securities 40 10 Capital 10 Securities 10 Capital 10 1. What will happen if there is a market freeze and Bank A is not willing to continue lending to Bank B (say, because of concerns about increased credit risk or uncertainty about its own future funding needs)? 2. What role can the central bank play if the zero lower bound constraint on the policy rate is binding? What is the effect of this intervention by the central bank? 3. Under what conditions will the central bank's intervention be inflationary