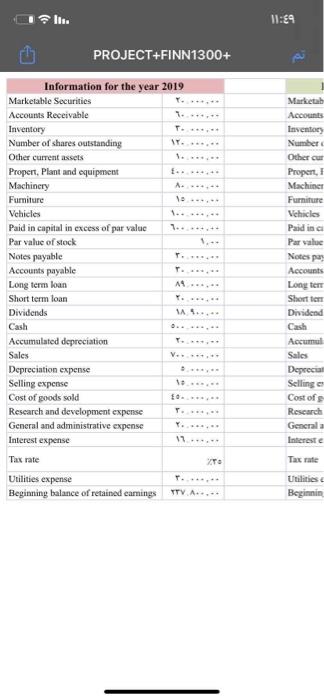

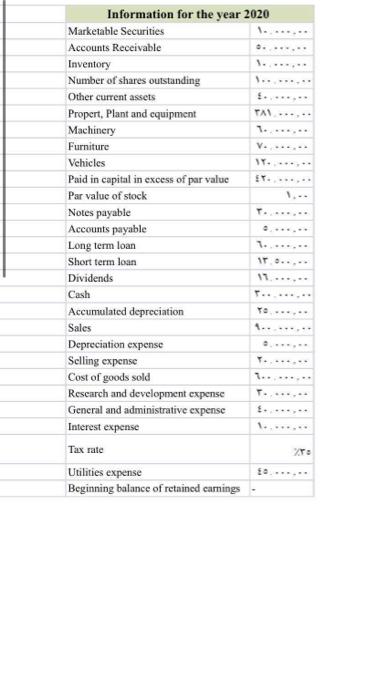

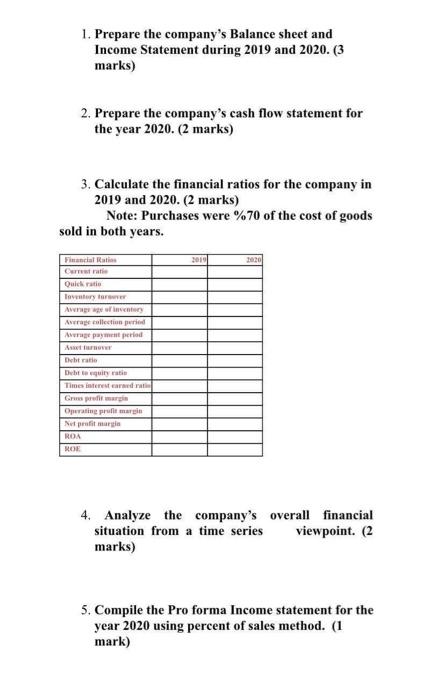

II. W:69 PROJECT+FINN1300+ Marketab Accounts Inventory Number Other Proper, Machines Furniture Vehicles Paid in Par value Notes Information for the year 2019 Marketable Securities Accounts Receivable Inventory Number of shares outstanding Other current assets Proper, Plant and equipment Machinery A .. Fumitur Vehicles Paid in capital in excess of par value Par value of stock Notes payable Accounts payable Long term loan Short term loan Dividends WAS Cash Accumulated depreciation Sales Depreciation expense Selling expense Cost of goods sold Research and development expense General and administrative expense Interest expense Tax rate Utilities expense Beginning balance of retained earnings YTY A... Accounts Long ter Short to Dividend Cash Accumul Sales Deprecia Sellinge Cost of Research Generala Interest T. TO Taxat Utilities Beginnin TAL, V. Information for the year 2020 Marketable Securities Accounts Receivable Inventory Number of shares outstanding Other current assets Propert, Plant and equipment Machinery Furniture Vehicles Paid in capital in excess of par value ET. Par value of stock Notes payable Accounts payable Long term loan Short term loan Dividends 11. Cash Accumulated depreciation Sales 1. Depreciation expense Selling expense Cost of goods sold Research and development expense General and administrative expense Interest expense Tax rate TE fo Utilities expense Beginning balance of retained carnings 1. Prepare the company's Balance sheet and Income Statement during 2019 and 2020. (3 marks) 2. Prepare the company's cash flow statement for the year 2020. (2 marks) 3. Calculate the financial ratios for the company in 2019 and 2020. (2 marks) Note: Purchases were %70 of the cost of goods sold in both years. 2019 2020 Financial Ratio Carte Quick ratio Tovary for Avrige flery Average collection period Average payment period Astro Debt ratio Times internet Operating profit margin Neprofit margin ROA ROE 4. Analyze the company's overall financial situation from a time series viewpoint. (2 marks) 5. Compile the Pro forma Income statement for the year 2020 using percent of sales method. (1 mark) II. W:69 PROJECT+FINN1300+ Marketab Accounts Inventory Number Other Proper, Machines Furniture Vehicles Paid in Par value Notes Information for the year 2019 Marketable Securities Accounts Receivable Inventory Number of shares outstanding Other current assets Proper, Plant and equipment Machinery A .. Fumitur Vehicles Paid in capital in excess of par value Par value of stock Notes payable Accounts payable Long term loan Short term loan Dividends WAS Cash Accumulated depreciation Sales Depreciation expense Selling expense Cost of goods sold Research and development expense General and administrative expense Interest expense Tax rate Utilities expense Beginning balance of retained earnings YTY A... Accounts Long ter Short to Dividend Cash Accumul Sales Deprecia Sellinge Cost of Research Generala Interest T. TO Taxat Utilities Beginnin TAL, V. Information for the year 2020 Marketable Securities Accounts Receivable Inventory Number of shares outstanding Other current assets Propert, Plant and equipment Machinery Furniture Vehicles Paid in capital in excess of par value ET. Par value of stock Notes payable Accounts payable Long term loan Short term loan Dividends 11. Cash Accumulated depreciation Sales 1. Depreciation expense Selling expense Cost of goods sold Research and development expense General and administrative expense Interest expense Tax rate TE fo Utilities expense Beginning balance of retained carnings 1. Prepare the company's Balance sheet and Income Statement during 2019 and 2020. (3 marks) 2. Prepare the company's cash flow statement for the year 2020. (2 marks) 3. Calculate the financial ratios for the company in 2019 and 2020. (2 marks) Note: Purchases were %70 of the cost of goods sold in both years. 2019 2020 Financial Ratio Carte Quick ratio Tovary for Avrige flery Average collection period Average payment period Astro Debt ratio Times internet Operating profit margin Neprofit margin ROA ROE 4. Analyze the company's overall financial situation from a time series viewpoint. (2 marks) 5. Compile the Pro forma Income statement for the year 2020 using percent of sales method. (1 mark)