Answered step by step

Verified Expert Solution

Question

1 Approved Answer

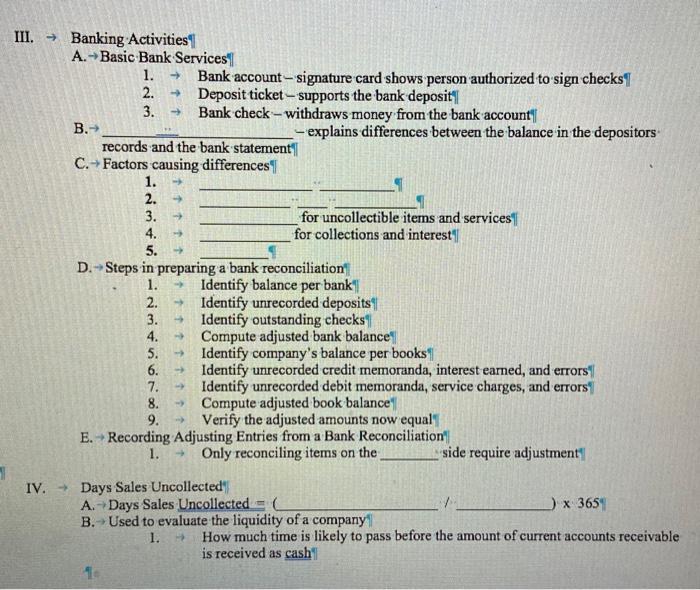

III. Banking Activities A. Basic Bank Services B. 1. > Bank account-signature card shows person authorized to sign checks 2. 4 Deposit ticket-supports the

III. Banking Activities A. Basic Bank Services B. 1. > Bank account-signature card shows person authorized to sign checks 2. 4 Deposit ticket-supports the bank deposit 3. Bank check-withdraws money from the bank account records and the bank statement C. Factors causing differences 1. 2. >> 3. >> 4. 2. 3. 4. 5. 6. 7. 8. 9. E. Recording 5. D. Steps in preparing a bank reconciliation 1. Identify balance per bank Identify unrecorded deposits Identify outstanding checks Compute adjusted bank balance Identify company's balance per books >> Identify unrecorded credit memoranda, interest earned, and errors" 4 Identify unrecorded debit memoranda, service charges, and errors Compute adjusted book balance Verify the adjusted amounts now equal" Adjusting Entries from a Bank Reconciliation 1. Only reconciling items on the 1111 11 -explains differences between the balance in the depositors IV. Days Sales Uncollected" for uncollectible items and services for collections and interest A. Days Sales Uncollected ( B. Used to evaluate the liquidity of a company side require adjustment 4 ) x 365 1. 1 How much time is likely to pass before the amount of current accounts receivable is received as cash

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

III Banking Activities A Basic Bank Services 1 Bank account signature card shows person authorized to sign ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started