Answered step by step

Verified Expert Solution

Question

1 Approved Answer

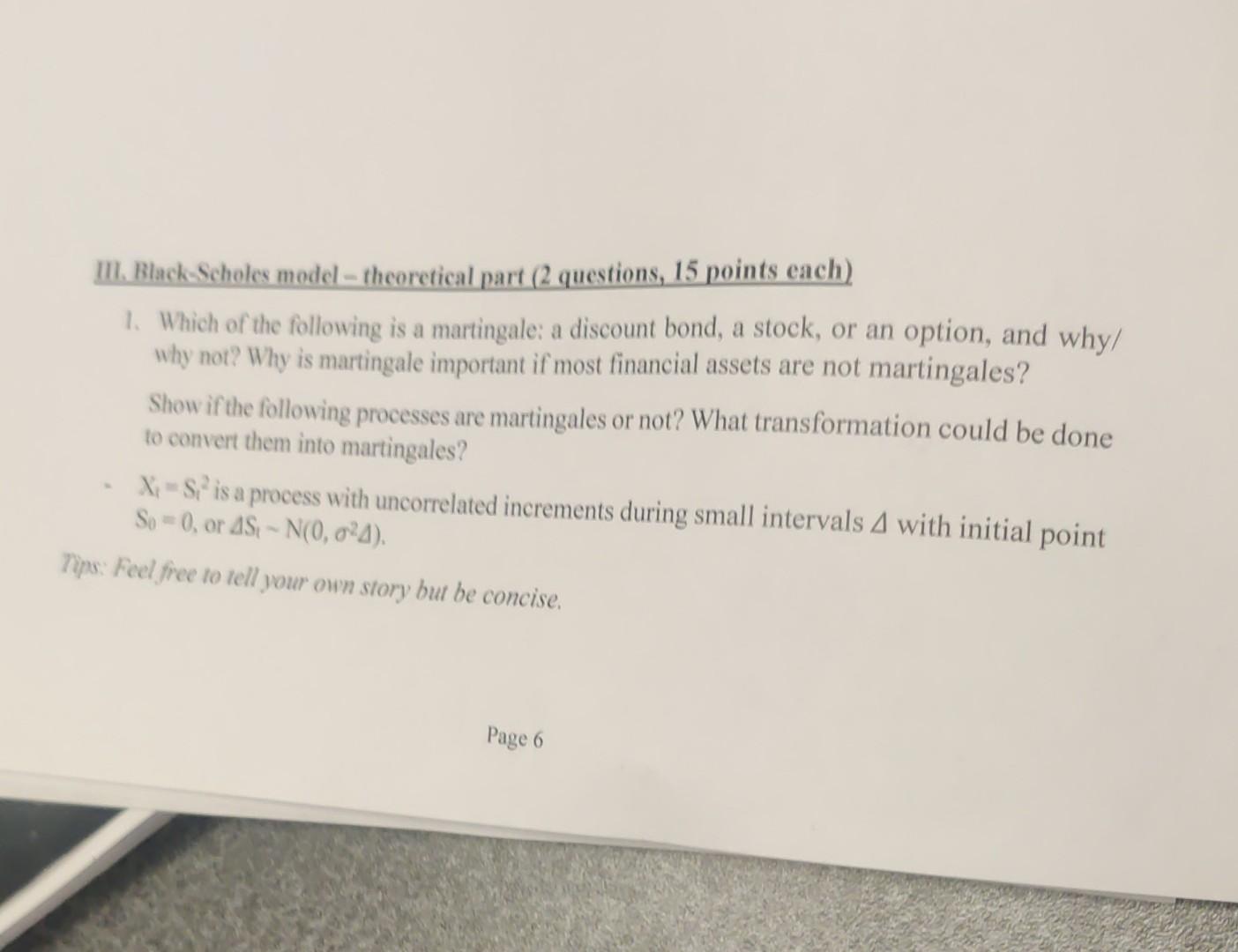

III. Black-Scholes model-theoretical part (2 questions, 15 points each) 1. Which of the following is a martingale: a discount bond, a stock, or an option,

III. Black-Scholes model-theoretical part (2 questions, 15 points each) 1. Which of the following is a martingale: a discount bond, a stock, or an option, and why/ why not? Why is martingale important if most financial assets are not martingales? Show if the following processes are martingales or not? What transformation could be done to convert them into martingales? - X1=S12 is a process with uncorrelated increments during small intervals with initial point S0=0, or SlN(0,2). ins: Feel free to tell your own story but be concise

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started