Answered step by step

Verified Expert Solution

Question

1 Approved Answer

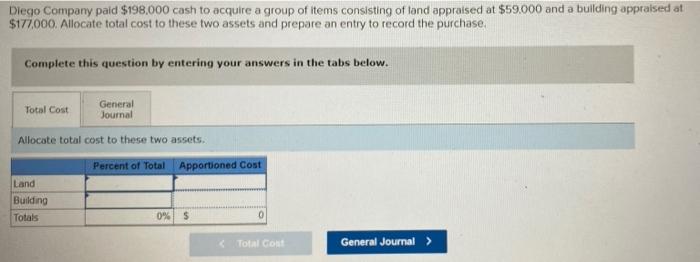

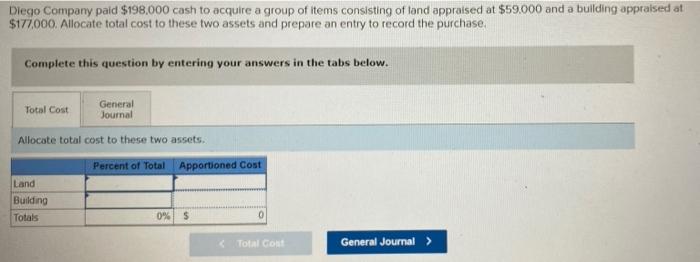

III Diego Company paid $198.000 cash to acquire a group of items consisting of land appraised at $59.000 and a building appraised at $177,000. Allocate

III

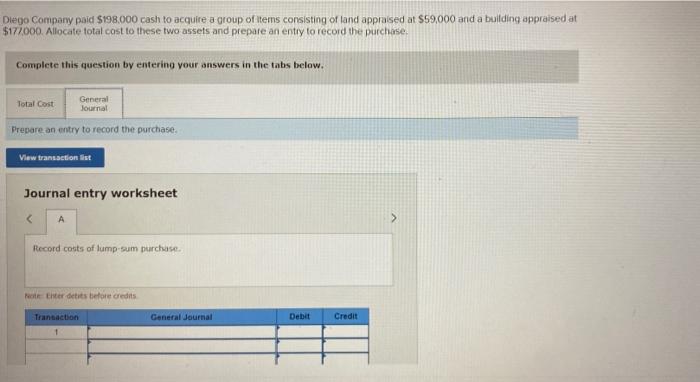

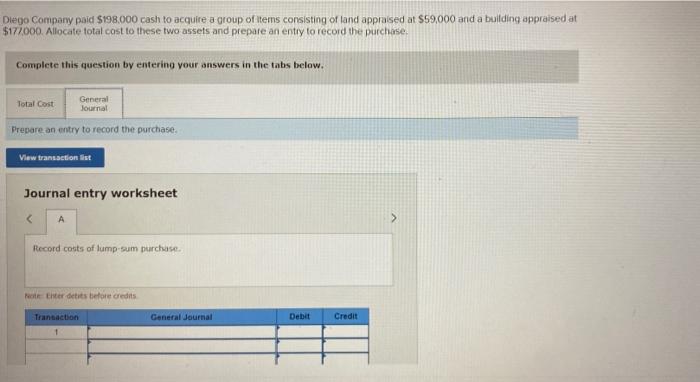

Diego Company paid $198.000 cash to acquire a group of items consisting of land appraised at $59.000 and a building appraised at $177,000. Allocate total cost to these two assets and prepare an entry to record the purchase Complete this question by entering your answers in the tabs below. Total Cost General Journal Allocate total cost to these two assets. Percent of Total Apportioned Cost Land Building Totals 0% 5 0 TOTAL CON General Journal > Diego Company paid $198.000 cash to acquire a group of items consisting of land appraised at $59.000 and a building appraised at $177000. Allocate total cost to these two assets and prepare an entry to record the purchase. Complete this question by enterino your answers in the tabs below. Total Cost General Journal Prepare an entry to record the purchase. View transaction ist Journal entry worksheet Record costs of lump sum purchase Enterdetits before credits Transaction General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started