Answered step by step

Verified Expert Solution

Question

1 Approved Answer

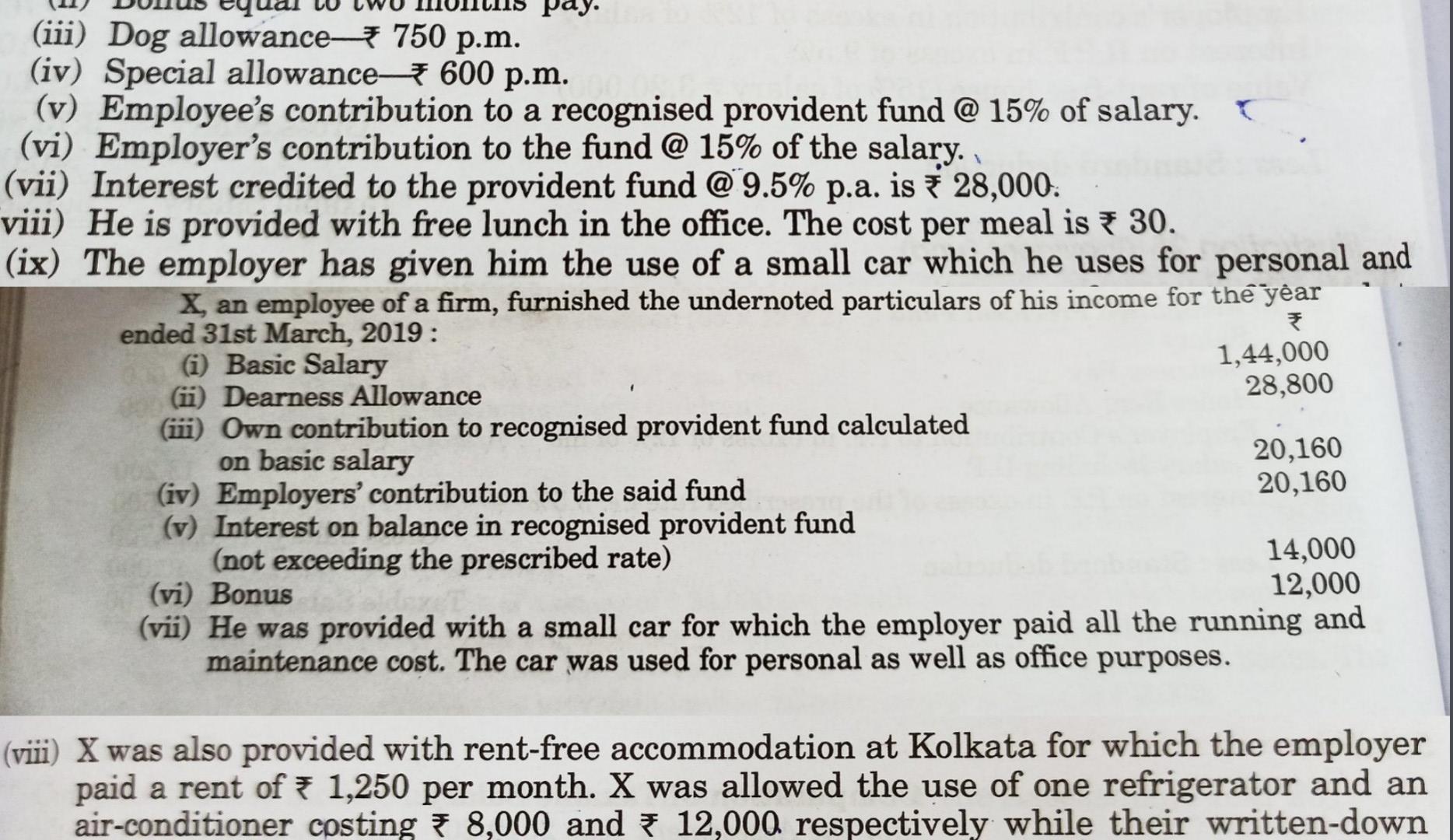

(iii) Dog allowance 750 p.m. (iv) Special allowance 600 p.m. (v) Employee's contribution to a recognised provident fund @ 15% of salary. I (vi) Employer's

(iii) Dog allowance 750 p.m. (iv) Special allowance 600 p.m. (v) Employee's contribution to a recognised provident fund @ 15% of salary. I (vi) Employer's contribution to the fund @ 15% of the salary. (vii) Interest credited to the provident fund @ 9.5% p.a. is * 28,000. viii) He is provided with free lunch in the office. The cost per meal is * 30. (ix) The employer has given him the use of a small car which he uses for personal and X, an employee of a firm, furnished the undernoted particulars of his income for the year ended 31st March, 2019: (i) Basic Salary 1,44,000 (ii) Dearness Allowance 28,800 (i) Own contribution to recognised provident fund calculated on basic salary 20,160 (iv) Employers' contribution to the said fund 20,160 (v) Interest on balance in recognised provident fund (not exceeding the prescribed rate) 14,000 (vi) Bonus 12,000 (vii) He was provided with a small car for which the employer paid all the running and maintenance cost. The car was used for personal as well as office purposes. (viii) X was also provided with rent-free accommodation at Kolkata for which the employer paid a rent of * 1,250 per month. X was allowed the use of one refrigerator and an air-conditioner cpsting = 8,000 and 12,000 respectively while their written-down (iii) Dog allowance 750 p.m. (iv) Special allowance 600 p.m. (v) Employee's contribution to a recognised provident fund @ 15% of salary. I (vi) Employer's contribution to the fund @ 15% of the salary. (vii) Interest credited to the provident fund @ 9.5% p.a. is * 28,000. viii) He is provided with free lunch in the office. The cost per meal is * 30. (ix) The employer has given him the use of a small car which he uses for personal and X, an employee of a firm, furnished the undernoted particulars of his income for the year ended 31st March, 2019: (i) Basic Salary 1,44,000 (ii) Dearness Allowance 28,800 (i) Own contribution to recognised provident fund calculated on basic salary 20,160 (iv) Employers' contribution to the said fund 20,160 (v) Interest on balance in recognised provident fund (not exceeding the prescribed rate) 14,000 (vi) Bonus 12,000 (vii) He was provided with a small car for which the employer paid all the running and maintenance cost. The car was used for personal as well as office purposes. (viii) X was also provided with rent-free accommodation at Kolkata for which the employer paid a rent of * 1,250 per month. X was allowed the use of one refrigerator and an air-conditioner cpsting = 8,000 and 12,000 respectively while their written-down

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started