Answered step by step

Verified Expert Solution

Question

1 Approved Answer

III. GregIFER inc., a Spain-based company, imports merchandise produced in Argentina. The price in the factory is 2,000,000. The expenses incurred during the transaction

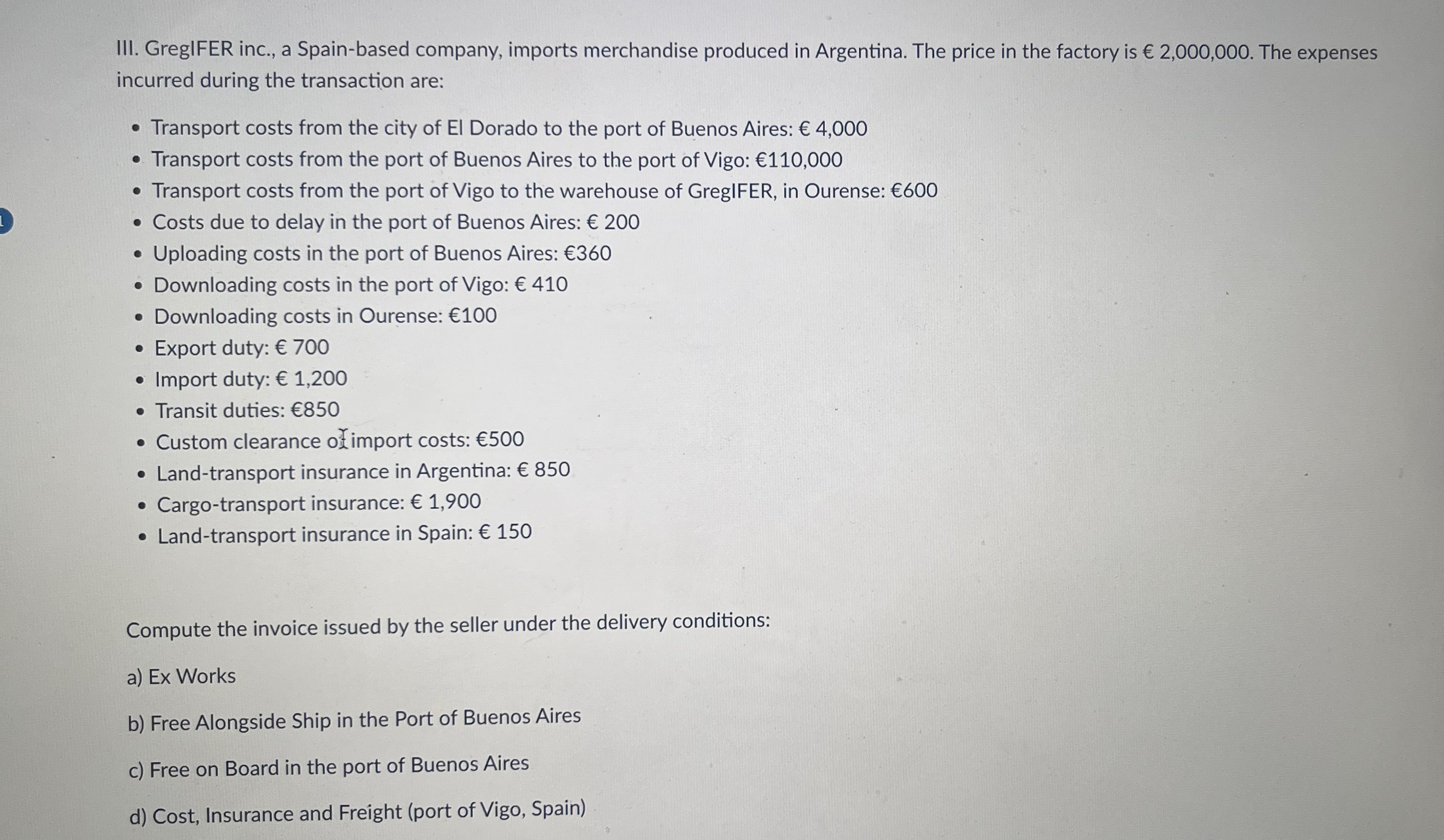

III. GregIFER inc., a Spain-based company, imports merchandise produced in Argentina. The price in the factory is 2,000,000. The expenses incurred during the transaction are: Transport costs from the city of El Dorado to the port of Buenos Aires: 4,000 Transport costs from the port of Buenos Aires to the port of Vigo: 110,000 Transport costs from the port of Vigo to the warehouse of GregIFER, in Ourense: 600 Costs due to delay in the port of Buenos Aires: 200 Uploading costs in the port of Buenos Aires: 360 Downloading costs in the port of Vigo: 410 Downloading costs in Ourense: 100 Export duty: 700 O Import duty: 1,200 Transit duties: 850 Custom clearance of import costs: 500 Land-transport insurance in Argentina: 850 Cargo-transport insurance: 1,900 Land-transport insurance in Spain: 150 Compute the invoice issued by the seller under the delivery conditions: a) Ex Works b) Free Alongside Ship in the Port of Buenos Aires c) Free on Board in the port of Buenos Aires d) Cost, Insurance and Freight (port of Vigo, Spain)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets compute the invoice issued by the seller under different delivery conditions a Ex Works EXW Under Ex Works the seller is responsible for making t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started