Answered step by step

Verified Expert Solution

Question

1 Approved Answer

III. LONG PROBLEMS. Use Worksheet (yellow) as indicated. Problem 1. (45 mins.) Watson Metal Products, an internationally based company, is planning to expand its 2015

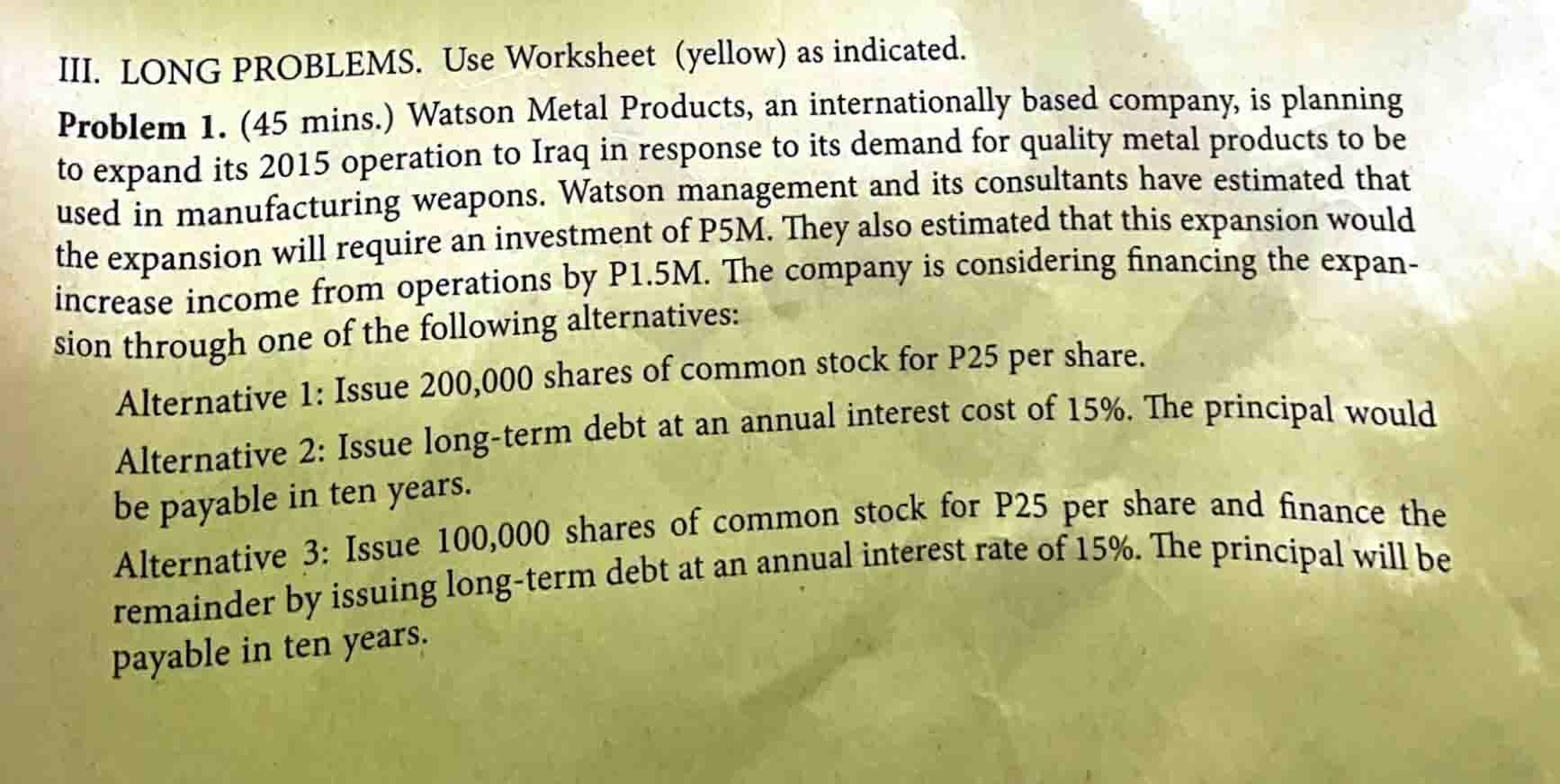

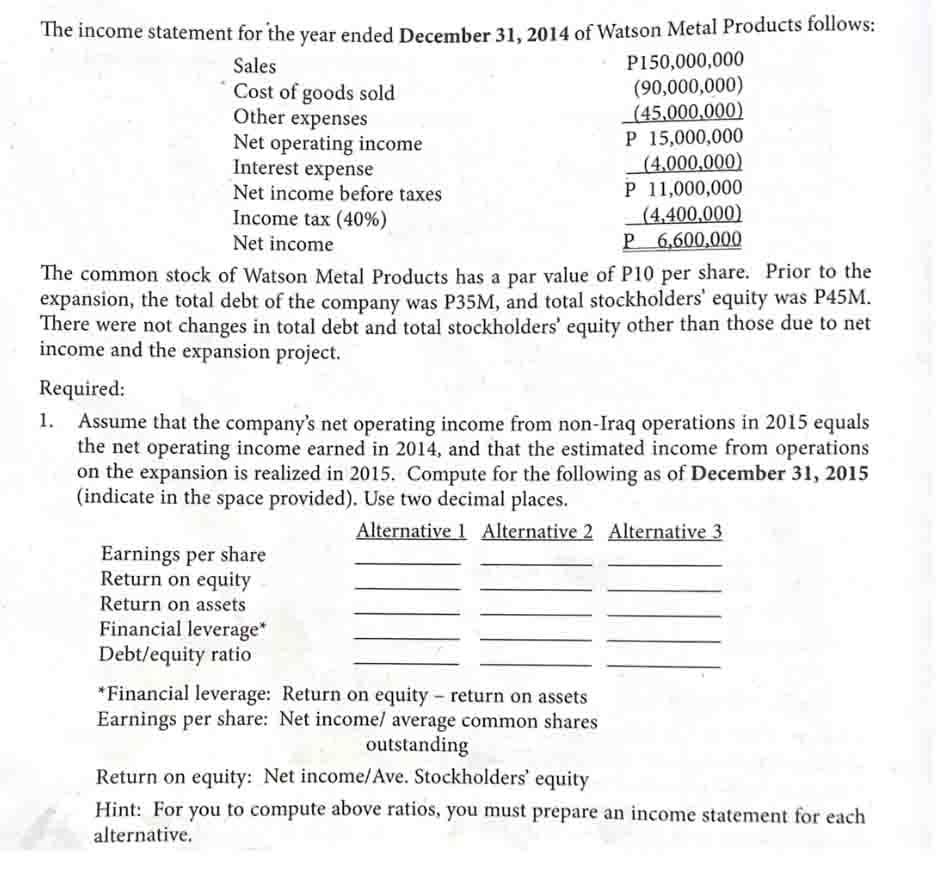

III. LONG PROBLEMS. Use Worksheet (yellow) as indicated. Problem 1. (45 mins.) Watson Metal Products, an internationally based company, is planning to expand its 2015 operation to Iraq in response to its demand for quality metal products to be used in manufacturing weapons. Watson management and its consultants have estimated that the expansion will require an investment of P5M. They also estimated that this expansion would increase income from operations by P1.5M. The company is considering financing the expansion through one of the following alternatives: Alternative 1: Issue 200,000 shares of common stock for P25 per share. Alternative 2: Issue long-term debt at an annual interest cost of 15%. The principal would be payable in ten years. Alternative 3: Issue 100,000 shares of common stock for P 25 per share and finance the remainder by issuing long-term debt at an annual interest rate of 15%. The principal will be payable in ten years. The income statement for the year ended December 31, 2014 of Watson Metal Products follows: The common stock of Watson Metal Products has a par value of P10 per share. Prior to the expansion, the total debt of the company was P35M, and total stockholders' equity was P45M. There were not changes in total debt and total stockholders' equity other than those due to net income and the expansion project. Required: 1. Assume that the company's net operating income from non-Iraq operations in 2015 equals the net operating income earned in 2014, and that the estimated income from operations on the expansion is realized in 2015. Compute for the following as of December 31, 2015 (indicate in the space provided). Use two decimal places. *Financial leverage: Return on equity - return on assets Earnings per share: Net incomel average common shares outstanding Return on equity: Net income/Ave. Stockholders' equity Hint: For you to compute above ratios, you must prepare an income statement for each alternative

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started