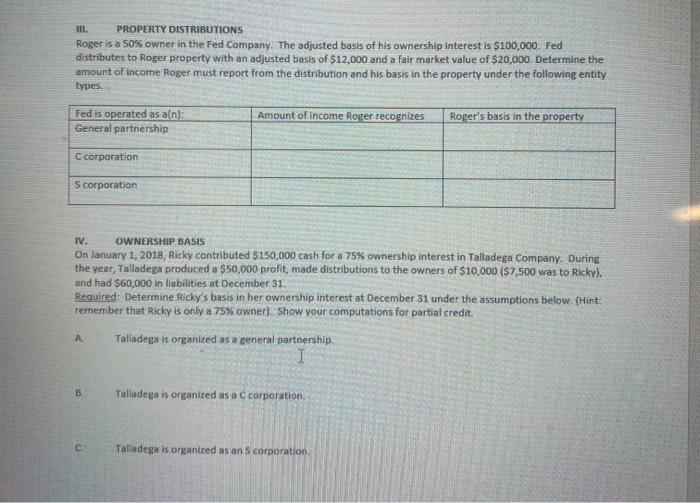

III. PROPERTY DISTRIBUTIONS Roger is a 50% owner in the Fed Company. The adjusted basis of his ownership interest is $100,000. Fed distributes to Roger property with an adjusted basis of $12,000 and a fair market value of $20,000. Determine the amount of income Roger must report from the distribution and his basis in the property under the following entity types Amount of income Roger recognizes Roger's basis in the property Fed is operated as an): General partnership C corporation Scorporation IV. OWNERSHIP BASIS On January 1, 2018, Ricky contributed $150,000 cash for a 75% ownership interest in Talladega Company. During the year, Tallade produced a $50,000 profit, made distributions to the owners of $10.000 ($7,500 was to Ricky). and had $60,000 in liabilities at December 31. Required: Determine Ricky's basis in her ownership interest at December 31 under the assumptions below. (Hint: remember that Ricky is only a 75% owner). Show your computations for partial credit Talladega is organized as a general partnership Talladega is organized as a C corporation Talladega is organized as an 5 corporation III. PROPERTY DISTRIBUTIONS Roger is a 50% owner in the Fed Company. The adjusted basis of his ownership interest is $100,000. Fed distributes to Roger property with an adjusted basis of $12,000 and a fair market value of $20,000. Determine the amount of income Roger must report from the distribution and his basis in the property under the following entity types Amount of income Roger recognizes Roger's basis in the property Fed is operated as an): General partnership C corporation Scorporation IV. OWNERSHIP BASIS On January 1, 2018, Ricky contributed $150,000 cash for a 75% ownership interest in Talladega Company. During the year, Tallade produced a $50,000 profit, made distributions to the owners of $10.000 ($7,500 was to Ricky). and had $60,000 in liabilities at December 31. Required: Determine Ricky's basis in her ownership interest at December 31 under the assumptions below. (Hint: remember that Ricky is only a 75% owner). Show your computations for partial credit Talladega is organized as a general partnership Talladega is organized as a C corporation Talladega is organized as an 5 corporation