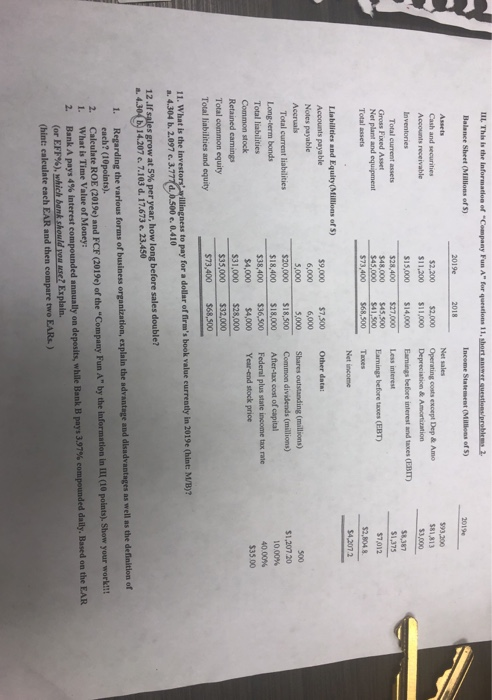

III. This is the information of Company Fun A" for question 11. short gustos problems 2. Balance Sheet (Millions of 5) Income Statement (Millions of S) 2019e 2018 Cash and securities Accounts receivable $2,200 $11,200 $2.000 $11,000 Net sales Operating costs except Dep & Amo Depreciation & Amortization Eamnings before interest and taxes (EBIT) $93,200 581813 $3,000 Inventories $15,000 $14.000 58.387 $1,375 Total current assets Gross Fixed Asset Net plant and equipment Total assets $28.400 $48.000 $45.000 $73,400 $27.000 $45.500 $41.500 $68,500 Less interest Earnings before taxes (EBT) $7012 52,8048 Thores Net income $4,2072 Other data Liabilities and Equity (Millions of 5) Accounts payable Notes payable Acerals Total current liabilities Long-term bonds Total liabilities Common stock Retained camings Total common equity Total liabilities and equity $9,000 6,000 5,000 $20,000 $18,400 $38,400 $4,000 $31,000 $35,000 $73,400 $7,500 6,000 5,000 $18,500 $18,000 $36,500 $4,000 $28,000 $32,000 $68,500 Shares outstanding (millions) Common dividends (millions) After-tax cost of capital Federal plus state income tax rate Year-end stock price 500 $1,20720 10.00% 40.00% $35.00 11. What is the investors willingness to pay for a dollar of firm's book value currently in 2019e (hint: M/B)? a. 4.304 b. 2.097 e. 3.777 d. 6.500 0.410 12.If sales grow at 5% per year, how long before sales double? 14.304 14.207.7.103 d. 17.673 e. 23.450 1. 2. 1. 2. Regarding the various forms of business organization, explain the advantage and disadvantages as well as the definition of each? (10points) Calculate ROE (2019e) and FCF (2019e) of the Company Fun A" by the information in ULE (10 points). Show your workill What is Time Value of Money: Bank A pays 4% Interest compounded annually on deposits, while Bank 3 pays 3.97% compounded daily. Based on the EAR (or EFF%), which bank should you use? Explain. (hint: calculate each EAR and then compare two EARS.) III. This is the information of Company Fun A" for question 11. short gustos problems 2. Balance Sheet (Millions of 5) Income Statement (Millions of S) 2019e 2018 Cash and securities Accounts receivable $2,200 $11,200 $2.000 $11,000 Net sales Operating costs except Dep & Amo Depreciation & Amortization Eamnings before interest and taxes (EBIT) $93,200 581813 $3,000 Inventories $15,000 $14.000 58.387 $1,375 Total current assets Gross Fixed Asset Net plant and equipment Total assets $28.400 $48.000 $45.000 $73,400 $27.000 $45.500 $41.500 $68,500 Less interest Earnings before taxes (EBT) $7012 52,8048 Thores Net income $4,2072 Other data Liabilities and Equity (Millions of 5) Accounts payable Notes payable Acerals Total current liabilities Long-term bonds Total liabilities Common stock Retained camings Total common equity Total liabilities and equity $9,000 6,000 5,000 $20,000 $18,400 $38,400 $4,000 $31,000 $35,000 $73,400 $7,500 6,000 5,000 $18,500 $18,000 $36,500 $4,000 $28,000 $32,000 $68,500 Shares outstanding (millions) Common dividends (millions) After-tax cost of capital Federal plus state income tax rate Year-end stock price 500 $1,20720 10.00% 40.00% $35.00 11. What is the investors willingness to pay for a dollar of firm's book value currently in 2019e (hint: M/B)? a. 4.304 b. 2.097 e. 3.777 d. 6.500 0.410 12.If sales grow at 5% per year, how long before sales double? 14.304 14.207.7.103 d. 17.673 e. 23.450 1. 2. 1. 2. Regarding the various forms of business organization, explain the advantage and disadvantages as well as the definition of each? (10points) Calculate ROE (2019e) and FCF (2019e) of the Company Fun A" by the information in ULE (10 points). Show your workill What is Time Value of Money: Bank A pays 4% Interest compounded annually on deposits, while Bank 3 pays 3.97% compounded daily. Based on the EAR (or EFF%), which bank should you use? Explain. (hint: calculate each EAR and then compare two EARS.)