Answered step by step

Verified Expert Solution

Question

1 Approved Answer

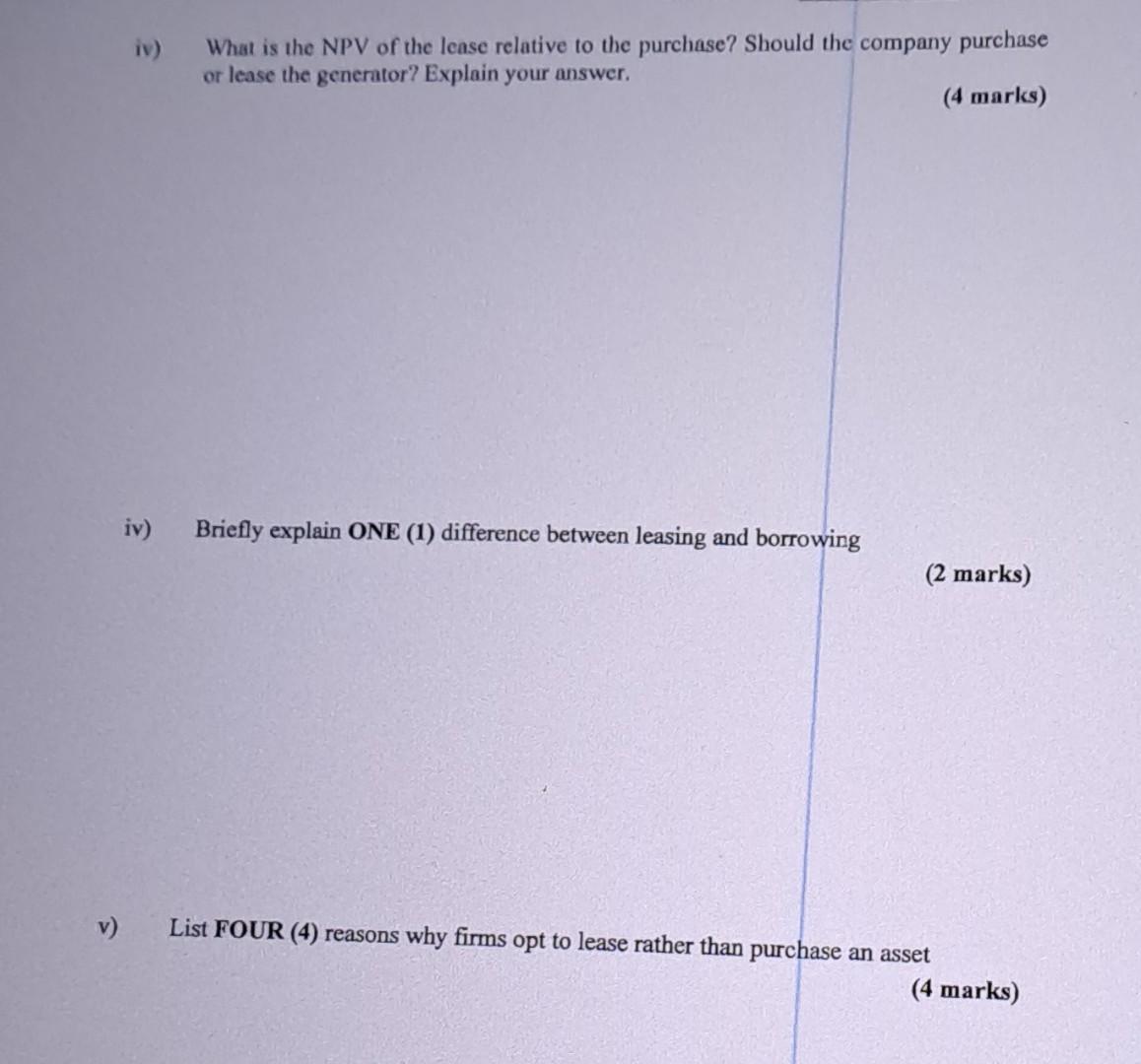

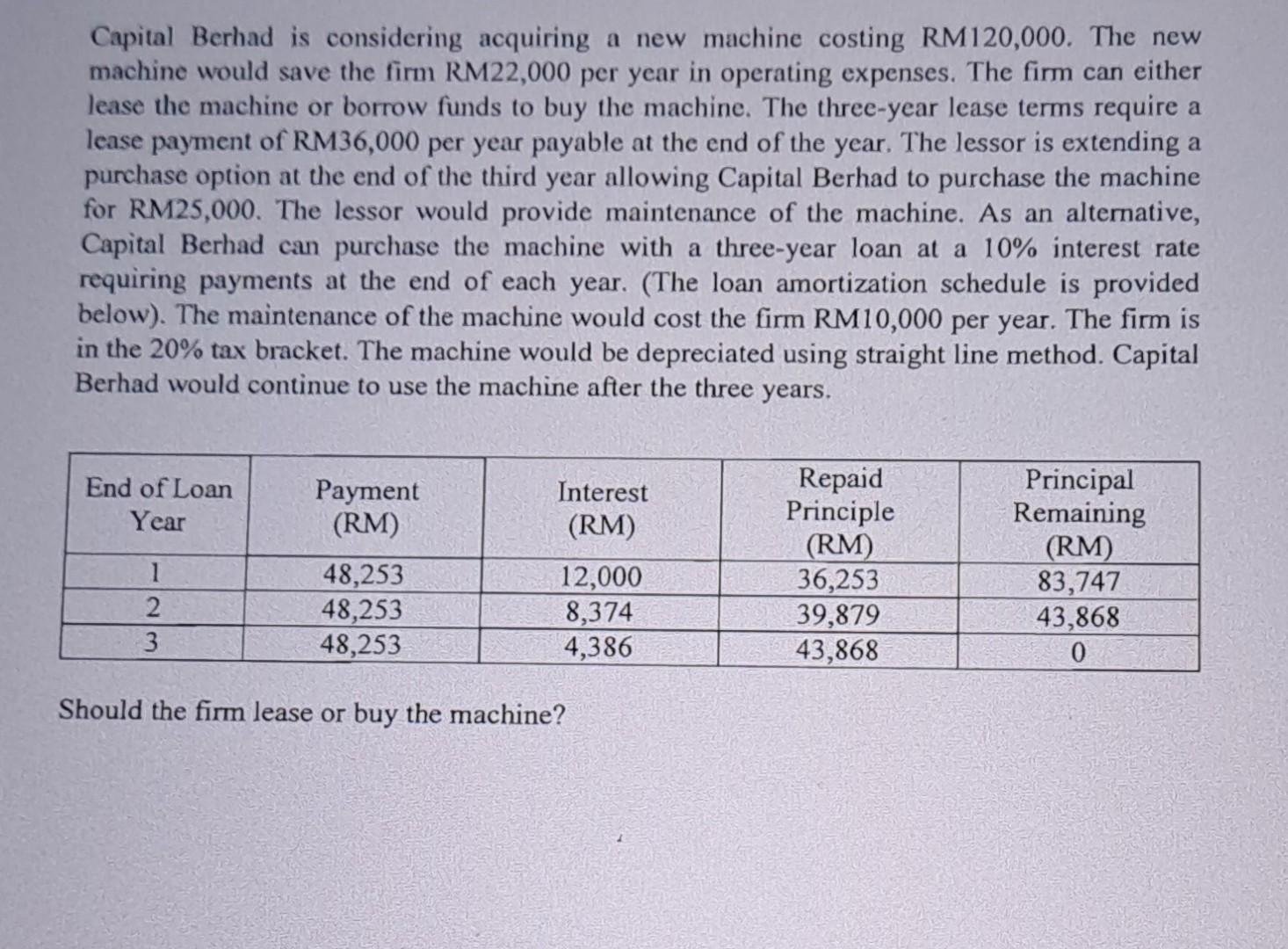

iii) What is the NPV of the lease relative to the purchase? Elaborate TWO (2) key differences between leasing and borrowing. A Briefly explain the

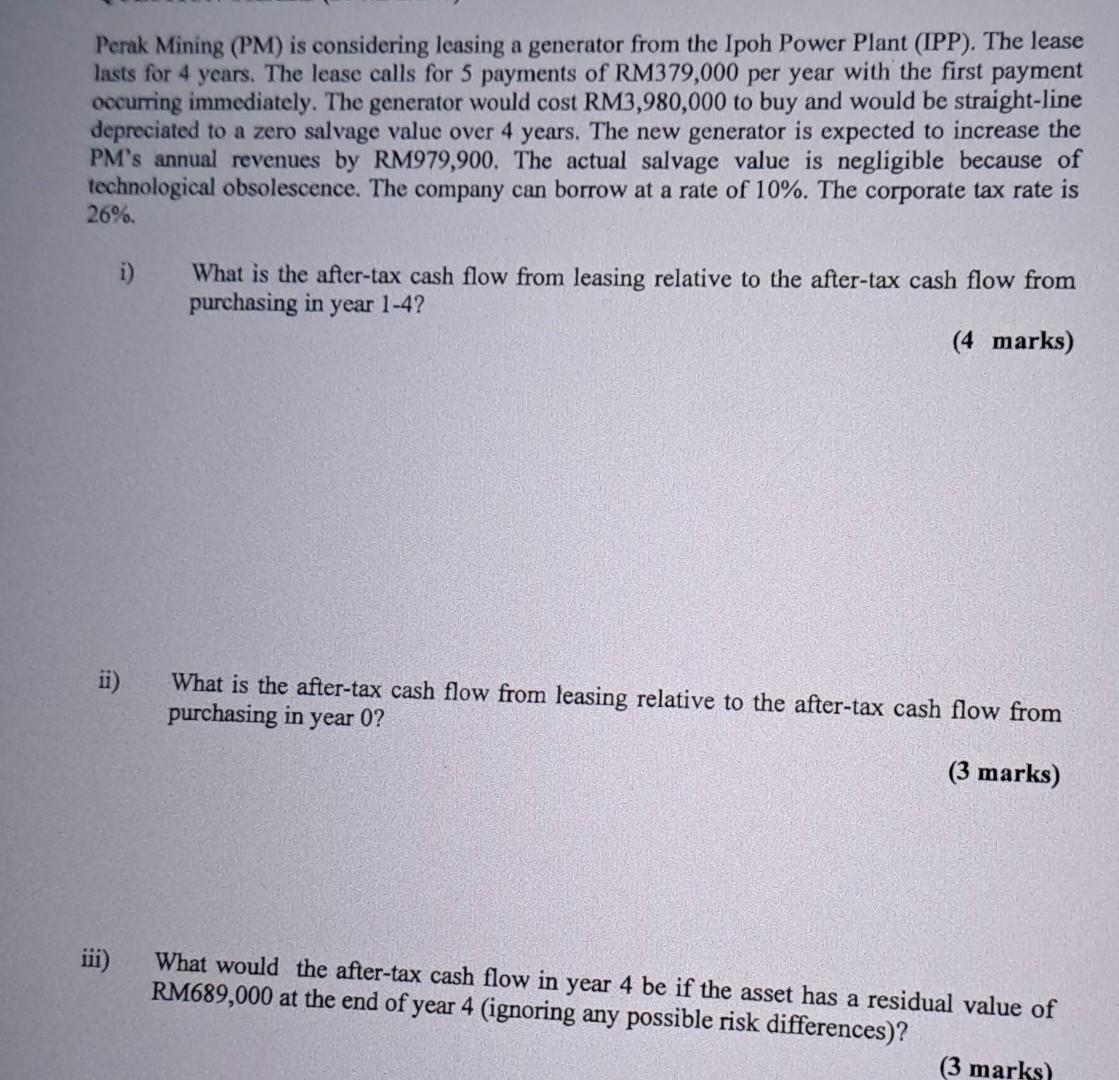

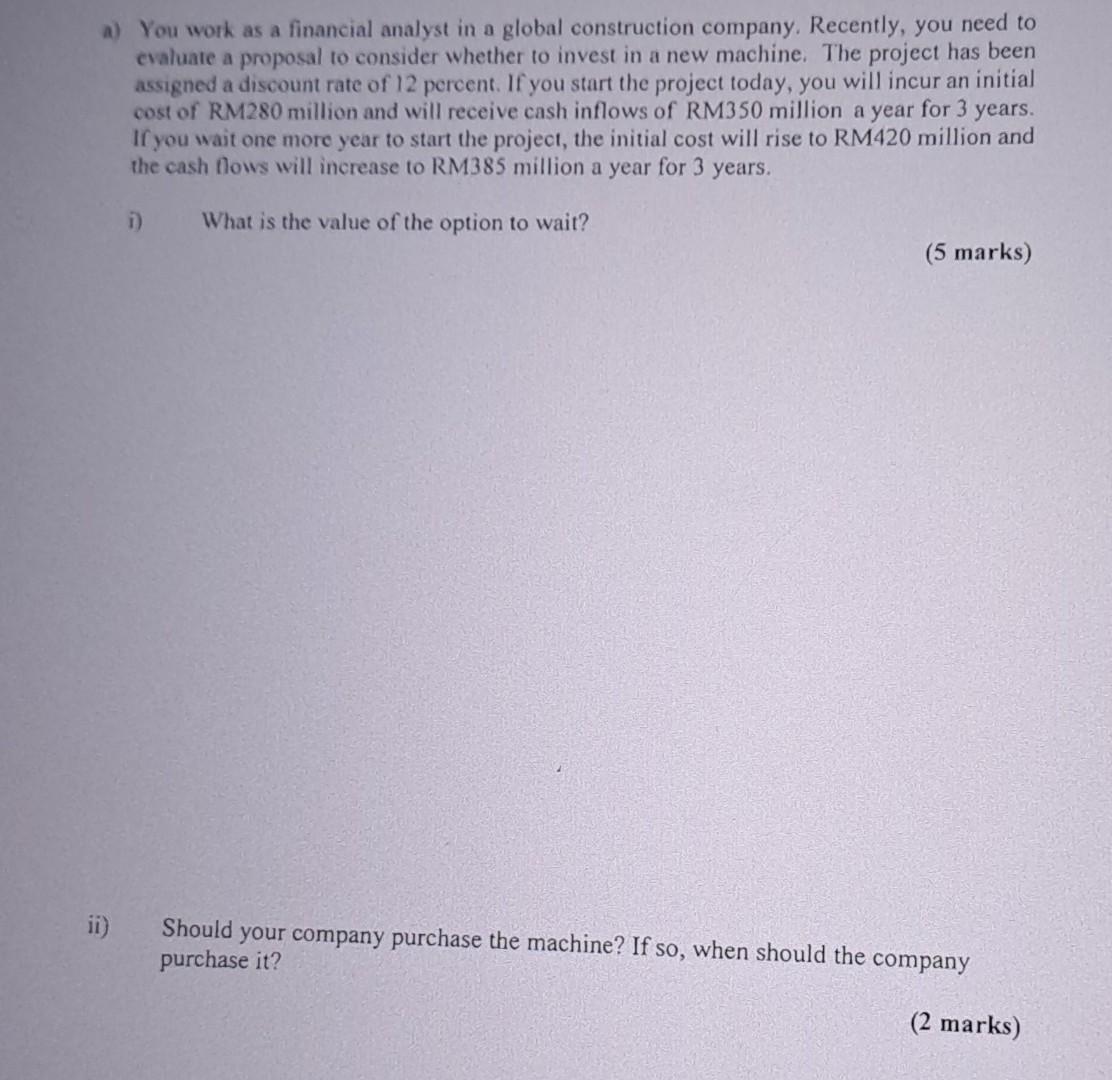

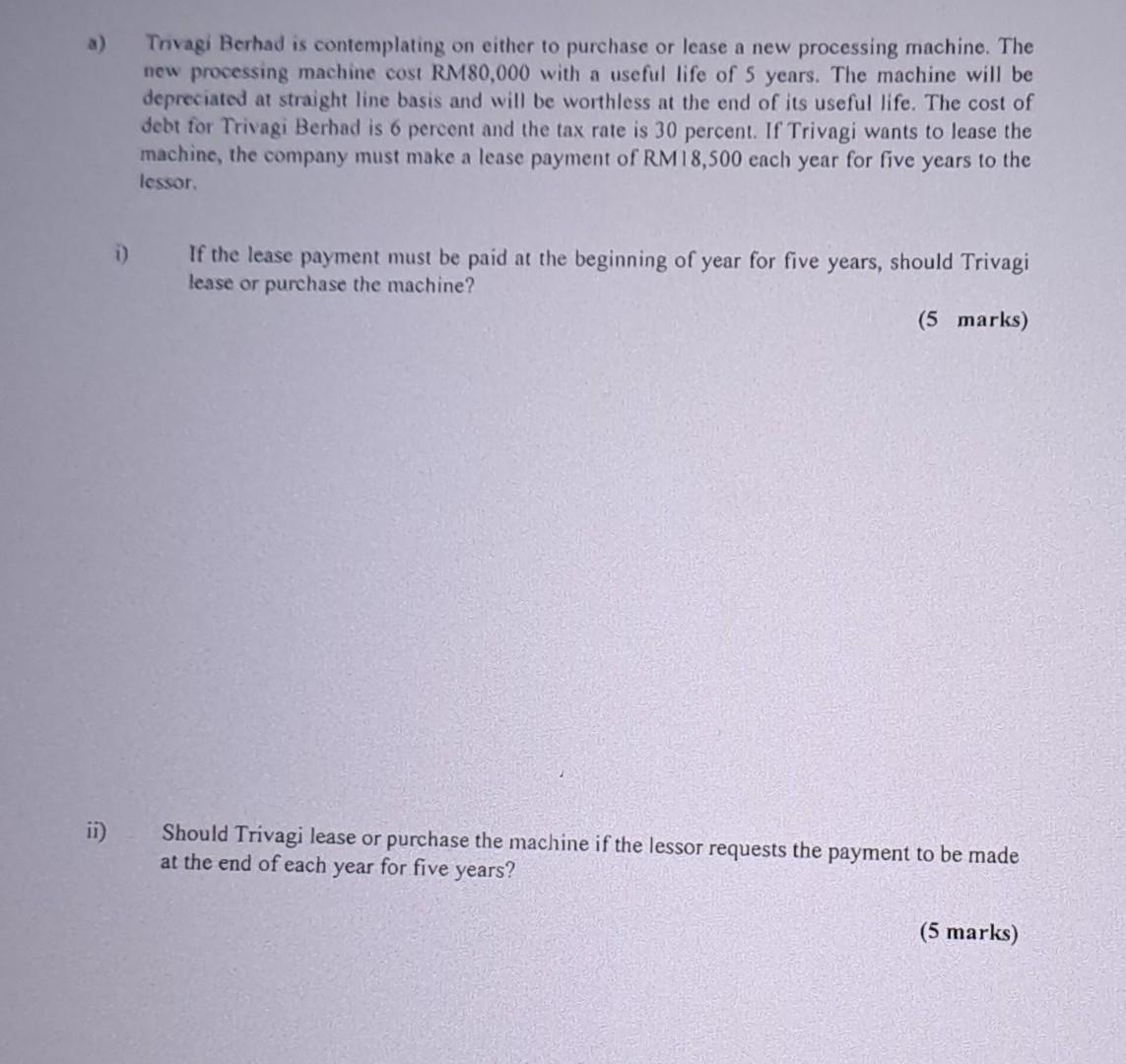

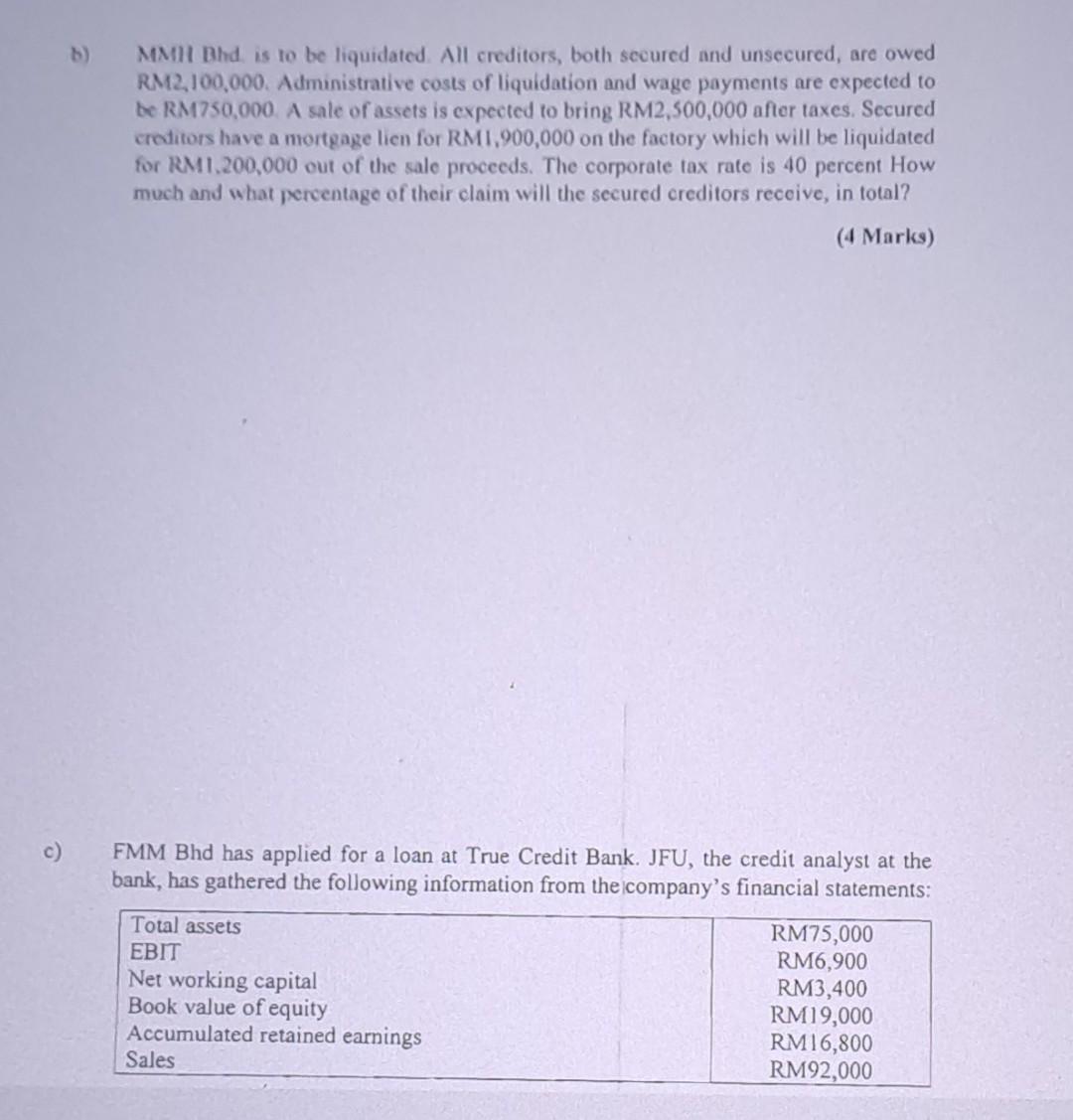

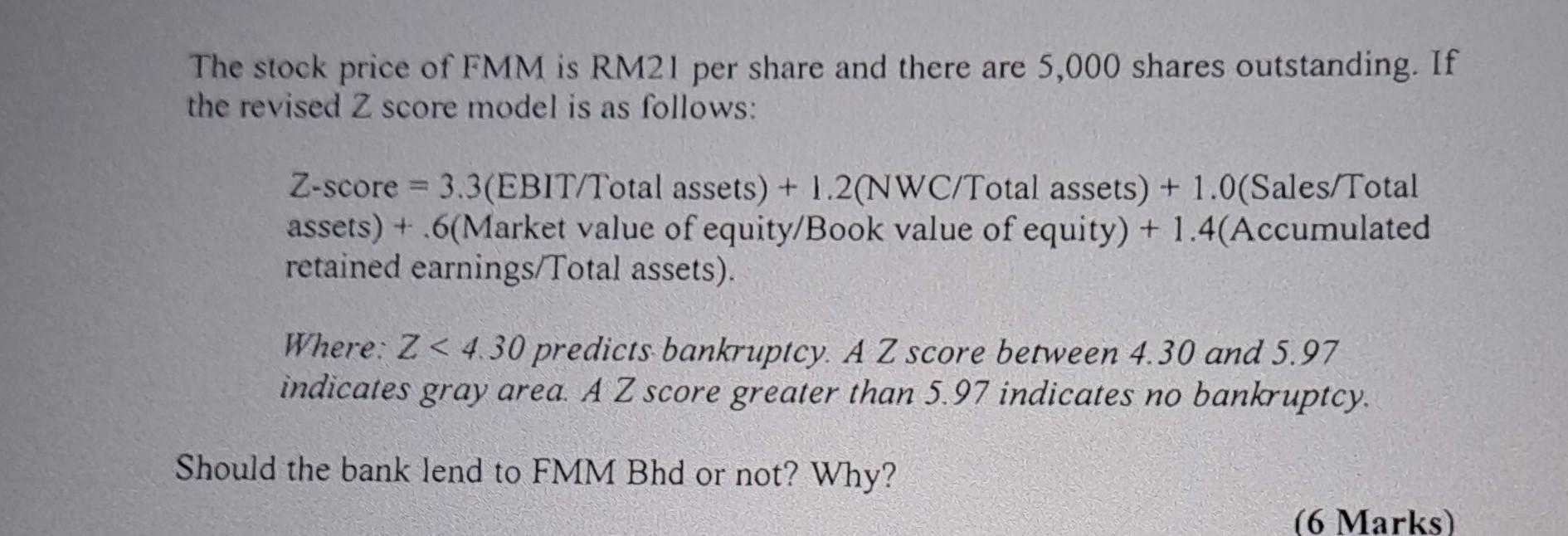

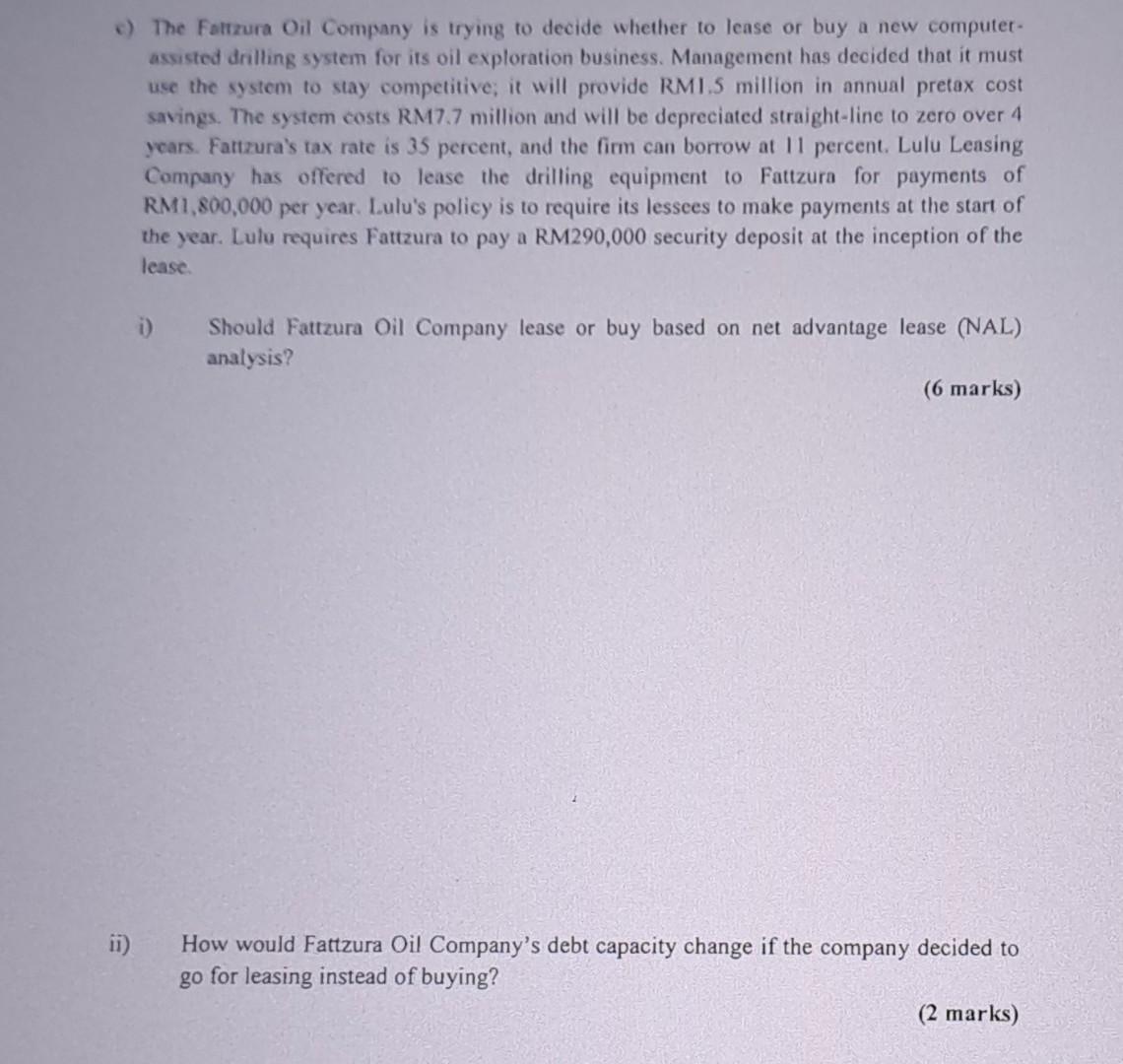

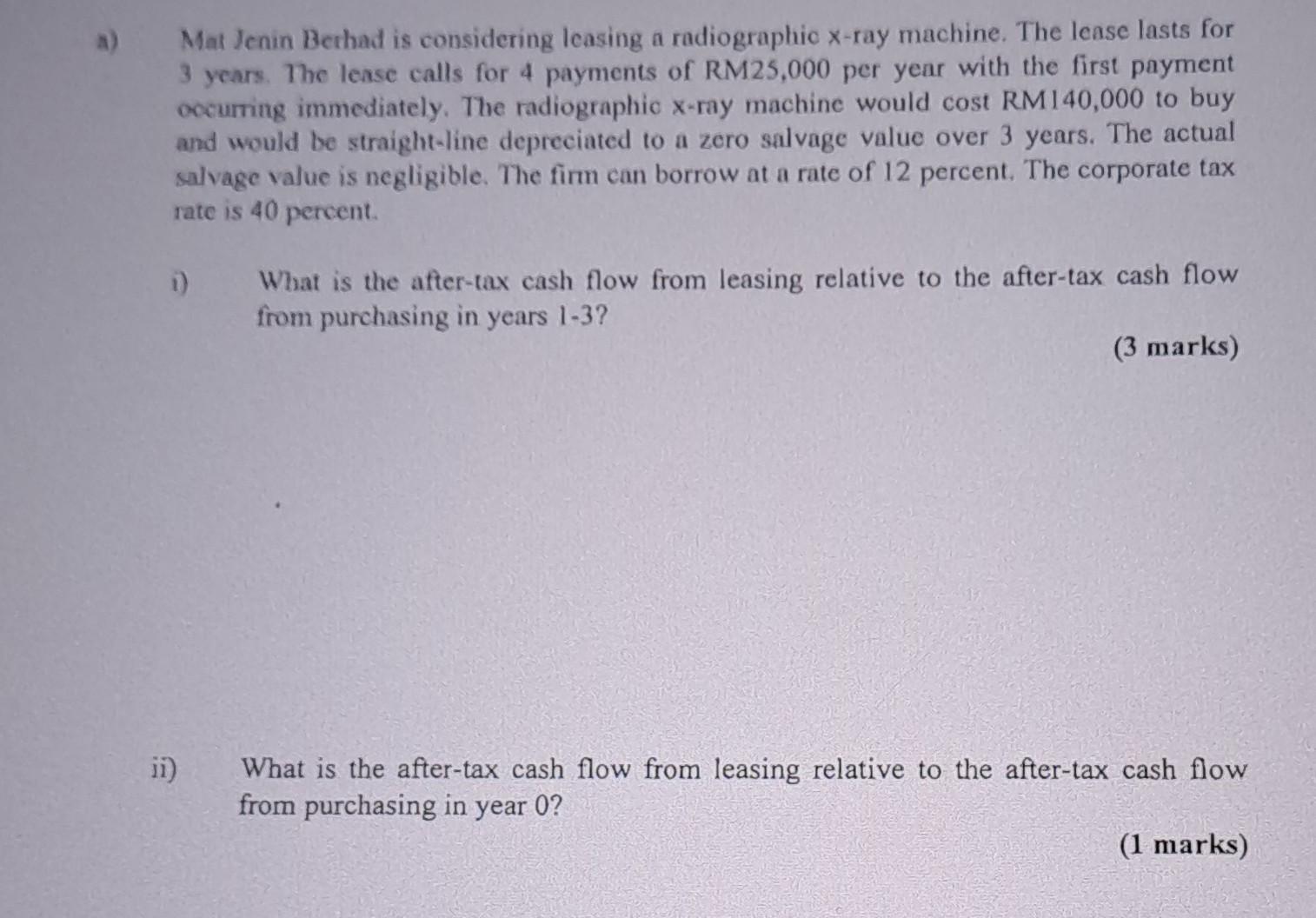

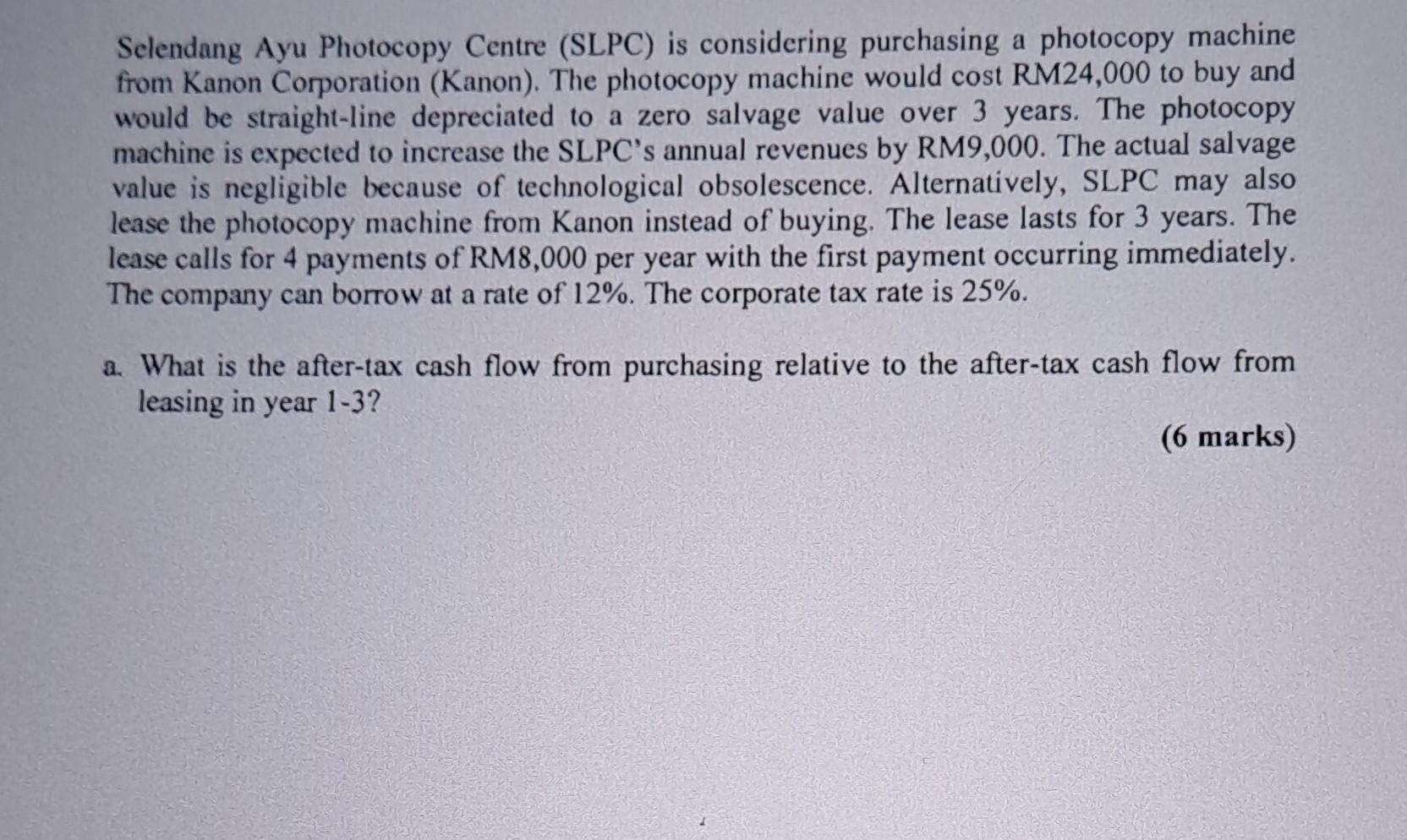

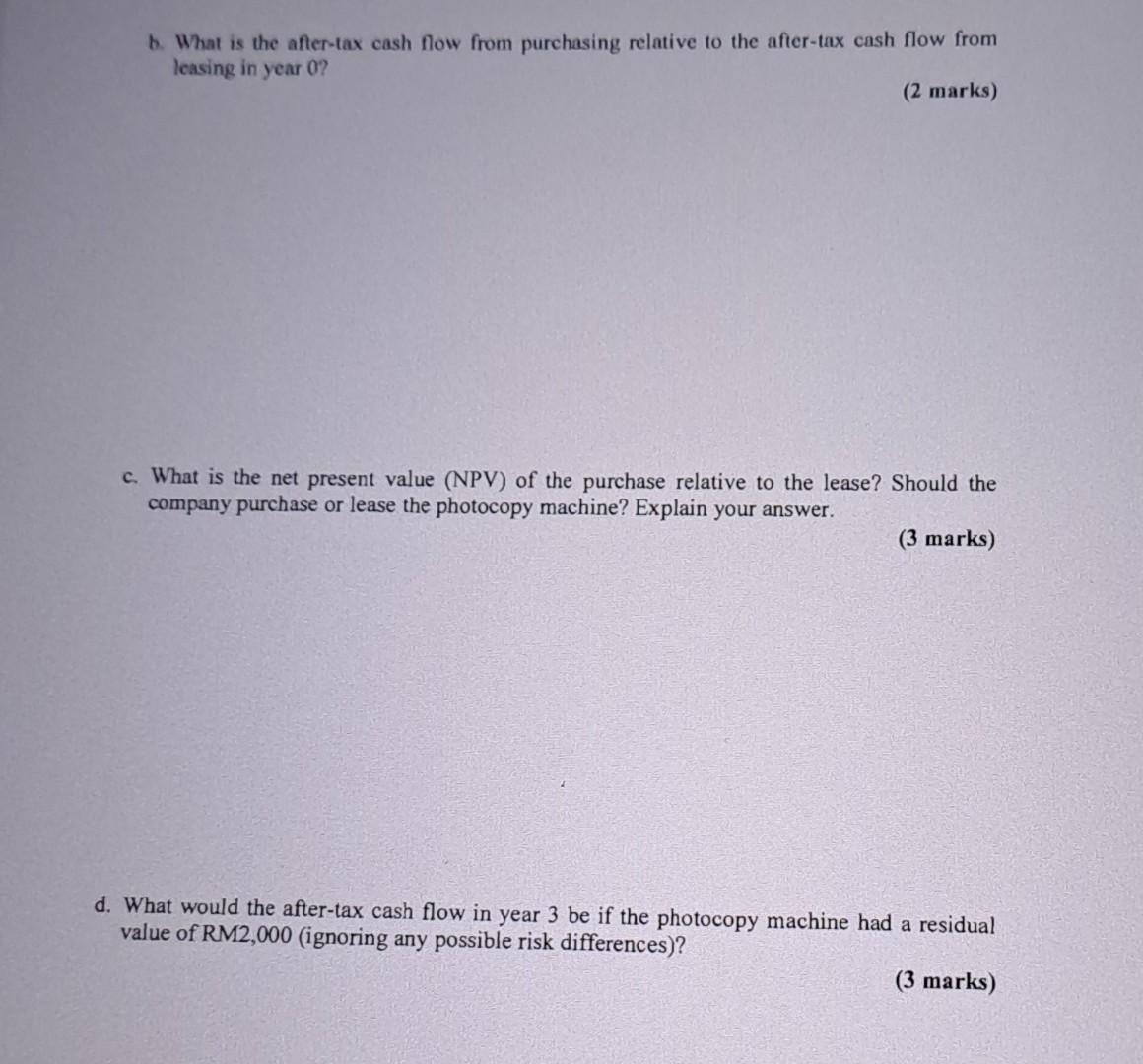

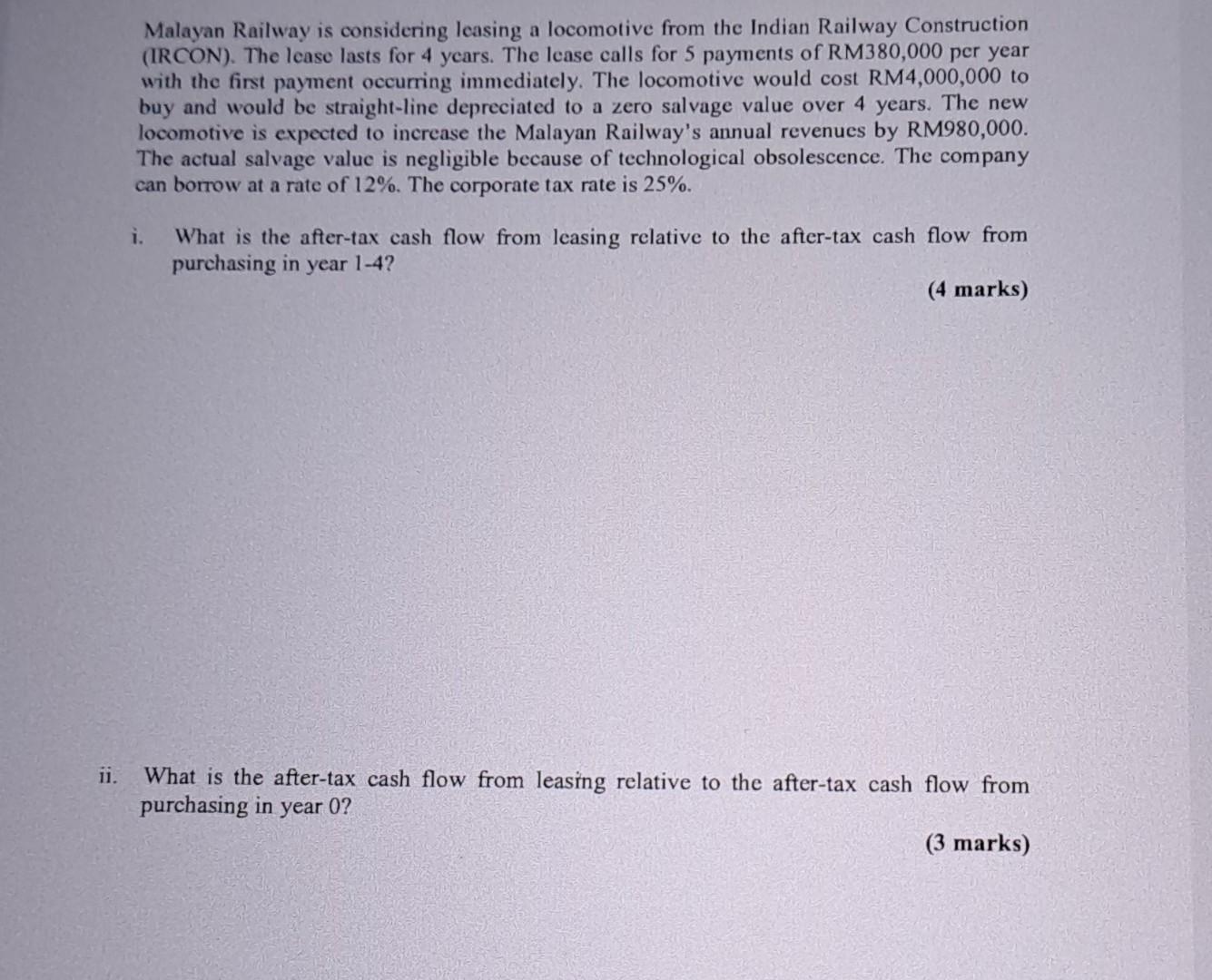

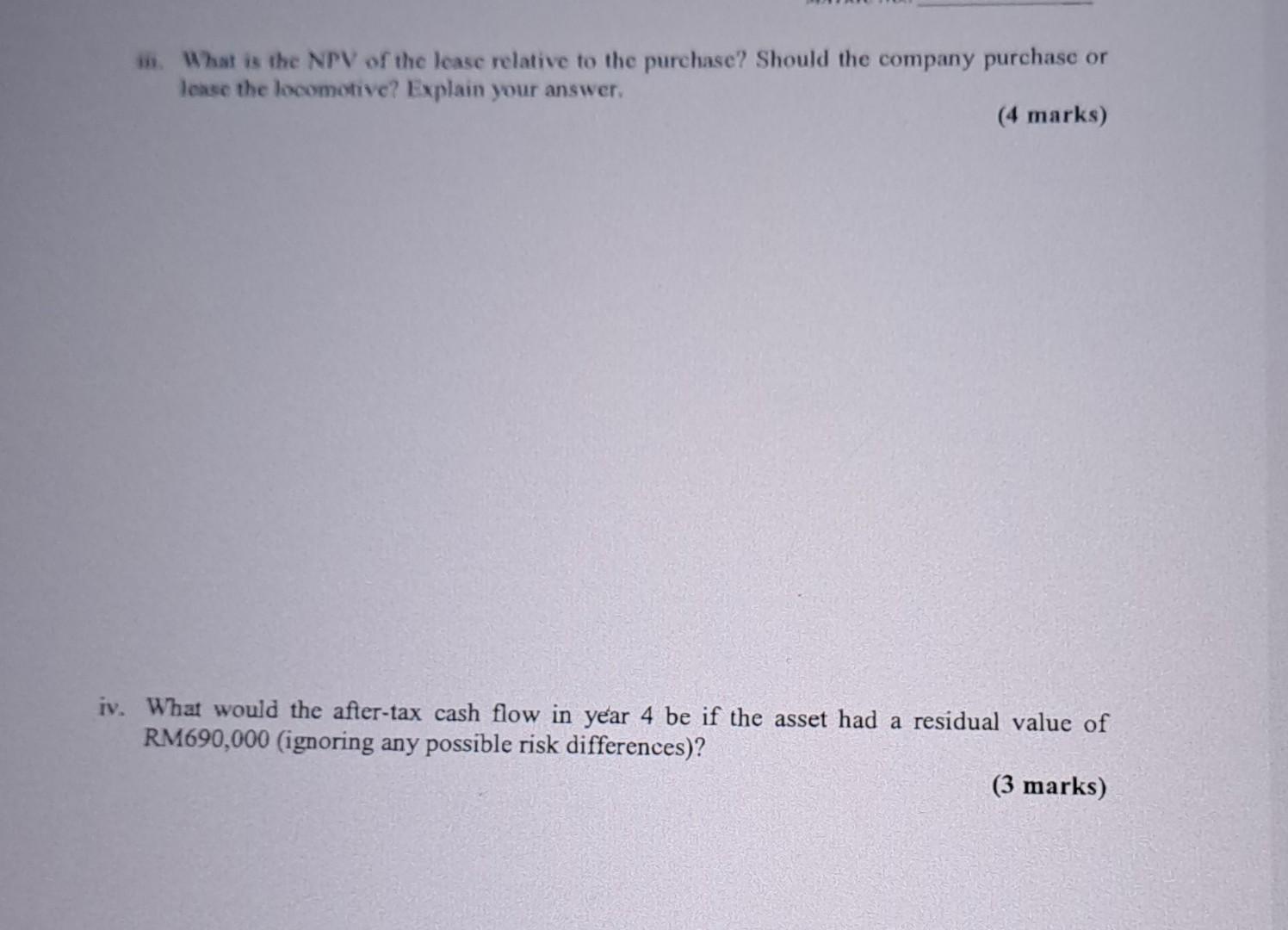

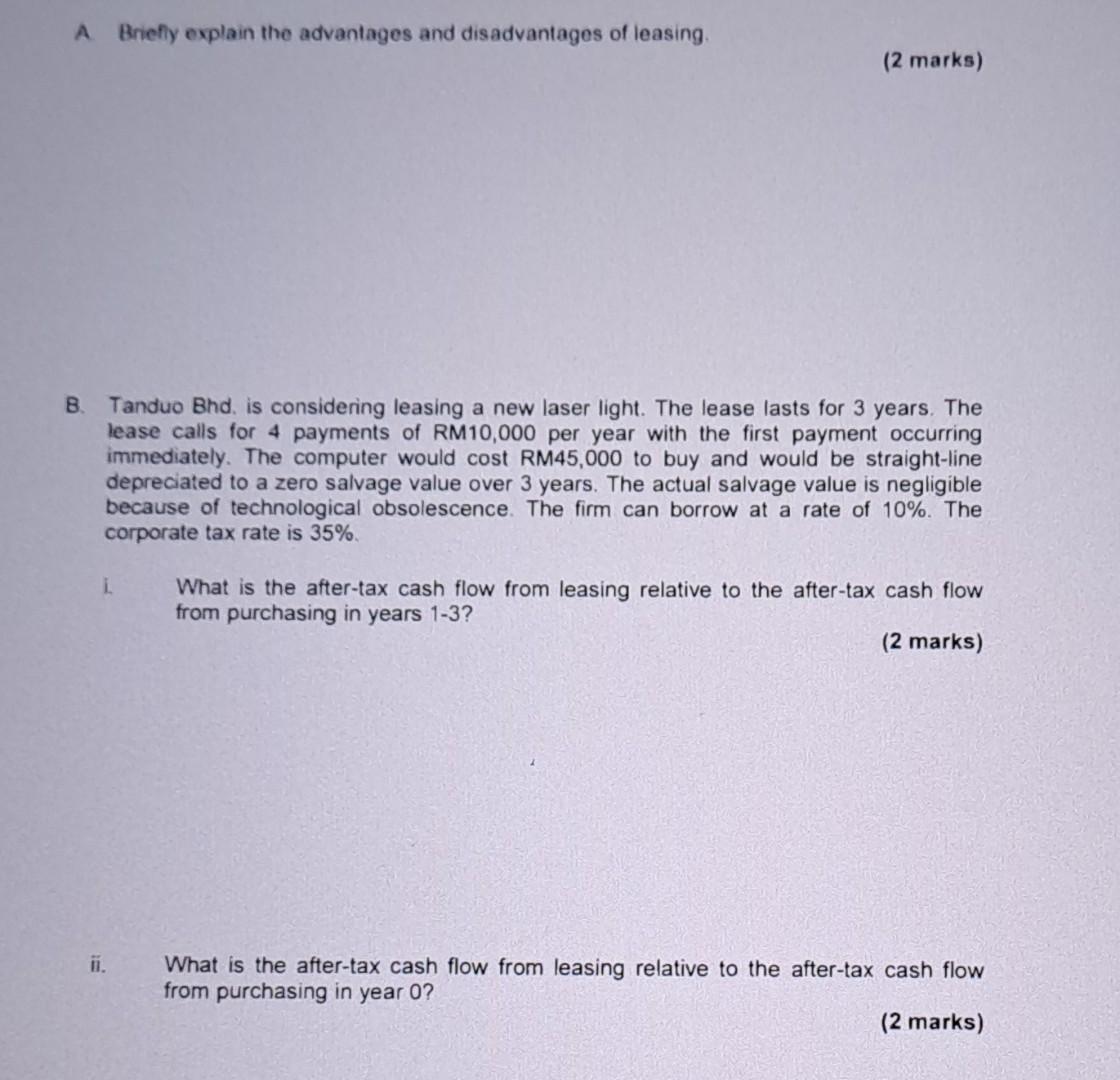

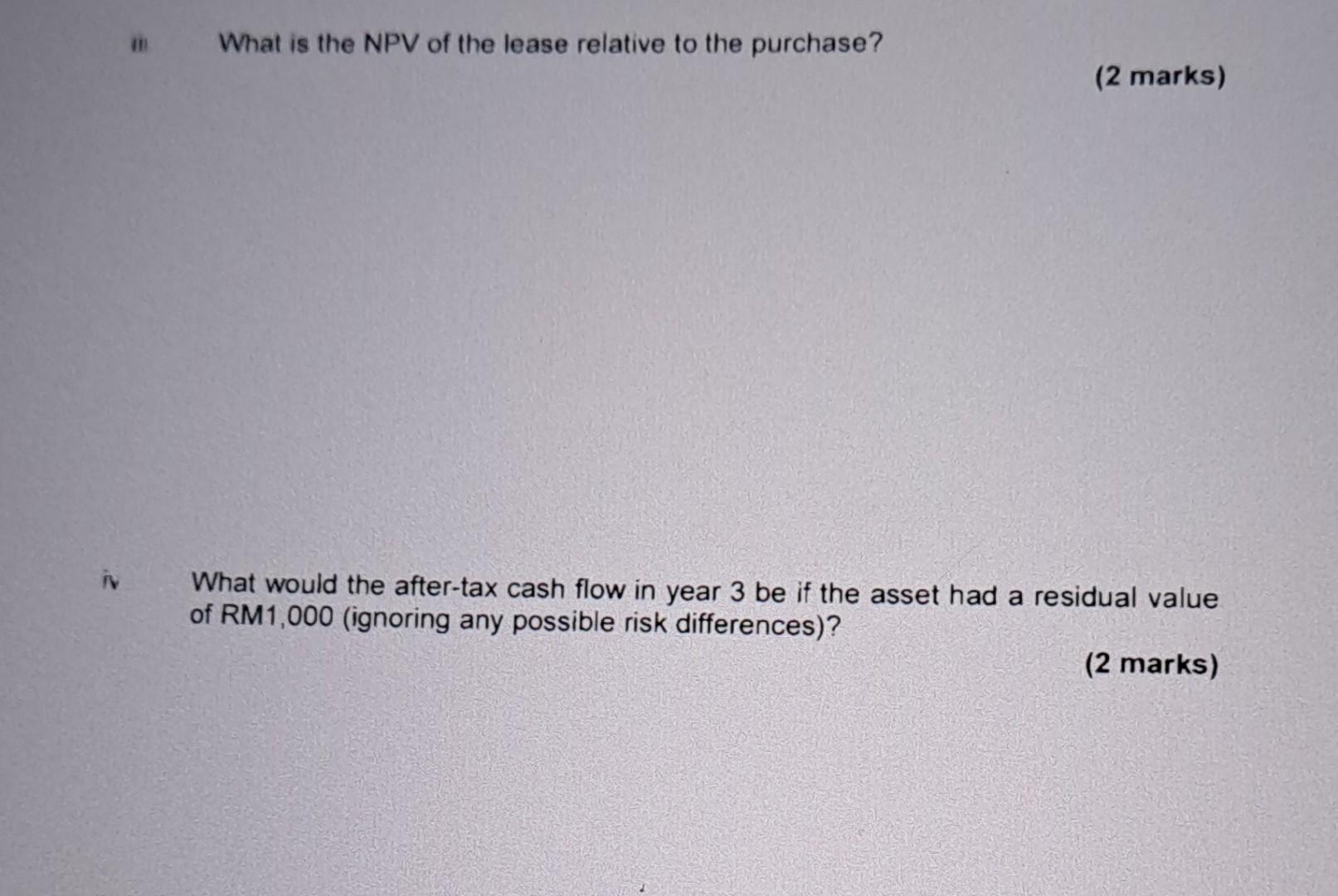

iii) What is the NPV of the lease relative to the purchase? Elaborate TWO (2) key differences between leasing and borrowing. A Briefly explain the advantages and disadvantages of leasing. (2 marks) 8. Tanduo Bhd. is considering leasing a new laser light. The lease lasts for 3 years. The lease calls for 4 payments of RM10,000 per year with the first payment occurring immediately. The computer would cost RM45,000 to buy and would be straight-line depreciated to a zero salvage value over 3 years. The actual salvage value is negligible because of technological obsolescence. The firm can borrow at a rate of 10%. The corporate tax rate is 35%. 1. What is the after-tax cash flow from leasing relative to the after-tax cash flow from purchasing in years 13 ? (2 marks) ii. What is the after-tax cash flow from leasing relative to the after-tax cash flow from purchasing in year 0 ? (2 marks) C. What is the NPV of the lease relative to the purchase? Apakah nilai NPV untuk sewaan relatif kepada pembelian? (3 marks/markah) D. What would the after-tax cash flow in year 9 be if the asset had a residual value of RM500 (ignoring any possible risk differences)? Apakah aliran tunai selepas cukai pada tahun ke-9 jika aset mempunyai nilai residual sebanyak RM500 (abaikan perbezaan risiko yang akan berlaku)? a) You work as a financial analyst in a global construction company. Recently, you need to cvaluate a proposal to consider whether to invest in a new machine. The project has been assigned a discount rate of 12 percent. If you start the project today, you will incur an initial cost of RM280 million and will receive cash inflows of RM350 million a year for 3 years. If you wait one more year to start the project, the initial cost will rise to RM420 million and the cash flows will increase to RM385 million a year for 3 years. i) What is the value of the option to wait? (5 marks) i) Should your company purchase the machine? If so, when should the company purchase it? b) MMII Bhd is to be liquidated. All creditors, both secured and unsecured, are owed RM2,100,000. Administrative costs of liquidation and wage payments are expected to be RM750,000. A sale of assets is expected to bring RM2,500,000 after taxes. Secured creditors have a mortgage lien for RMI, 900,000 on the factory which will be liquidated for RMI, 200,000 out of the sale proceeds. The corporate tax rate is 40 percent How much and what percentage of their claim will the secured creditors receive, in total? (4 Marks) c) FMM Bhd has applied for a loan at True Credit Bank. JFU, the credit analyst at the bank, has gathered the following information from the company's financial statements: Your firm is considering leasing a new computer. The lease lasts for 9 years. The lease calls for 10 payments of RM1,000 per year with the first payment occurring immediately. The computer would cost RM7,650 to buy and would be straight-line depreciated to a zero salvage over 9 years. The actual salvage value is negligible because of technological obsolescence. The firm can borrow at a rate of 8%. The corporate tax rate is 27%. Firma anda sedang mempertimbangkan untuk menyewa sebuah komputer baru. Sewaan adalah dalam tempoh 9 tahun dan melahi pembayaran sebanyak 10 kali iaitu dengan hanga RM1.000 setahun di mana bayaran pertama adalah serta-merta. Komputer tersebut bernilai RM7.650 jika dibeli dan tidak mempunyai nilai susut nilai selama 9 tahum. Susut nilai berlaku kerana keusangan computer. Firma boleh meminjam pada kadar 8% Kadar cukai korporat ialah 27%. A. What is the after-tax cash flow from leasing relative to the after-tax cash flow from purchasing in years 1-9? Apakah aliran tunai selepas cukai dari sewaan relatif kepada aliran tunai selepas cukai dari pembelian dalam tahun pertama hingga ke-9? (3 marks/markah) B. What is the after-tax cash flow from leasing relative to the after-tax cash flow from purchasing in year 0 ? Apakah aliran tunai selepas cukai dari sewaan relatifkepada aliran tunai selepas cukai dari pembelian pada tahun 0 ? The stock price of FMM is RM21 per share and there are 5,000 shares outstanding. If the revised Z score model is as follows: Z-score =3.3(EBIT/ Total assets )+1.2(NWC/Total assets )+1.0 (Sales/Total assets) +.6 (Market value of equity/Book value of equity) +1.4 (Accumulated retained earnings/Total assets). Where: Z

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started