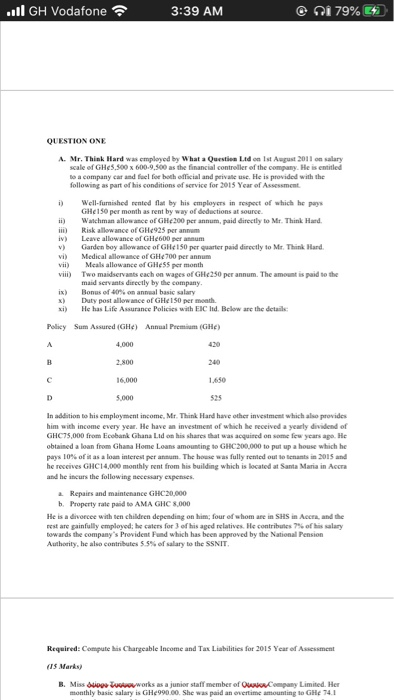

..Il GH Vodafone 3:39 AM CI 79% 4 QUESTION ONE A. Mr. Think Hard was employed by What a Question Lid on Ist August 2011 on salary scale of GH5.500 x 600-9.500 as the financial controller of the company. He is entitled to a company car and fuel for both official and private use. He is provided with the following as part of this conditions of service for 2015 Year of Assessment ii) in iv) v) vi) vii) viii) Well-furnished rented by his employers in respect of which he pays GH150 per month as rent by way of deductions at source Watchman allowance of GH200 per annum, paid directly to Mr. Think Hard Risk allowance of GH4925 per annum Leave allowance of GH 600 per annum Garden boy allowance of GR 150 per quarter paid directly to Mr. Think Hard Medical allowance of GH700 per annum Meals allowance of GH55 per month Two maidservants each on wages of GHc250 per annum. The amount is paid to the maid servants directly by the company. Bonus of 40% on annual basic salary Duly post allowance of GH 1S0 per month He has Life Assurance Policies with E d . Below are the detail ix) x) xi) Policy Sum Assured (GH) Annual Premium (GH) 4.000 2.800 240 16.000 1.650 In addition to his employment income, Mr. Think Hard have other investment which also provides him with income every year. He have an investment of which he received a yearly dividend of GHC75,000 from Ecobank Ghana Lid on his shares that was acquired on some few years ago. He obtained a loan from Ghana Home Loans amounting to GHC200,000 to put up a house which he pays 10% of it as a loan interest per a m . The house was fully rented out to tenants in 2015 and he receives GHC14.000 monthly rent from his building which is located at Santa Maria in Accra and he incurs the following secerary expenses Repairs and maintenance GHC 20.000 b. Property role paid to AMA GHC 8.000 He is a divorcee with ten children depending on him four of whom are in SHS in Accra, and the restare gainfully employed; he calcs for of his aged relatives. He contributes of his salary towards the company's Provident Fund which has been approved by the National Pension Authority, he also contributes 5.5% of salary to the SSNIT Required: Compute his Chargeable Income and Tax Liabilities for 2015 Year of Assessment (IS Marks) B. Miss Sioe works as a junior staff member of Our Company Limited. Her monthly basic salary is GH990.00. She was paid an overtime amounting to GHe 74.1 ..Il GH Vodafone 3:39 AM CI 79% 4 QUESTION ONE A. Mr. Think Hard was employed by What a Question Lid on Ist August 2011 on salary scale of GH5.500 x 600-9.500 as the financial controller of the company. He is entitled to a company car and fuel for both official and private use. He is provided with the following as part of this conditions of service for 2015 Year of Assessment ii) in iv) v) vi) vii) viii) Well-furnished rented by his employers in respect of which he pays GH150 per month as rent by way of deductions at source Watchman allowance of GH200 per annum, paid directly to Mr. Think Hard Risk allowance of GH4925 per annum Leave allowance of GH 600 per annum Garden boy allowance of GR 150 per quarter paid directly to Mr. Think Hard Medical allowance of GH700 per annum Meals allowance of GH55 per month Two maidservants each on wages of GHc250 per annum. The amount is paid to the maid servants directly by the company. Bonus of 40% on annual basic salary Duly post allowance of GH 1S0 per month He has Life Assurance Policies with E d . Below are the detail ix) x) xi) Policy Sum Assured (GH) Annual Premium (GH) 4.000 2.800 240 16.000 1.650 In addition to his employment income, Mr. Think Hard have other investment which also provides him with income every year. He have an investment of which he received a yearly dividend of GHC75,000 from Ecobank Ghana Lid on his shares that was acquired on some few years ago. He obtained a loan from Ghana Home Loans amounting to GHC200,000 to put up a house which he pays 10% of it as a loan interest per a m . The house was fully rented out to tenants in 2015 and he receives GHC14.000 monthly rent from his building which is located at Santa Maria in Accra and he incurs the following secerary expenses Repairs and maintenance GHC 20.000 b. Property role paid to AMA GHC 8.000 He is a divorcee with ten children depending on him four of whom are in SHS in Accra, and the restare gainfully employed; he calcs for of his aged relatives. He contributes of his salary towards the company's Provident Fund which has been approved by the National Pension Authority, he also contributes 5.5% of salary to the SSNIT Required: Compute his Chargeable Income and Tax Liabilities for 2015 Year of Assessment (IS Marks) B. Miss Sioe works as a junior staff member of Our Company Limited. Her monthly basic salary is GH990.00. She was paid an overtime amounting to GHe 74.1